Ripple

XRP rallies post-SEC victory: Is this the start of its bull run?

Could XRP be poised to reach new heights following its recent legal victory against the U.S. Securities and Exchange Commission (SEC)?

- XRP has surged over 5% in the past week, trading at $0.60 at press time.

- Technical and fundamental analyses suggested potential future price movements, with long-term bullish scenarios highlighted.

XRP is currently seeing a notable rebound in its price following the recent victory against the United States Securities and Exchange Commission (SEC).

Over the past week, XRP has now surged by more than 5%, with its press time price sitting at $0.60.

This surge is not only reflected in its price, but also in its market cap, which has added roughly over $1 billion in the past seven days.

XRP’s daily trading volume has also surged from merely above $2 billion as of last Friday to staying above $2.6 billion as of today.

Technical and fundamental outlook

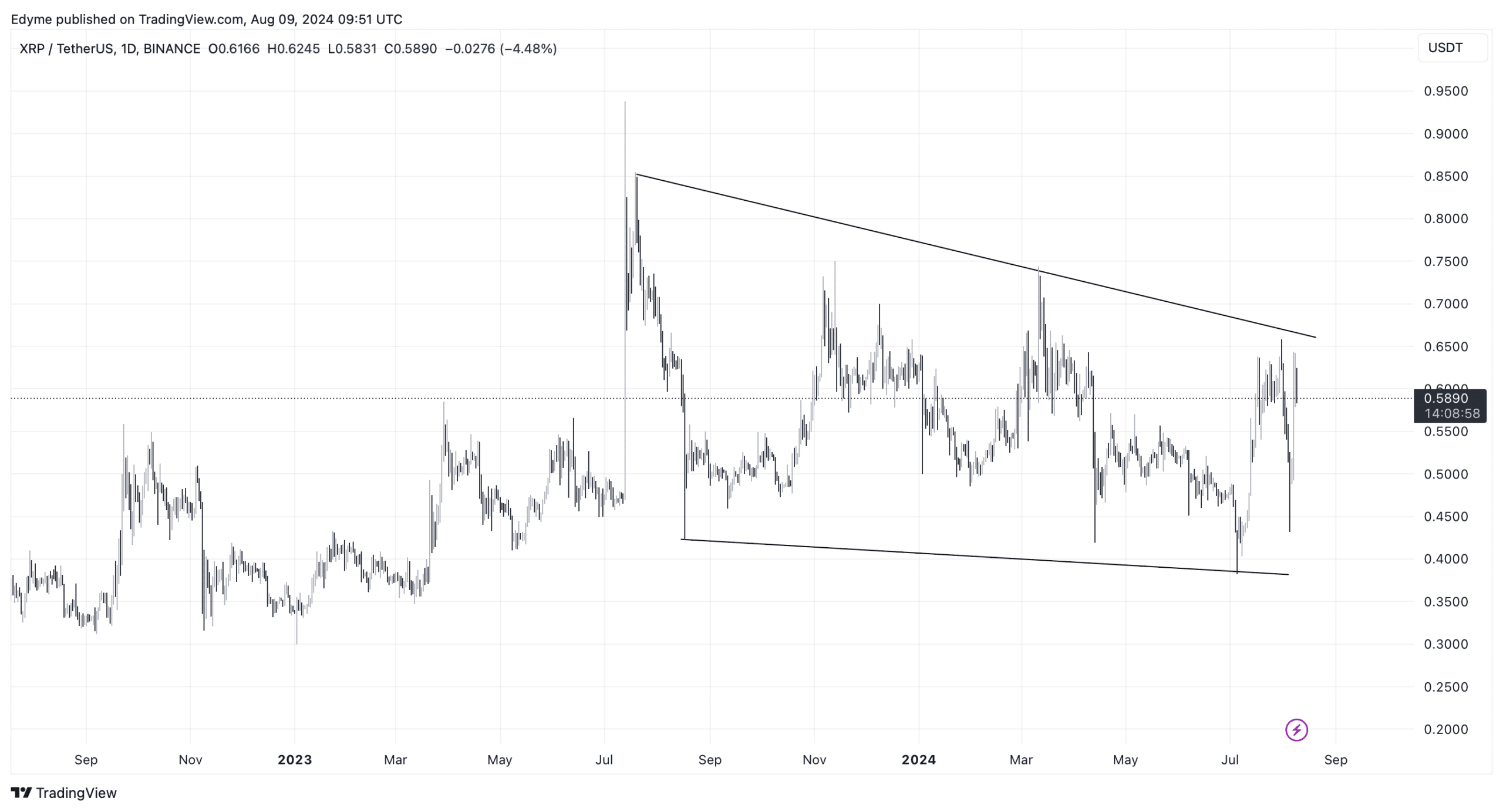

A technical analysis of XRP’s daily chart showed a pattern of higher highs and higher lows, forming what appeared to be a descending channel pattern.

Although XRP was consolidating within this channel, a breakout in either direction could indicate the future price direction.

At press time, XRP was approaching a potential breakout above the channel but has encountered resistance, likely due to a supply zone identified on the daily chart.

It is essential to monitor the key price levels of $0.74 and $0.38, as these could determine XRP’s next significant movements.

A break above $0.74 could signal the start of a rally, while a drop below $0.38 might suggest a further decline.

From a fundamental perspective, XRP’s Network Value to Transactions (NVT) ratio, which compares the network value to the transaction volume, was 674.69 at this time.

This high ratio could indicate that the network is either overvalued or that the transaction volume does not justify the current network value, which could indicate slow moves to the upside.

Moreover, XRP’s Open Interest, which represents the total number of outstanding derivative contracts that have not been settled, has decreased by 9.27% in the last 24 hours to $655.35 million.

This decline in Open Interest, accompanied by a 61% drop in open interest volume to $5.19 billion, suggested a decrease in market leverage and could impact price stability.

XRP’s long term outlook

Looking at long-term prospects, a prominent analyst known as Doctor Profit on social media has drawn parallels between the current market patterns and those of 2017, prior to XRP’s meteoric rise.

According to Doctor Profit, the consistent rejection of a long-standing resistance line could either lead to a significant breakout, with potential price targets well above $1 by early 2025.

Read Ripple’s [XRP] Price Prediction 2024-2025

The analyst particularly noted:

“If we hit another rejection at $0.72, don’t panic. The breakout is inevitable, and I expect targets way above $1 latest by Q1 2025. When XRP pulls a 2017 move and hits the same Fibonacci levels we have seen in 2017, we’re looking at a potential top of $16.”

Meanwhile, he gave two price targets for XRP, noting,

“Best case: $16 – $20. Worst case: $4 – $7.”