XRP nears key $0.52 support: Can it withstand Bitcoin’s volatility?

- XRP stood at a crucial crossover at press time, nearing the $0.52 support level.

- Are rebound prospects too optimistic given BTC’s volatility, or can XRP defy the odds?

Ripple [XRP], like other altcoins, has followed Bitcoin’s recent market downturn, dropping by approximately 2% to $0.5494 at press time.

As Ripple approaches its critical $0.52 support level, ongoing volatility could soon push it into a bearish swing, potentially plunging the price to $0.40.

However, in a recent post, an analyst predicted that Ripple could defy the odds and test its $1 ceiling. Driven by this anomaly, AMBCrypto investigated who the odds would favor.

Market trends eclipse XRP’s reserve impact

In the past two months, Ripple attracted significant bullish attention following its victory over the SEC. Now that the dust has settled, it is facing renewed pressure amid Bitcoin’s meltdown.

The impact of Bitcoin volatility is overtly visible, as Ripple has been in a consecutive bearish trend since the last week of August, preventing bulls from pushing the price above the $0.60 threshold.

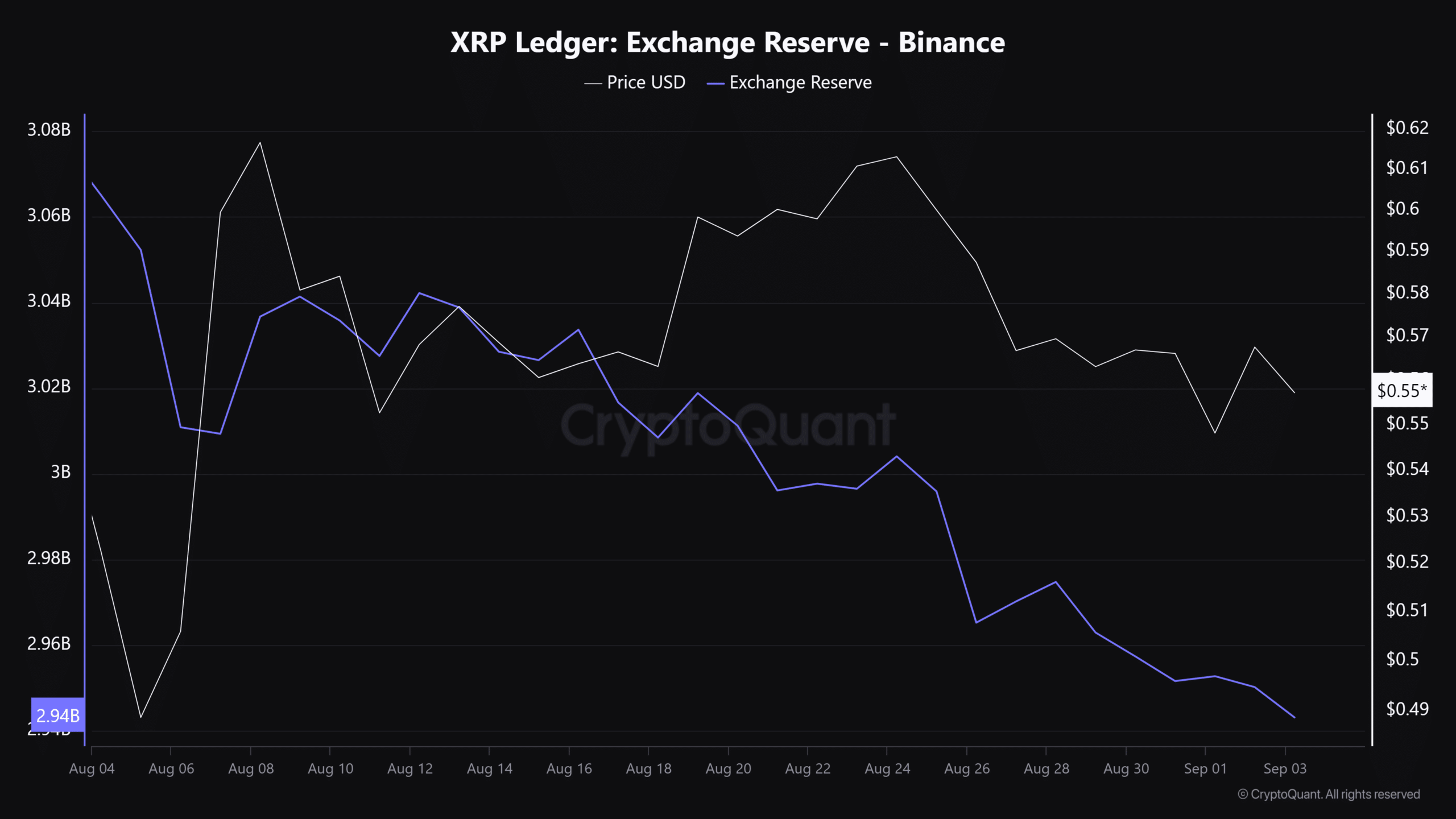

Unsurprisingly, the amount of XRP held on exchanges has dropped by $1 billion in just one month, reinforcing the facts mentioned above.

That being said, despite the decreasing exchange reserve, the impact on XRP’s price did not inflate, suggesting that other factors, such as ongoing market volatility or bearish trends driven by Bitcoin, might be outweighing the effects of lower exchange reserves – So, are they?

Rising OI failed to spur Ripple effect

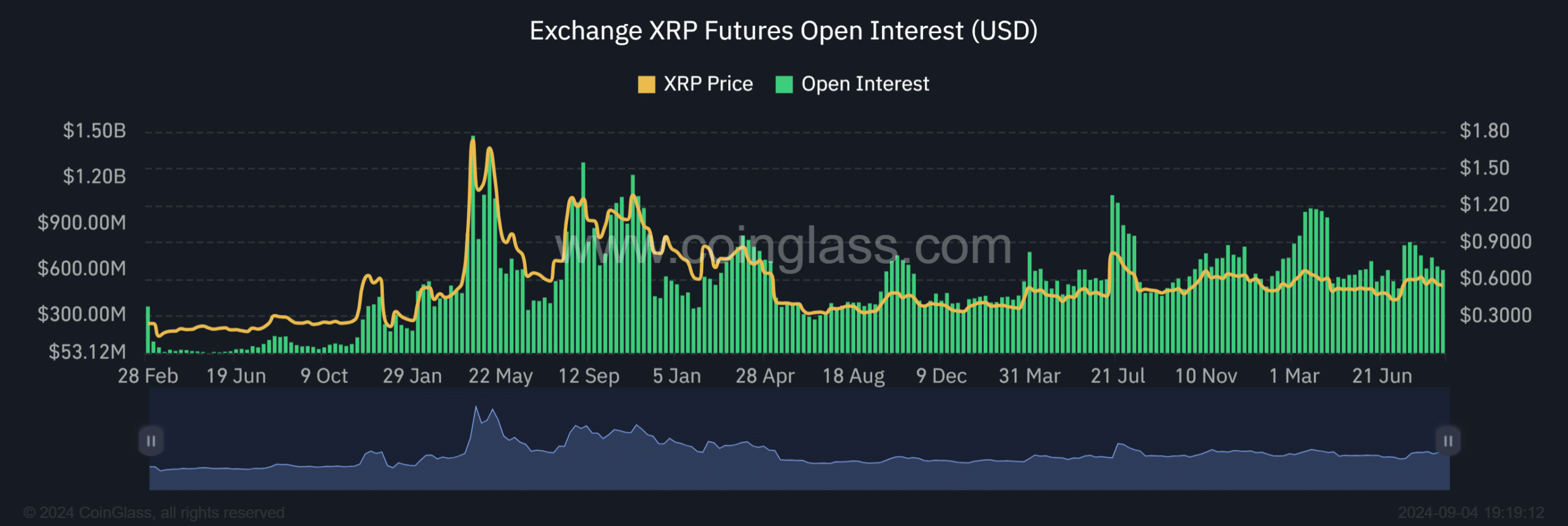

According to AMBCrypto’s chart analysis, XRP surged in tandem with rising OI. For instance, when XRP reached an ATH three years ago, it was accompanied by a record OI of $1.47 billion.

Put simply, this indicated that more traders entered long positions, reflecting confidence in an upward swing. Conversely, a drop in OI often signaled profit-taking, which typically led to a decline in Ripple price.

Surprisingly, on the 22nd of March, while the OI surged to an astounding $998 million, the expected upward momentum in XRP did not materialize.

Since then, despite OI mirroring the early April trend that led the token to test the $0.86 rejection, no similar price movement has been observed.

Read Ripple’s [XRP] Price Prediction 2024-25

In short, the analysis supports our initial hypothesis, showing a direct correlation between Ripple and Bitcoin.

Therefore, XRP may only see a price correction if overall market conditions improve for Bitcoin.