Altcoin

XRP sees $288 mln outflow – Sign of a price surge?

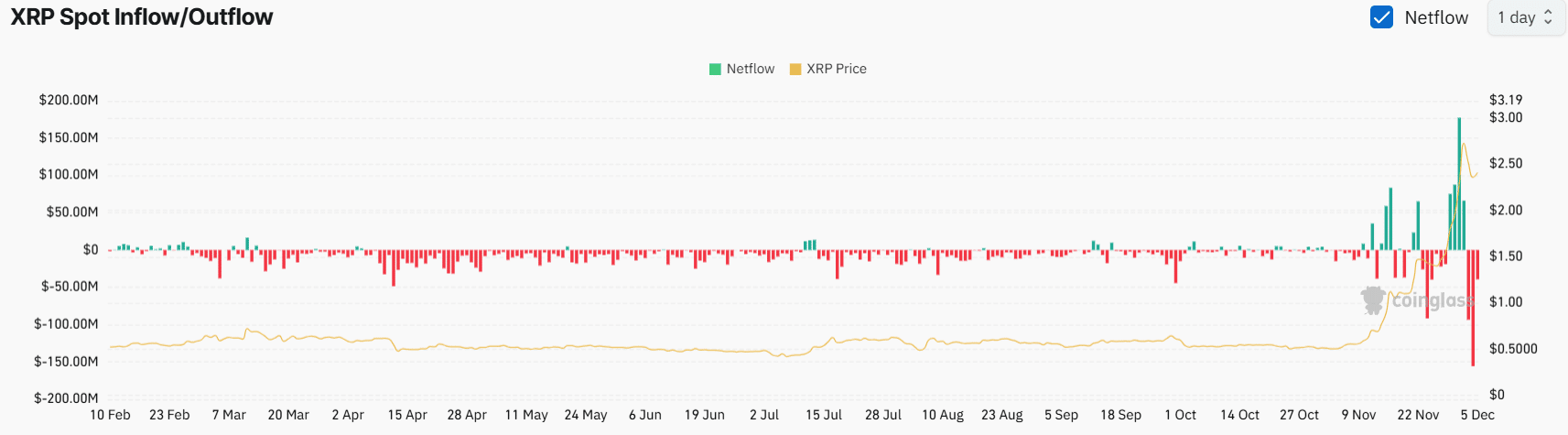

XRP spot inflow/outflow data shows that exchanges have witnessed a significant outflow of $288 million.

- XRP could rally by 18% to reach the $2.90 level if it closes a daily candle above the $2.50 level.

- 50.8% of top XRP traders held short positions at press time, while 49.2% held long positions.

Despite the ongoing price correction, XRP, the native token of Ripple, remains under the radar of whales and investors, as reported by on-chain metrics from Coinglass.

The potential reason for this attraction could be XRP’s recent performance, which saw a significant surge of 370% over the past month.

$288 million XRP outflow

According to CoinGlass’s XRP spot inflow/outflow data, exchanges have witnessed a significant outflow of $288 million in tokens since the beginning of December.

In the cryptocurrency context, this substantial outflow refers to the withdrawal of assets from exchanges to wallet addresses for long-term holding.

This indicates a potential buying opportunity, hints at possible upside momentum, and reduces selling pressure.

Bearish sentiment among traders

In addition to the withdrawal of assets for long-term holding, traders appear to be neutral as they might be waiting for an XRP breakout.

Data showed that the XRP Long/Short Ratio was 0.98 at press time, reflecting bearish sentiment among traders. 50.8% of top traders held short positions, while 49.2% held long positions.

According to AMBCrypto’s technical analysis, XRP has recently broken out of an inclined trendline on the hourly time frame and was facing resistance at the $0.247 level.

Based on recent price action and historical momentum, if XRP breaks through this resistance and closes a daily candle above the $2.50 level, there is a strong possibility it could rally by 18% to reach the $2.90 level in the coming days.

On the positive side, the altcoin was trading above the 200 Exponential Moving Average (EMA) on both lower and higher time frames, indicating an uptrend. Meanwhile, XRP’s Relative Strength Index (RSI) was at 40, near the oversold zone.

When an asset’s RSI approaches the oversold area, it often signals that the asset has significant room to rally in the coming days.

Read Ripple’s [XRP] Price Prediction 2024–2025

XRP’s price momentum

As of press time, XRP was trading near $2.40, having registered a price decline of 7.2% in the past 24 hours.

During the same period, its trading volume dropped by 25%, indicating reduced participation from traders and investors compared to previous days.