Analysis

XRP price prediction – Identifying the entry points for traders

The OBV trend encouraged the idea that the bulls can eventually reclaim $0.585 as support.

- XRP formed a short-term range within a thirteen-month-old range formation

- A small price dip, followed by the bulls reclaiming $0.585, is anticipated but not guaranteed

XRP saw whales accumulate 50 million tokens during the most recent price dip. This could have buoyed investor confidence but in the short term, the market sentiment has been somewhat bearish.

The whale to exchange flow hit a multi-year low

and is another metric that long-term investors can take heart from. However, the price action on the daily timeframe did not inspire much confidence.XRP forms another smaller range

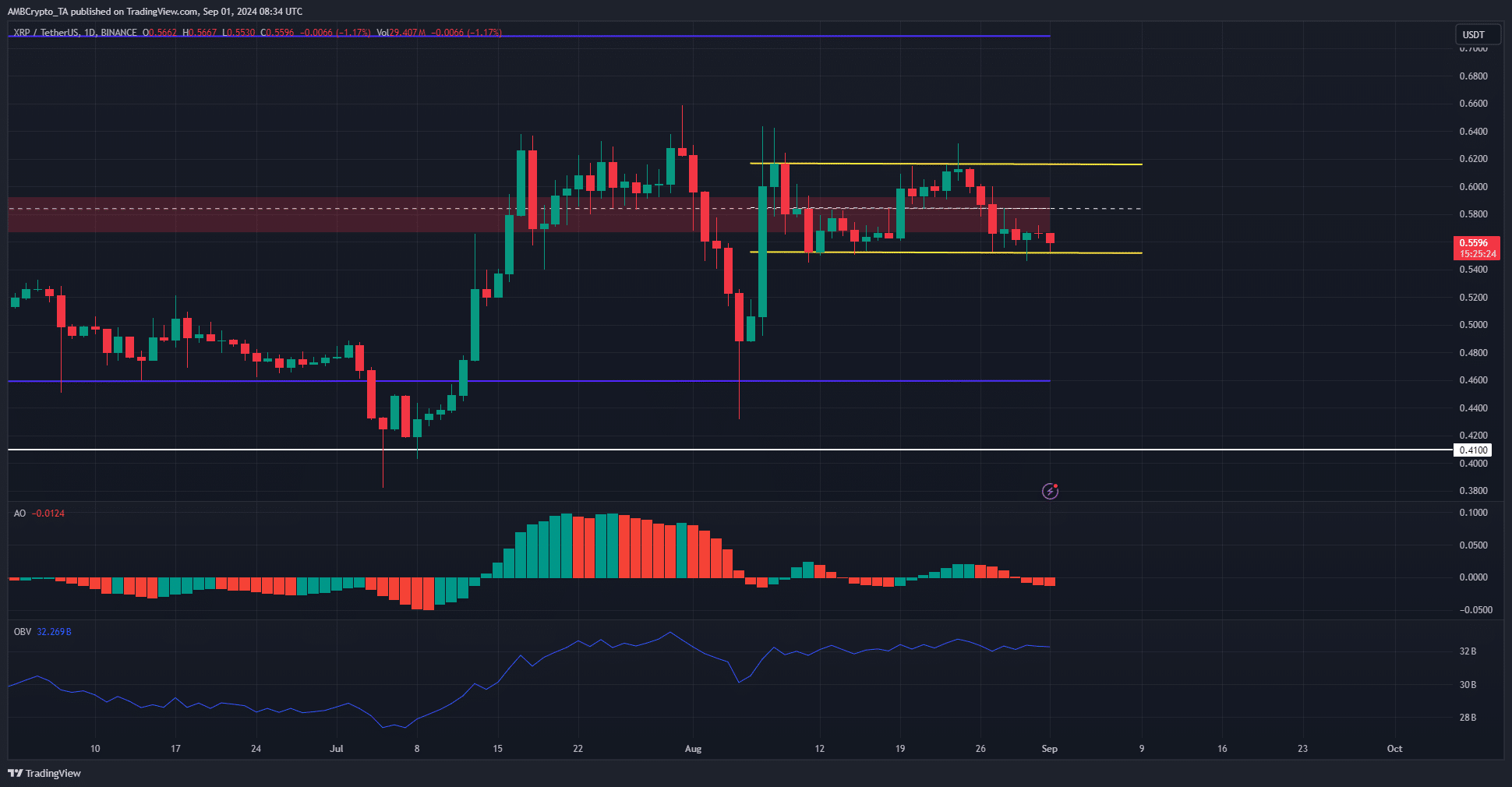

The year-long range (purple) has its mid-point at $0.585. XRP formed another range here that stretched from $0.553-$0.617. At press time, it was trading near the lows of the range.

The OBV has not sunk too deep in recent days. Over the past three weeks, it managed to form a series of slightly higher lows, which meant that traders could expect this dip to be bought as well.

At the same time, the Awesome Oscillator dropped below neutral 50 to signal bearish momentum on the rise. This came in response to the price rejection at the $0.62 zone on Saturday, 24 August.

Lower timeframe traders can use the $0.54-$0.55 zone to bid XRP expecting a price bounce to $0.617-$0.62.

Liquidation levels beckon XRP lower

Source: Hyblock

AMBCrypto then analyzed the 1-month look-back period liquidations heatmap and found that there was a large pool of liquidity at $0.5425. This would mean a price move just below the range marked in an earlier chart.

Is your portfolio green? Check the XRP Profit Calculator

Such a move would afford a low-risk, high-probability buying opportunity for traders with a clear invalidation below $0.5317. The OBV trend encouraged the idea that the bulls can eventually reclaim the $0.585 level as support and make a sustained run towards the $0.7 range high.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion