XRP records $1M inflows as investors show confidence

- XRP was among the coins benefiting from increased demand as investor preference shifted towards altcoins.

- XRP was still experiencing short-term sell pressure despite the favorable weekly outcome.

Digital asset management firm Coinshares released its latest weekly report on 19 June, which XRP investors and enthusiasts might find appealing. The report particularly highlighted how top cryptos by market cap fared in the last seven days.

How much are 1,10,100 XRPs worth today?

According to the Coinshares report, altcoins have been receiving more investor attention after last week’s crash. Investors added over $1 million to their XRP positions, making it the biggest gainer in the asset management firm’s portfolio.

XRP‘s large number of inflows reflected the optimism traders have regarding the SEC-Ripple legal battle.

Assessing the impact on XRP’s price action

The liquidity inflow has been apparent in XRP’s price action in the last four days. It exchanged hands at $0.49 at press time, representing an 8.8% upside. The bullish pivot also occurred right after the price retested an ascending support line.

The bounce also coincided with a recent statement from Ripple CEO Brad Garlinghouse regarding the Hinman documents. The statement may have played a key role in rejuvenating investor interest. But what does this mean for the altcoin’s performance in the short to mid-term?

XRP’s performance still hinges on the assumed outcome of the legal battle between Ripple and the SEC. It is worth noting that things were leaning in Ripple’s favor at press time, but the final decision was yet to be made.

Perhaps a look at the current XRP-related on-chain activity may offer some insights into what to expect.

On-chain performance

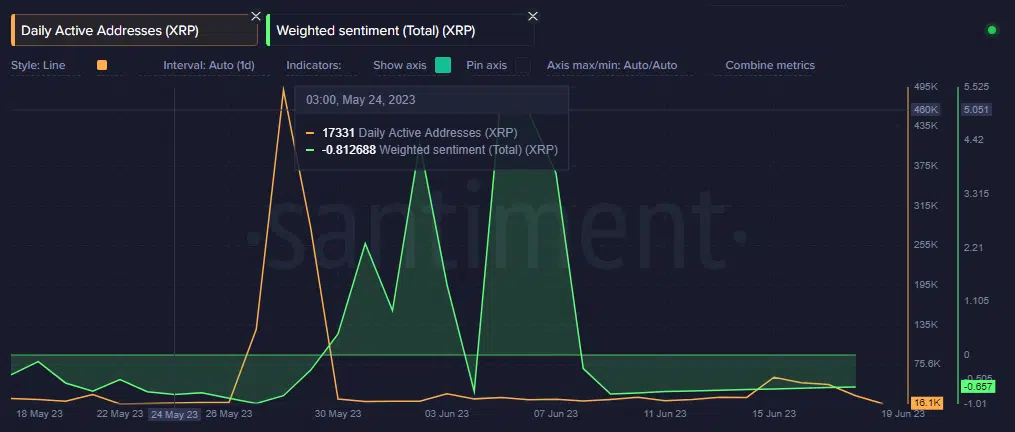

XRP’s daily active addresses saw a slight uptick during mid-June. However, the same metric has since reverted to its 4-week low range. This outcome displayed a lack of investor confidence, as seen in the weighted sentiment metric, which revealed a lack of strong optimism.

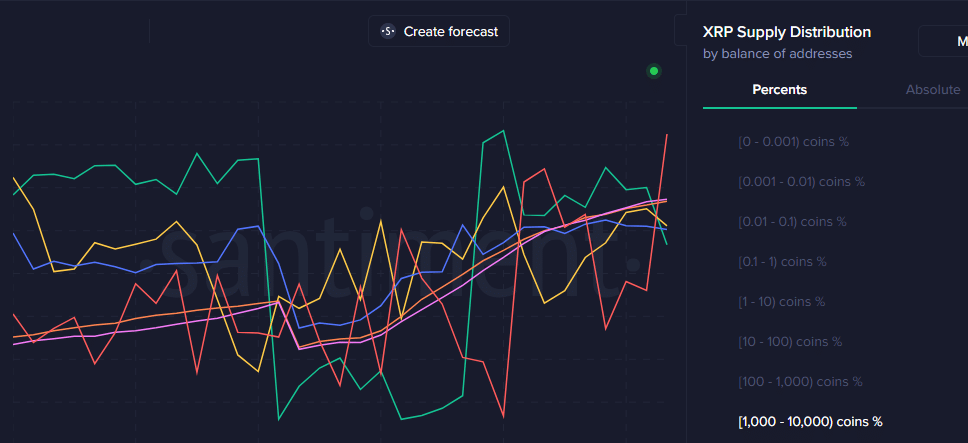

The above metrics suggested that the market may not be poised for a robust move to the upside in the short term. That expectation is further supported by the fact that whale activity based on supply distribution confirmed that short-term profit-taking was still in play.

XRP’s supply distribution metric revealed that the largest whale categories have been buying the cryptocurrency since the second week of June. This means they have been contributing to the return of buy pressure.

Realistic or not, here’s XRP’s market cap in BTC’s terms

However, addresses holding over 100 million XRPs have been offloading some of their coins in the last three days.

The largest whale category controlled over 18% of XRP’s total circulating supply at press time. This means the sell pressure from the same whale category has the potential to offset some, if not all, of the bullish momentum from other whale categories.