Analysis

XRP price prediction: Is a rebound targeting 12% gains possible?

The mean coin age had been trending higher in September, showing accumulation.

- The XRP market outlook was uncertain once again for the coming days after rejection at $0.64.

- The price action and metrics showed that there is a buying opportunity targeting a 12% move upward.

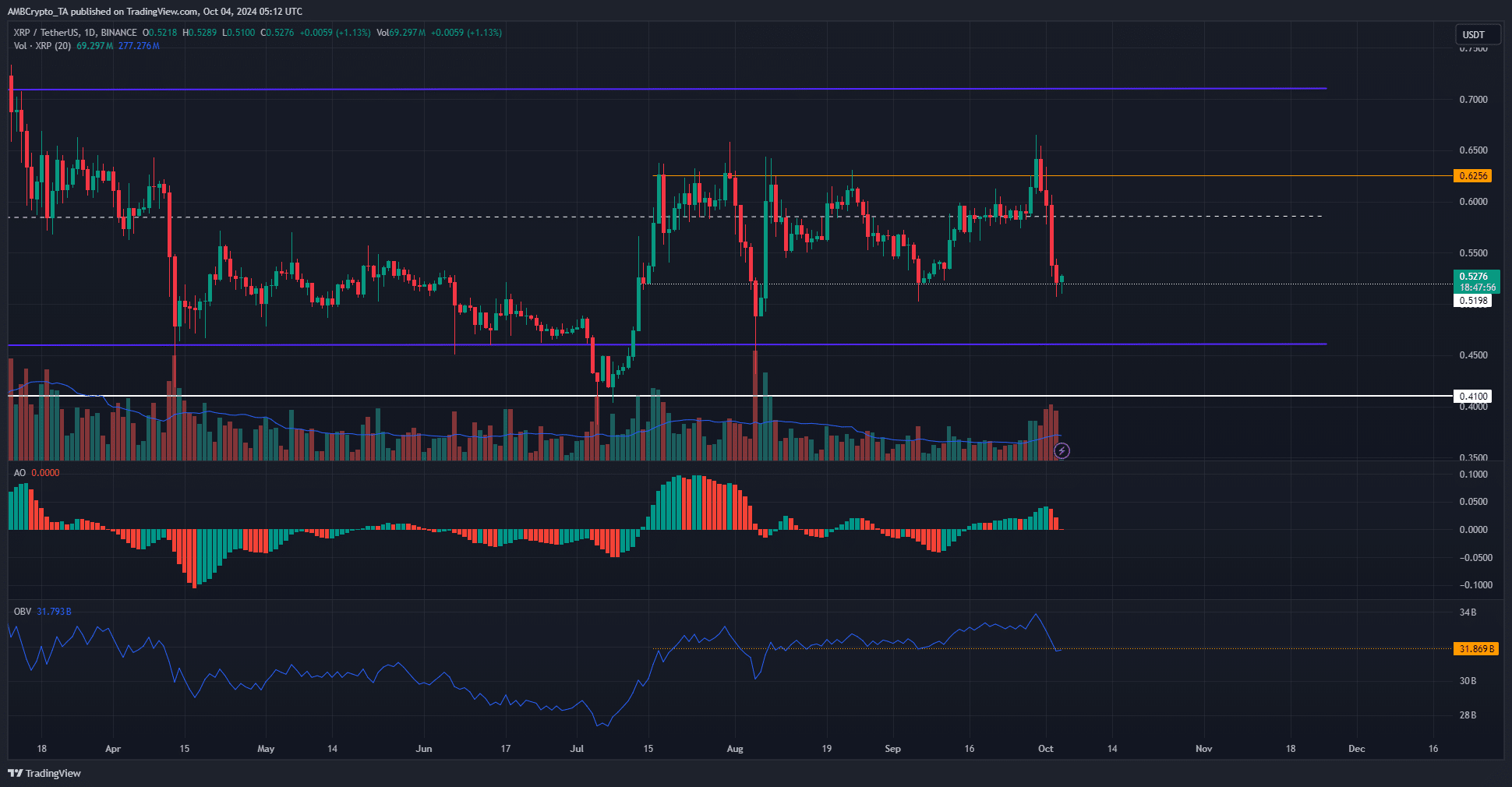

Ripple [XRP] saw a large price reset over the past week. The token threatened to break the local resistance zone at $0.625, and the bulls achieved this on Sunday, September 29th. Since then, XRP has fallen 21% on the price chart.

The Bitwise XRP exchange-traded product (ETP) application brought a flurry of social media engagement. However, the increase in whale transactions began when Bitcoin [BTC] saw a rejection at the $66.5k resistance.

Will the bulls succeed in defending the $0.5 support zone amid muted market sentiment? It is possible, especially if BTC can halt its losses too.

XRP price prediction shows brutal rejection for bulls

The near 20% downturn took just four days. This continued the trend of a bearish first week of the month for crypto that since July. In June, the second week of the month saw the trends turn bearish over the next two weeks.

XRP bulls would be hoping that they can salvage this situation. Swing traders in particular would be smelling a buy opportunity. The OBV and the price are at support levels. BTC has stalled its downward momentum at the $60k area.

The Awesome Oscillator was at zero, showing the upward momentum of the final week of September has been nullified. Bulls would be hoping for a sizeable buying volume during any price bounce.

Attempted breakout saw a storm of XRP selling

Source: Santiment

The mean coin age had been trending higher in September, showing accumulation. The past few days saw this metric plunge calamitously to signal intense selling pressure. The 30-day MVRV also fell to nearly -10%.

Read Ripple’s [XRP] Price Prediction 2024-25

This showed that short-term holders were, on average, at a loss of -10%. This meant that most of these buyers entered around the $0.57-$0.58 area.

It is another clue for us that, on the way up, the $0.585 level which is also the long-term mid-range level would likely be a formidable obstacle.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion