XRP market watch: Buy more or sell now? Key insights here!

- XRP prices have been flying, starting earlier than the BTC breakout past $60k.

- This kind of price run before a news event could be a concern for long-term holders.

Ripple [XRP] gained 58.18% from the 8th of July to the 17th on the back of rumors that a verdict in favor of the payment remittance firm in the U.S. Securities and Exchanges Commission, or SEC, vs Ripple case will be reached.

The ruling on 13th July, 2023 was that XRP is not a security in its secondary market sales. Attorney Fred Rispoli predicted that the case would get a ruling this month. What is the price and trend prediction from AMBCrypto’s XRP market watch?

Has the market priced in the verdict, or does the rally have room to expand?

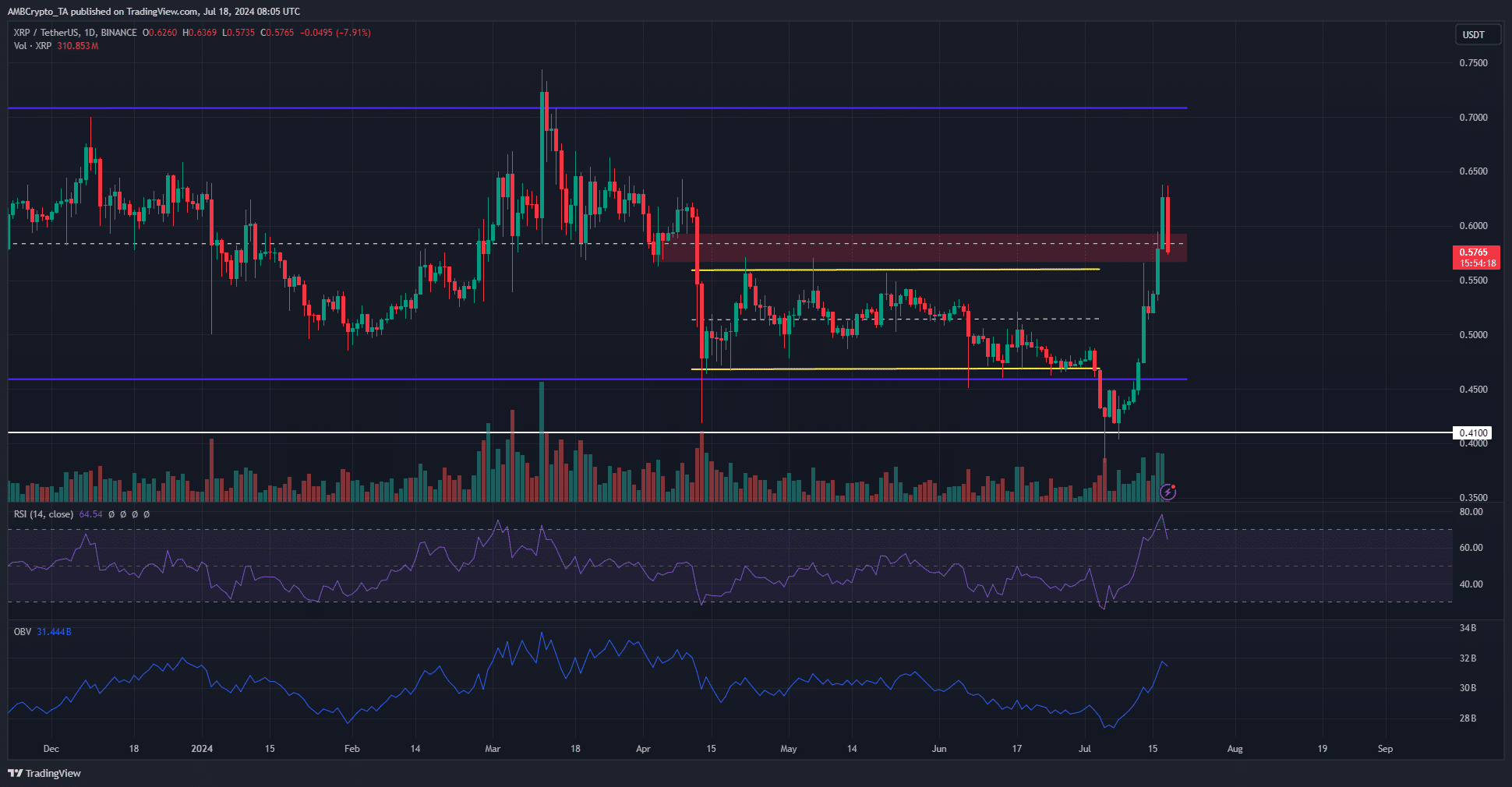

The 11-month long range was reclaimed, and at press time the mid-range level at $0.585 was being tested as support. If XRP closes the daily session below $0.562, the low from early April, it would be a sign that the prices would move toward $0.46 again.

On the other hand, if the token can stabilize around the $0.57-$0.58 mark over the next few days, it would be an indication that the $0.71 range highs could be targeted next.

The trading volume saw a steady uptick over the past ten days. The OBV also soared higher to reflect increased buying pressure.

The RSI was correcting from the overbought territory and reflected sustained bullish momentum after three months of a downward trending market.

XRP market watch: The liquidity pools could inflict a reversal

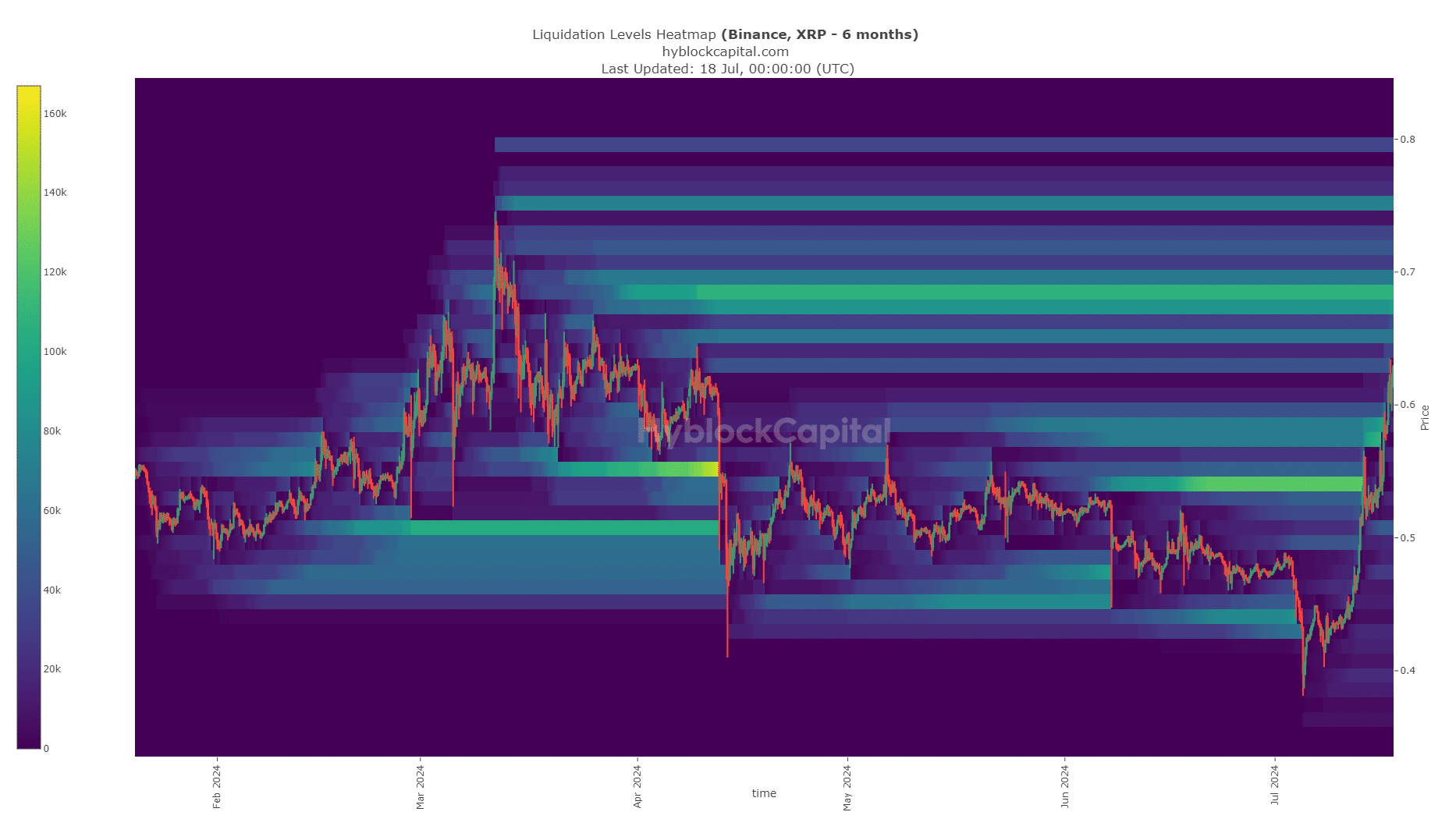

Source: Hyblock

Analysis of the 6-month look-back liquidation heatmap showed a strong cluster of liquidity just below $0.7. This lined up well with the range highs at $0.71, with another magnetic zone at $0.751.

Is your portfolio green? Check the XRP Profit Calculator

The $0.585 mid-range zone, which was expected to offer resistance, was broken. As things stand, XRP offered a buying opportunity for trend-following traders.

However, it could also become a “sell the news” type event, which could see prices slump toward the end of July.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.