Ripple

XRP metric hits ‘newest low’ since 2020, but should that concern traders?

The long-term outlook was bullish, as evidenced by whale activity and stable network activity.

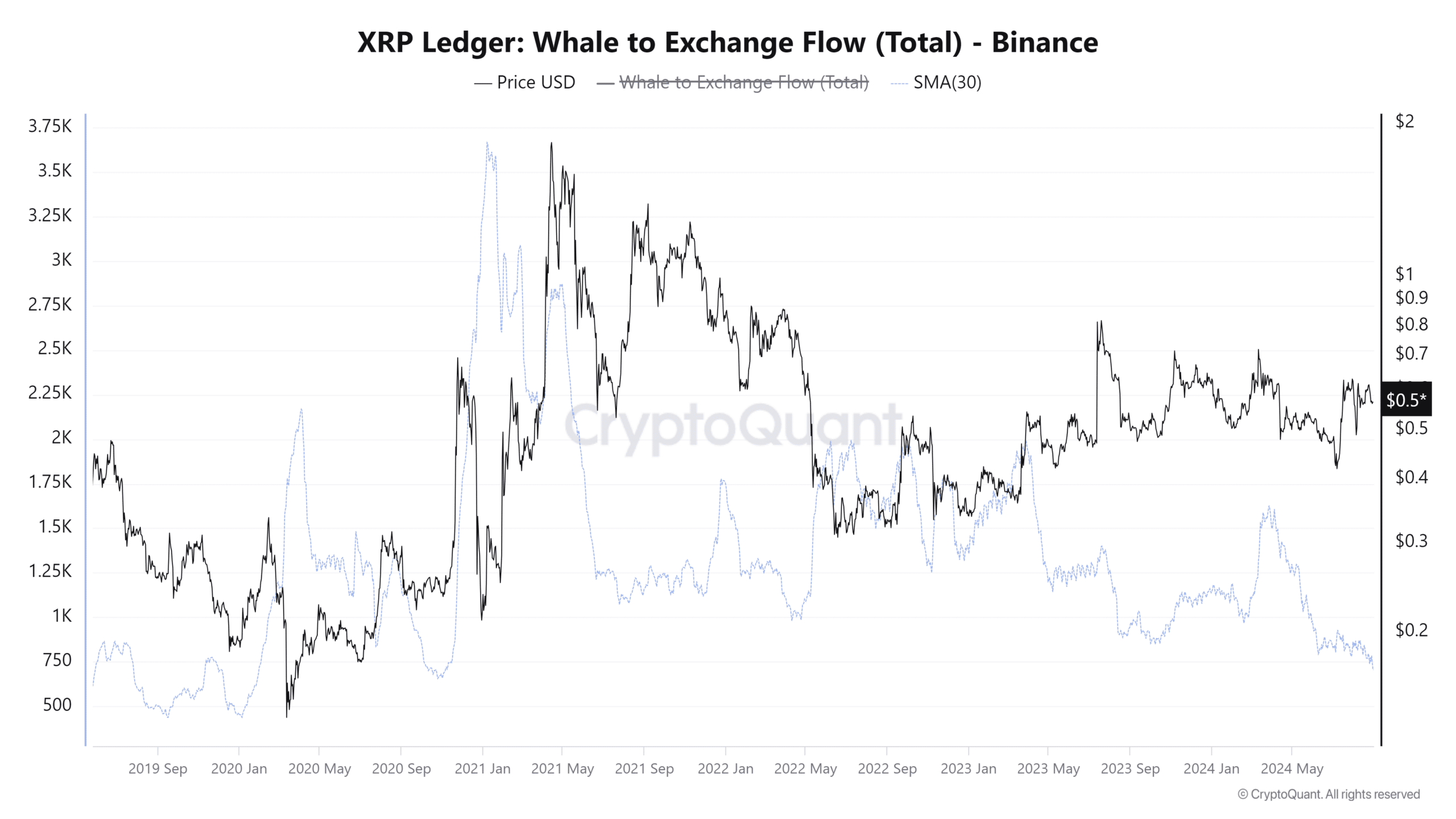

- Whale-to-exchange flow fell dramatically in recent months

- Network activity was fairly good, but near-term sentiment remained weak

XRP failed to overcome the mid-range resistance level at $0.585. In fact, XRP has fallen by 5.35% in the past three days alone from $0.6 to $0.568. However, on-chain metrics offered some hope to counter the bearish short-term price action and the year-long range-bound trading.

A recent report noted that XRP whales capitalized on the price drop to add over 50 million tokens

to their holdings. AMBCrypto looked closer at other metrics to see if XRP investors have more good news elsewhere or not.Whale to exchange flow hits its lowest point since 2020

Source: CryptoQuant

The Whale to Exchange Flow metric measures the volume of tokens transferred from whales to exchanges. The metric reached its lowest point since October 2020 recently.

A spike in this metric is generally seen alongside a sharp price move in either direction. With the values the lowest they have been in nearly four years, the long-term bullish case was buoyed.

Source: Santiment

The daily active addresses metric has been stable over the past two months. On certain weekends, it jumped higher but this was not a sustained move higher. Similarly, the network growth has also been steady since mid-July.

Together, it indicated a healthy and growing network, but daily activity has not stepped up meaningfully.

Also, the MVRV ratio showed that XRP was an undervalued asset as the 30-day holders were at a minor loss.

XRP’s speculative market unconvinced thus far

Source: Coinalyze

Throughout August, XRP bulls have fought hard to push prices beyond the $0.6 resistance zone. Their efforts were in vain and the highest point they managed was $0.634. Over the past three weeks, the Open Interest has stayed between the $430 million-$490 million range.

Is your portfolio green? Check the Ripple Profit Calculator

This meant that each breach of $0.6 brought bullish speculators, but the demand was not strong enough to shift the resistance to support. The funding has also fallen recently to highlight reduced bullish conviction in the market.

Overall, the short-term sentiment seemed to be wavering between bullish and bearish. The long-term outlook remains bullish though, as evidenced by whale activity and stable network activity metrics. However, investors would need to be very patient.