XRP price prediction: Bulls and bears clash over THIS support

- The XRP price action leaned bearishly.

- The defense of the $2 support has been stout and the selling volume was weak.

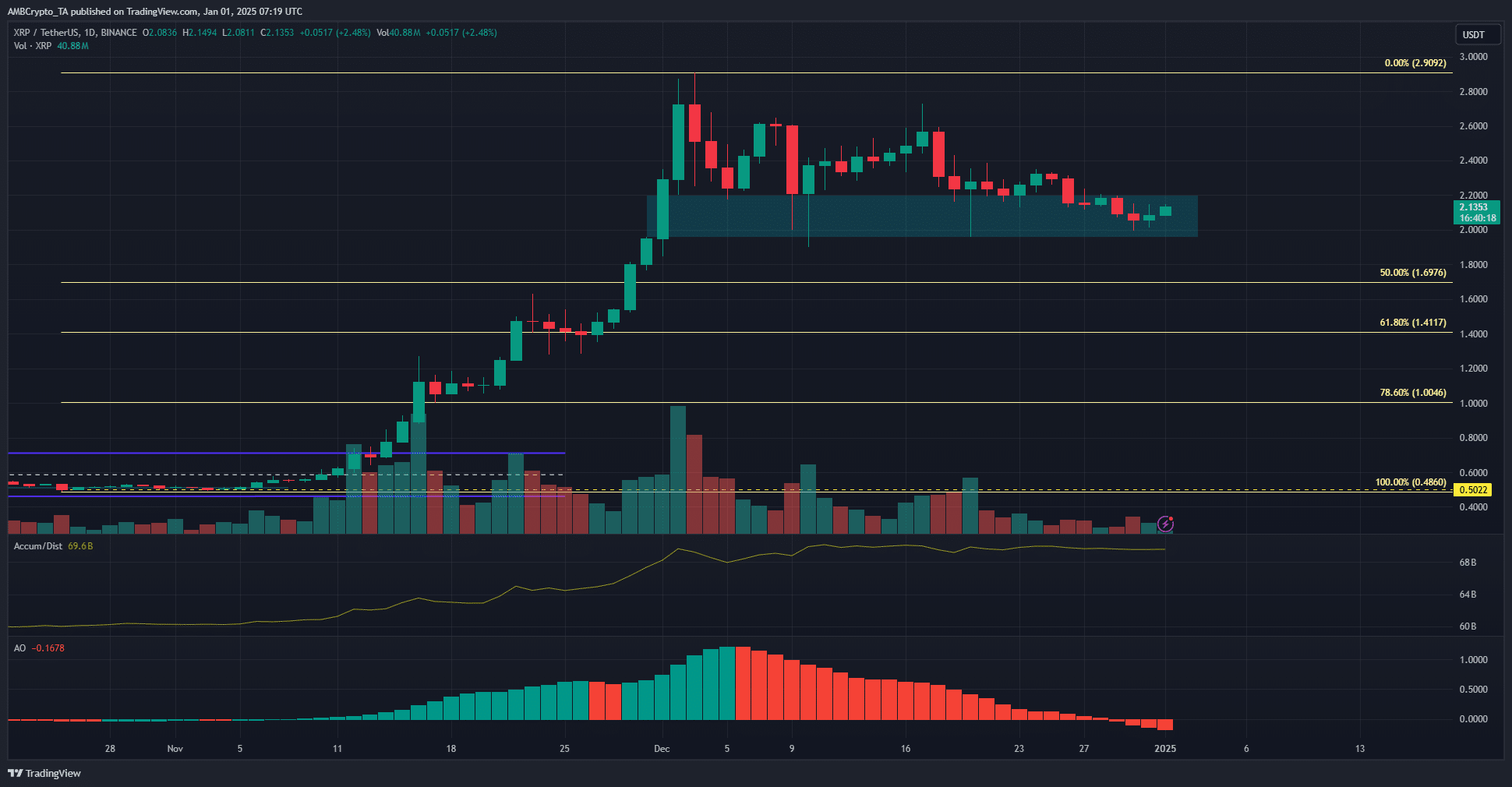

Based on the price charts and the liquidation heatmap, Ripple [XRP] has a short-term bearish outlook. Like most of the crypto market, XRP has suffered due to the Bitcoin [BTC] pullback of the past two weeks.

The daily timeframe also reflected a bearish XRP price prediction. A drop below the $2 demand zone would likely be followed by a deeper retracement toward $1.4 or even $1. This could present a buying opportunity for swing traders to re-enter the market.

XRP price prediction-bulls and bears tussle for control of $2

AMBCrypto’s analysis of the XRP’s daily timeframe indicates a bearish bias. The price action shows a bearish structure, and a retracement phase is underway. The Awesome Oscillator has crossed below the zero line, suggesting that downward momentum is gaining strength.

A drop to the 61.8% and 78.6% Fibonacci retracement levels is possible but not very likely at this time, due to strong buying interest in the $1.96-$2.2 demand zone. This zone is identified as a fair value gap on the daily chart from December 1st.

The A/D indicator continues to trend higher, signaling steady buying pressure. Thus, despite the momentum shift, selling volume has been relatively low, as evidenced by the downward trend in volume bars over the past three weeks.

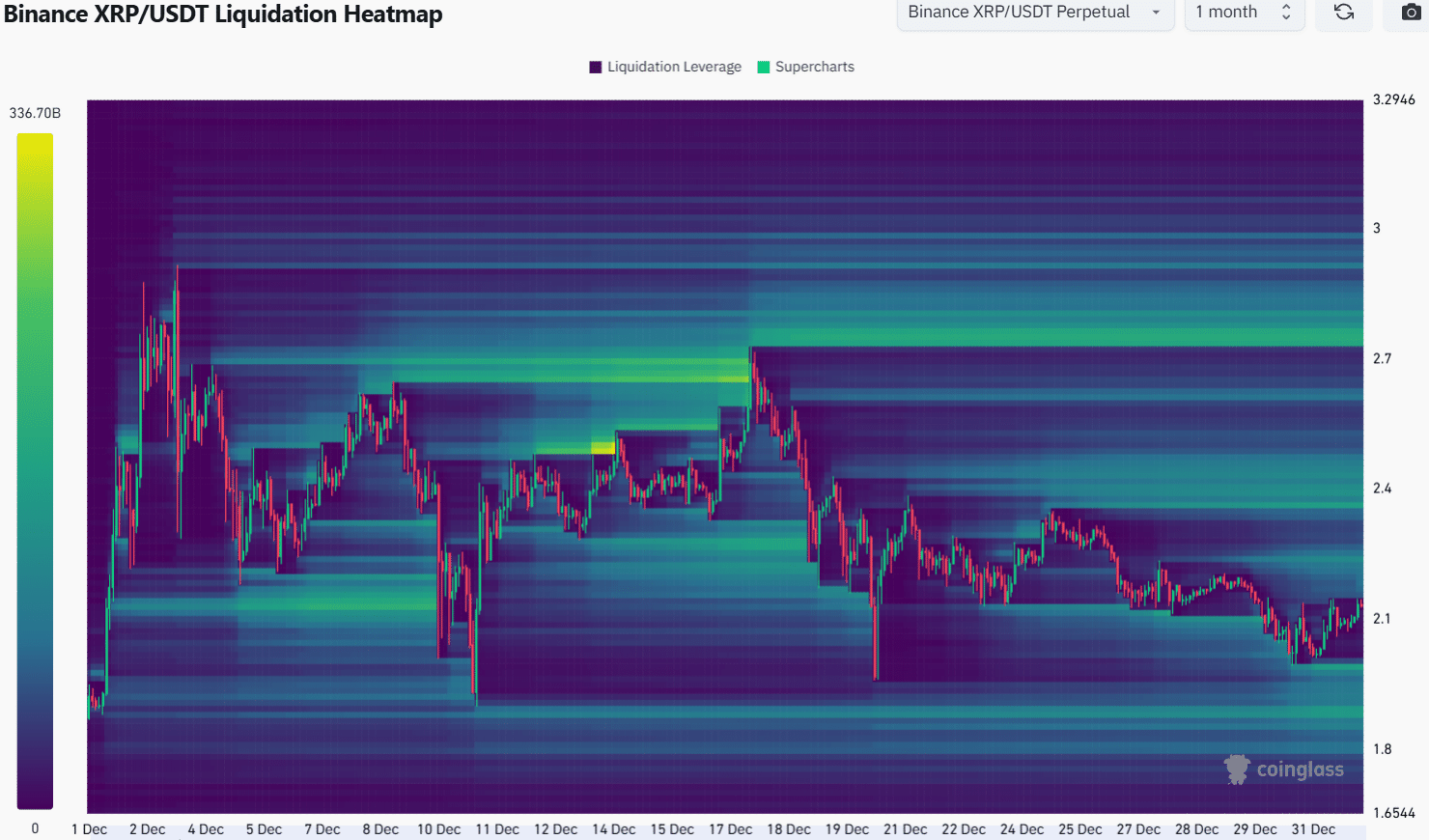

Liquidity build-up and imminent price targets

Despite the efforts of XRP bulls to defend the $2 zone, the liquidity build-up beneath this support area remains relatively small. The liquidation heatmap highlights the $1.98 and $2.23 regions in bright green, indicating these are the next significant price targets.

Read Ripple’s [XRP] Price Prediction 2025-26

It is possible that XRP revisits these zones and reverses temporarily toward the other liquidity pocket, forming a range in the coming weeks.

The direction of Bitcoin is also anticipated to dictate XRP’s market sentiment.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion