XRP price prediction – Here’s what’s next after altcoin’s latest pattern break

- XRP’s recent downtrend provoked a bearish crossover on the 20-day and 50-day EMAs

- Derivates data skewed slightly in favor of bulls, especially as the altcoin approached its near-term support level

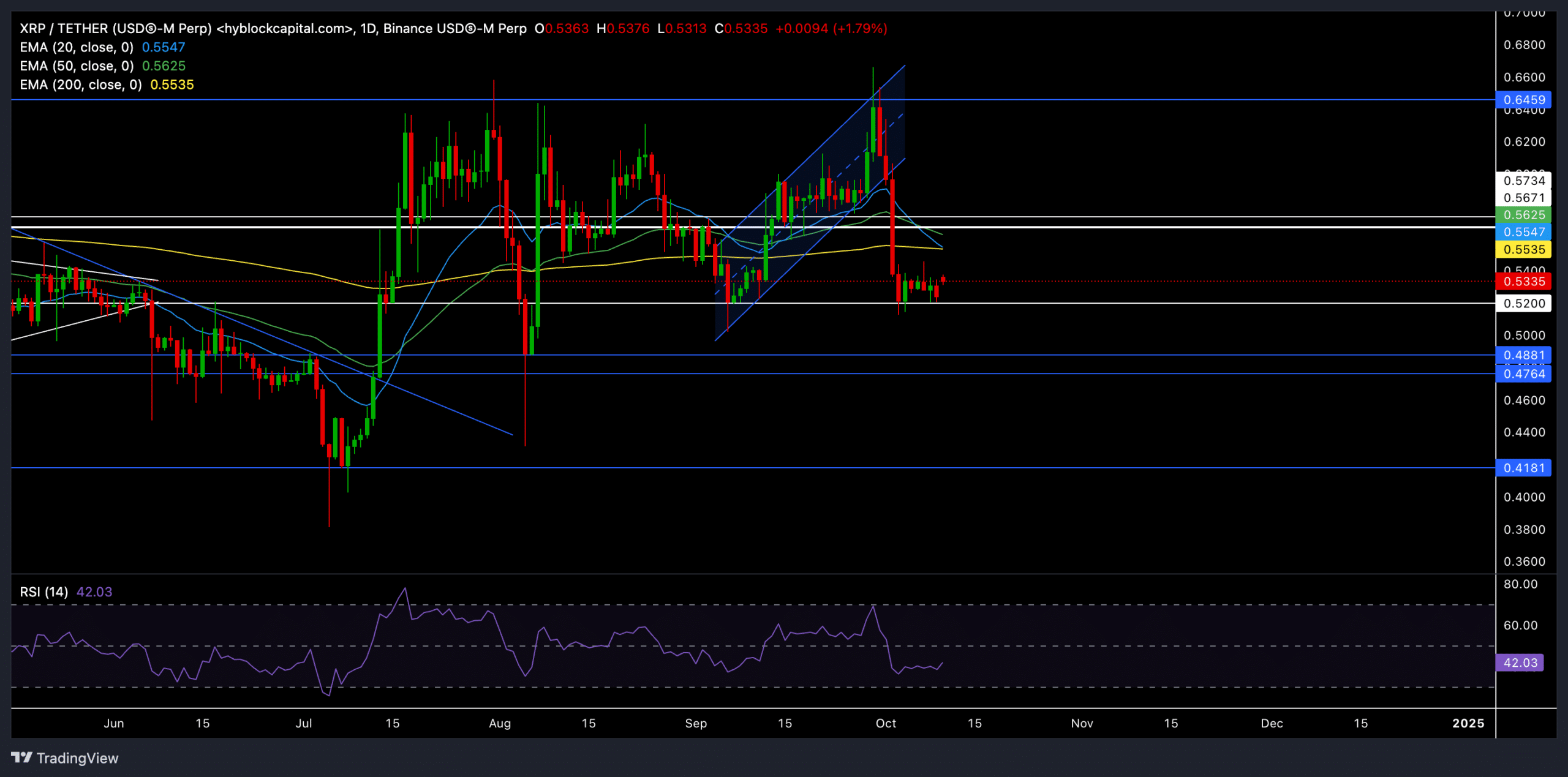

XRP continued its sideways trajectory after repeatedly facing rejection at the $0.60 resistance level for nearly three months. The recent pullback from this level resulted in an ascending channel breakout on the daily chart, highlighting a potential shift in sentiment.

At press time, XRP was trading at approximately $0.5328, up 1.66% over the last 24 hours.

Can XRP bulls make a comeback?

XRP has consistently faced resistance at the $0.60 level, resulting in a prolonged consolidation. The recent rejection from this level triggered a classic ascending channel breakout, leading to a drop below the 20-day EMA and the 50-day EMA – Levels that are now acting as immediate resistances.

The 20-day EMA’s downward trend and its likely bearish crossover with the 200-day EMA suggested that bearish power has been increasing. If this crossover materializes, XRP could continue consolidating below the $0.56 resistance level, limiting the scope for an immediate recovery.

However, XRP showed strong rebound tendency from the $0.52 support level. A sustained bounce from this support could help it reclaim its EMAs, potentially paving the way for a near-term recovery. If momentum strengthens, a retest of the $0.56 resistance could be on the cards, followed by $0.6.

The RSI was at 41.79 at press time, reflecting a rather bearish sentiment. The RSI’s recent movement showed flatter lows, compared to the higher lows on the price action since August – Indicating a mild bullish divergence. This alluded to potential recovery if the bulls step in, although this remains largely contingent on a broader sentiment shift.

Derivatives data revealed THIS

The derivatives market sentiment for XRP appeared mixed, but leaned slightly towards a bullish outlook. The 24-hour long/short ratio stood at around 0.9662, at the time of writing. However, this ratio on Binance and OKX revealed a strong bullish edge— At 3.8216 and 3.11, respectively.

Interestingly, XRP’s Options volume surged by over 753%, pointing to a rise in speculative activity. The Open Interest hiked by 3.3% too and the huge uptick in Options Open Interest (+27.2%) indicated renewed interest among traders, despite the recent downturn.

Here, it’s worth noting that long liquidations were higher, pointing to profit-taking behavior as XRP failed to sustain its gains above $0.56. However, the prominent long positions among top traders implied that a potential recovery might still be in play.