XRP recovers from crash as whales go on an accumulation spree

- Despite the interest shown by whales, the short-term sentiment surrounding XRP remained grim.

- The temporary rise in interest gave a fillip to XRP’s social activity.

Ripple [XRP] gained good ground in the last 24 hours of trading, defying the lackluster market of other large-cap crypto assets like Bitcoin [BTC] and Ethereum [ETH].

Is your portfolio green? Check out the XRP Profit Calculator

XRP shows signs of recovery

XRP bumped up to $0.55 during Sunday, 20 August, trading hours, according to CoinMarketCap data. However, because of liquidation by short-term bulls, prices dipped and XRP traded at $0.52 at the time of writing.

Nonetheless, the temporary uptick was enough to heighten the social buzz around the payments-focused cryptocurrency. As per social analytics firm LunarCrush, XRP’s social engagements increased significantly in the last 24 hours.

$XRP has leading combined social + market activity.#XRP has hit the #1 LunarCrush AltRank™.

24-hour activity

Price +4.412% to $0.5410

Social engagements 140,152,191https://t.co/NzkiB1zmlx pic.twitter.com/CXm9aj8iPn— LunarCrush (@LunarCrush) August 20, 2023

Whales leading the charge

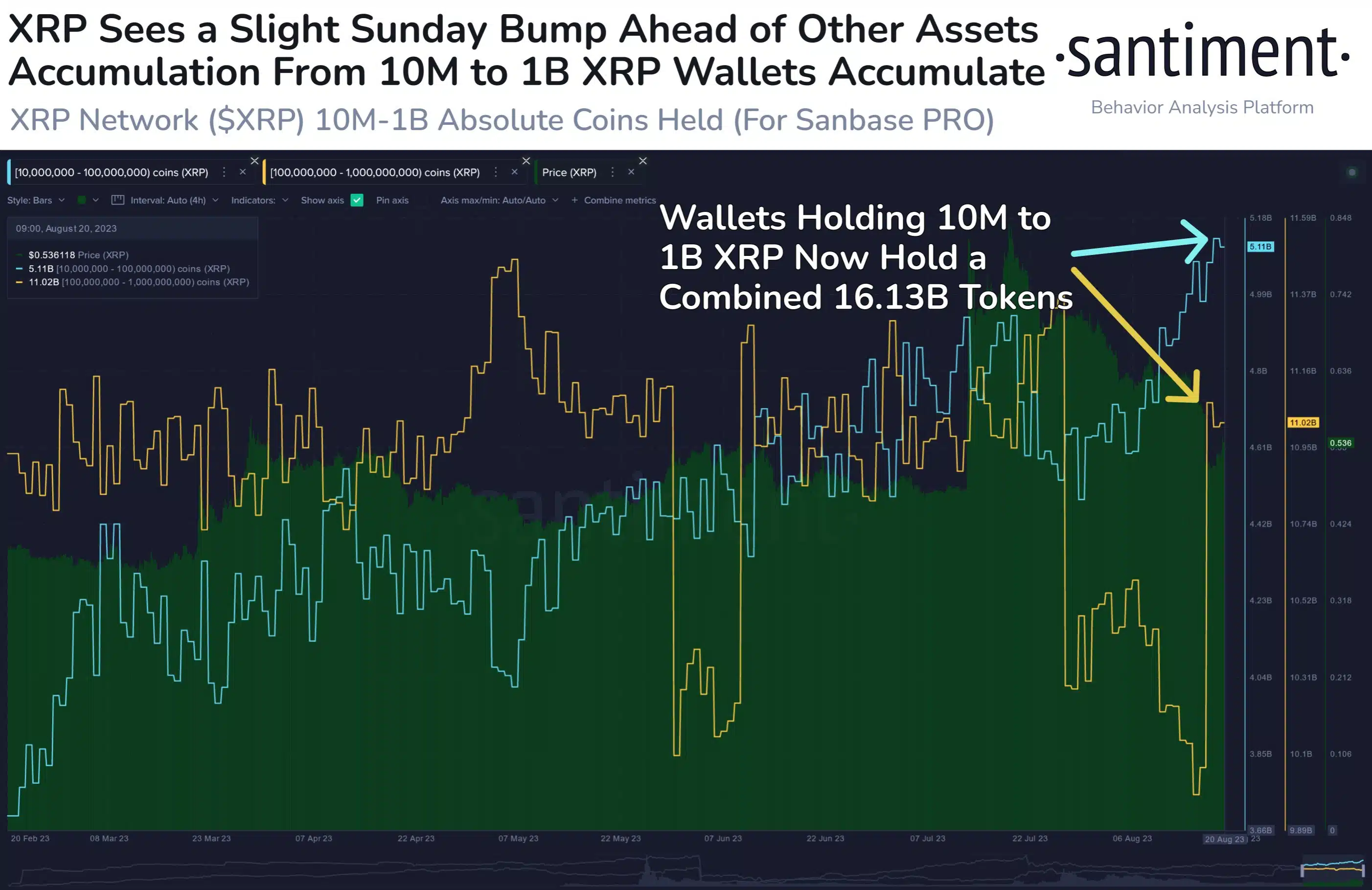

The price recovery, coming from the market crash of the last week, was spurred by the accumulation activity of large XRP whales. Data from blockchain analytics firm Santiment showed that the cohort hoarding between 10 million and 1 billion tokens added to their positions aggressively in the last 24 hours.

These large whales held a combined total of more than 16 billion XRP tokens at the time of writing, worth $8.32 billion at the press time market price.

The flurry of whale activity on Sunday was also reflected in the significant uptick in the total number of whale transactions worth more than $1 million.

However, despite the interest shown by whales, the short-term sentiment surrounding the token remained grim, as the weighted sentiment indicator remained in the negative zone.

Speculative interest for XRP increases

XRP’s futures market followed the fluctuations in the spot market. As prices rose, bullish-leveraged traders became dominant and bets on price gains surpassed those on price declines, according to Coinglass.

However, the pullback changed the dynamics as long-position traders became a minority at the time of writing.

Read Ripple’s [XRP] Price Prediction 2023-24

The overall mood in the XRP circles has been upbeat ever since the partial win in the hotly-contested legal battle against the U.S. Securities and Exchange Commission (SEC).

But the battle is far from over as the regulator’s request for appeal of the 13 July order was partially granted by the U.S. District Judge Analisa Torres.