XRP retraces into a golden pocket but can the bulls enforce a comeback

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

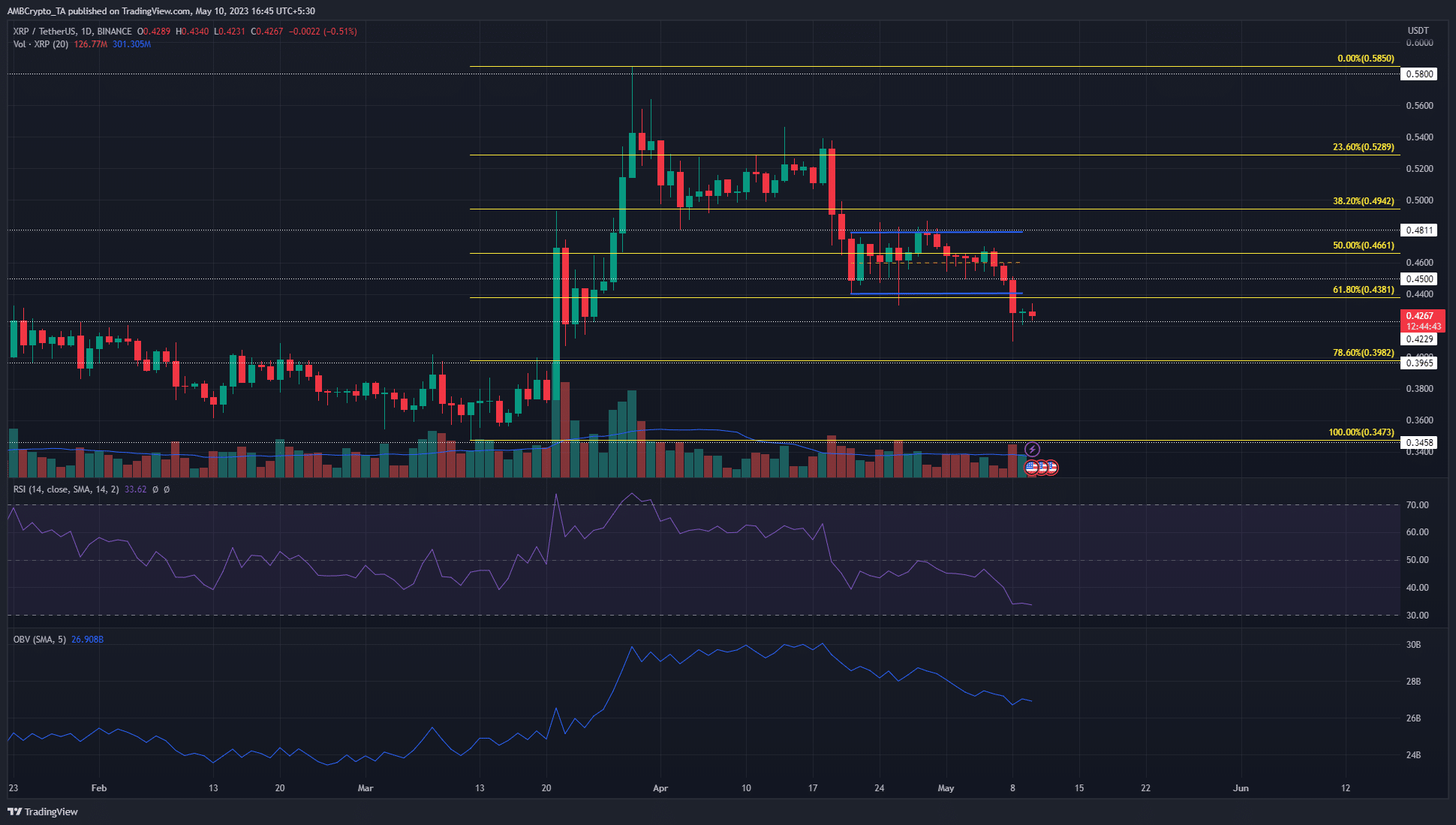

- The $0.4 support level has confluence with a Fibonacci level

- A fall beneath $0.42 could spur swift losses for XRP

The ongoing XRP vs SEC case does not seem to have an end in sight yet. A verdict in the first half of 2023 seems unlikely. Meanwhile, the XRPL on-chain activity was on the rise, despite the losses that XRP saw on the price charts over the past month.

Read XRP’s Price Prediction 2023-24

The price action showed a strong bearish bias and the slump below $0.44 only reinforced the high ground that the sellers already held. Over the rest of May, two critical levels of support will be worth watching.

XRP falls beneath the late April range lows but a recovery could be in sight

A set of Fibonacci retracement levels (yellow) was plotted based on the rally from $0.347 to $0.585 that began in March. It showed the 61.8% and 78.6% retracement levels lay at $0.398 and $0.438, respectively.

This meant that on the higher timeframes, the area between these two levels can be expected to see a positive reaction from the price.

In recent days, Bitcoin’s move beneath $27.8k meant the lower timeframe bias was strongly bearish. Unless the market sentiment can take a 180-degree turn in May, the rally XRP bulls are attempting to create might end up being a feeble bounce.

Is your portfolio green? Check the XRP Profit Calculator

The RSI was well below the neutral 50, with a value of 33 showing a strong downtrend in progress. The OBV was also in decline since mid-April when prices faced rejection at the $0.5 zone. Buyers with a longer investment horizon can wait for these factors to swing in bullish favor.

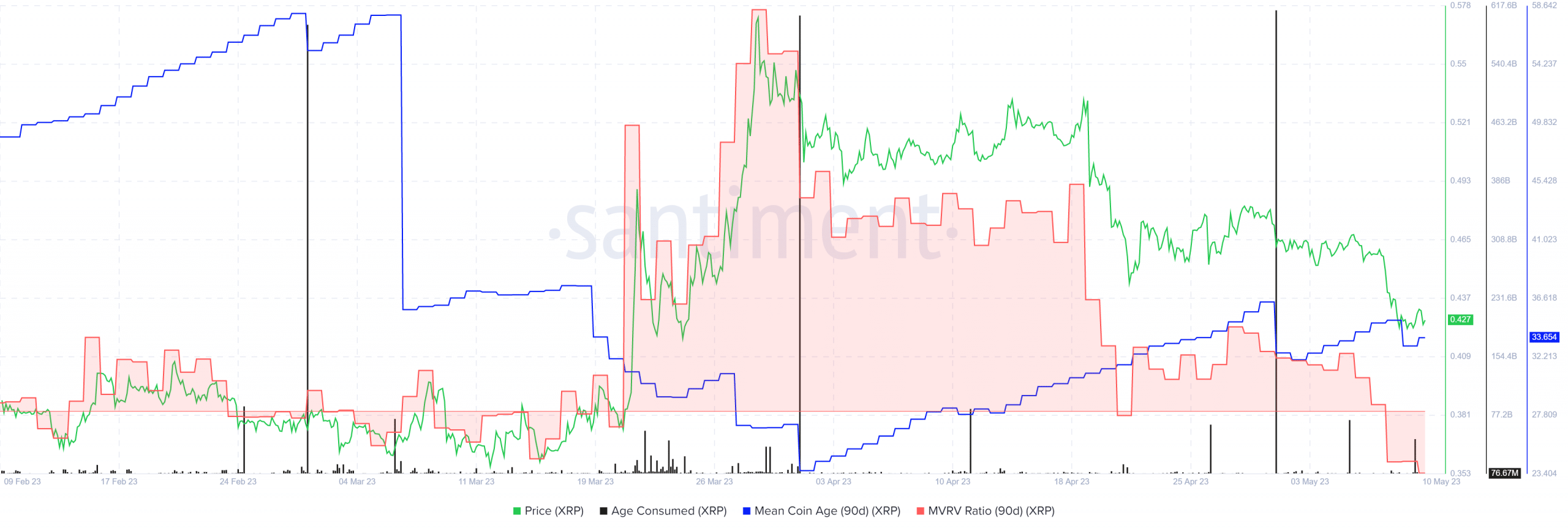

Holders were in the red as selling pressure continues

Source: Santiment

The mean coin age metric had been rising for a good chunk of April, but the developments in late April showed the accumulation phase was disturbed. The MVRV ratio also slumped below zero. This showed holders were at a loss and the asset was likely undervalued.

The age-consumed metric saw a heavy spike in early May to underline the strength of selling, as old XRP tokens on-chain saw a rapid flurry of movement. This was a sign of intense selling, and the metric saw two more noticeable surges in the past week.