XRP’s week ahead: Why traders should prepare for a 20% surge

- XRP has a strongly bullish bias on the daily chart, and swing traders can seek to enter long positions.

- In the short term, some consolidation over the next 12-24 hours is likely.

Ripple [XRP] saw a rapid rise in the number of transactions. This could be due to the hike in micropayment transactions which have become prevalent on the XRP Ledger. Its trading volume was also high.

In South Korea, the 24-hour volume of XRP was higher than Bitcoin’s [BTC] on the 17th of July. Moreover, the bulls defended a former resistance level as support, setting the stage for another impulse move higher.

XRP bulls gear up for a 20% rally

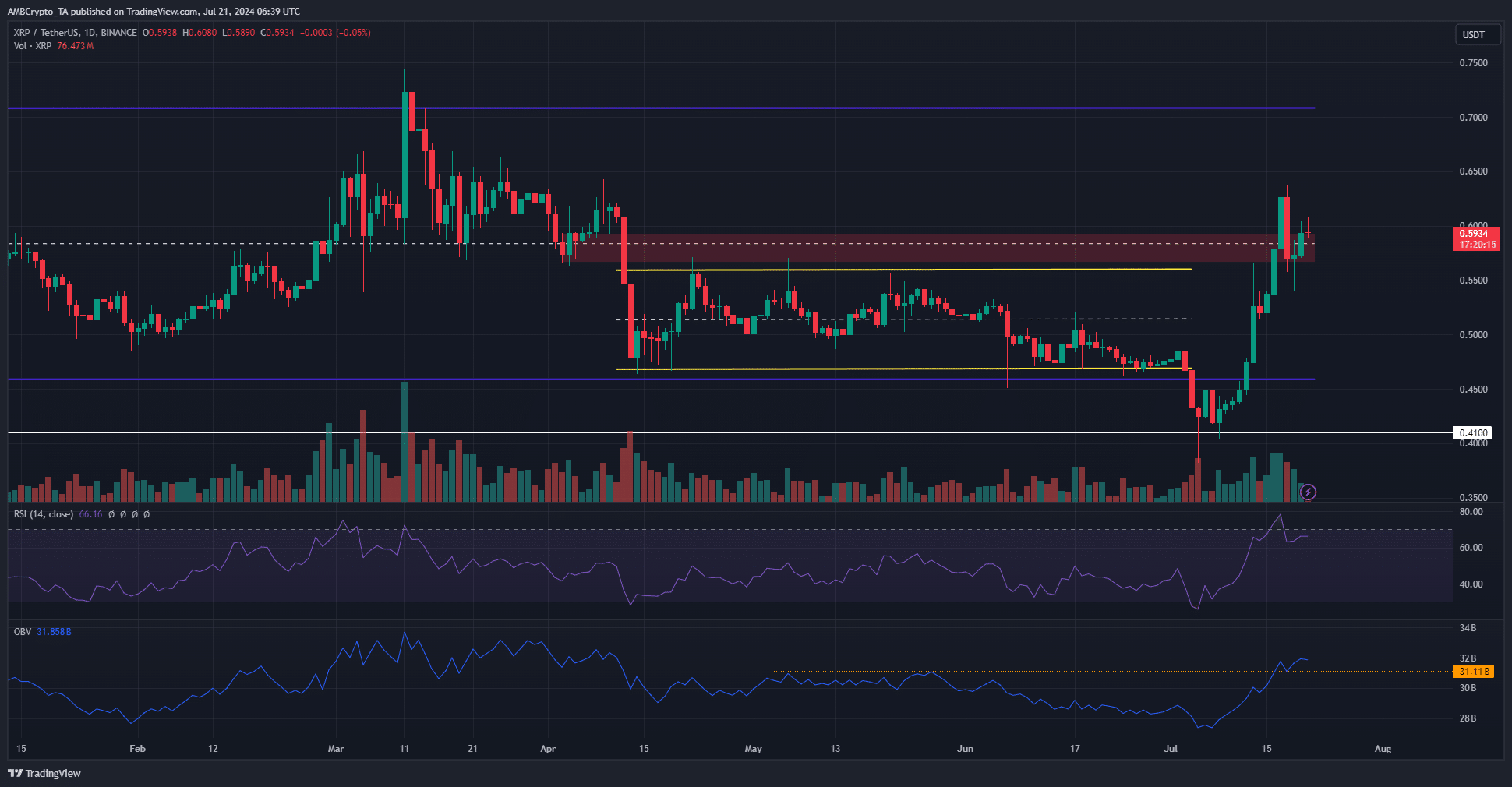

The market structure on the daily chart was firmly bullish. The mid-range mark at $0.585 was flipped to support. Additionally, the OBV cleared the local highs from May to signal strong buying pressure during the price rally.

The RSI was also well above neutral 50 to show bullish momentum. As things stand, XRP could advance to the range highs at $0.71.

On Friday, the 19th of July, XRP dropped as far south as $0.54 and bounced past $0.59 after that. The inference was that $0.54, the former range (yellow) highs, and $0.585 are expected to serve as support in the coming days.

After the move to $0.635, such a deep drop meant that overleveraged longs or late bulls would have been liquidated. This would have set up the price for a more sustainable move upward.

Gauging how the futures market is poised

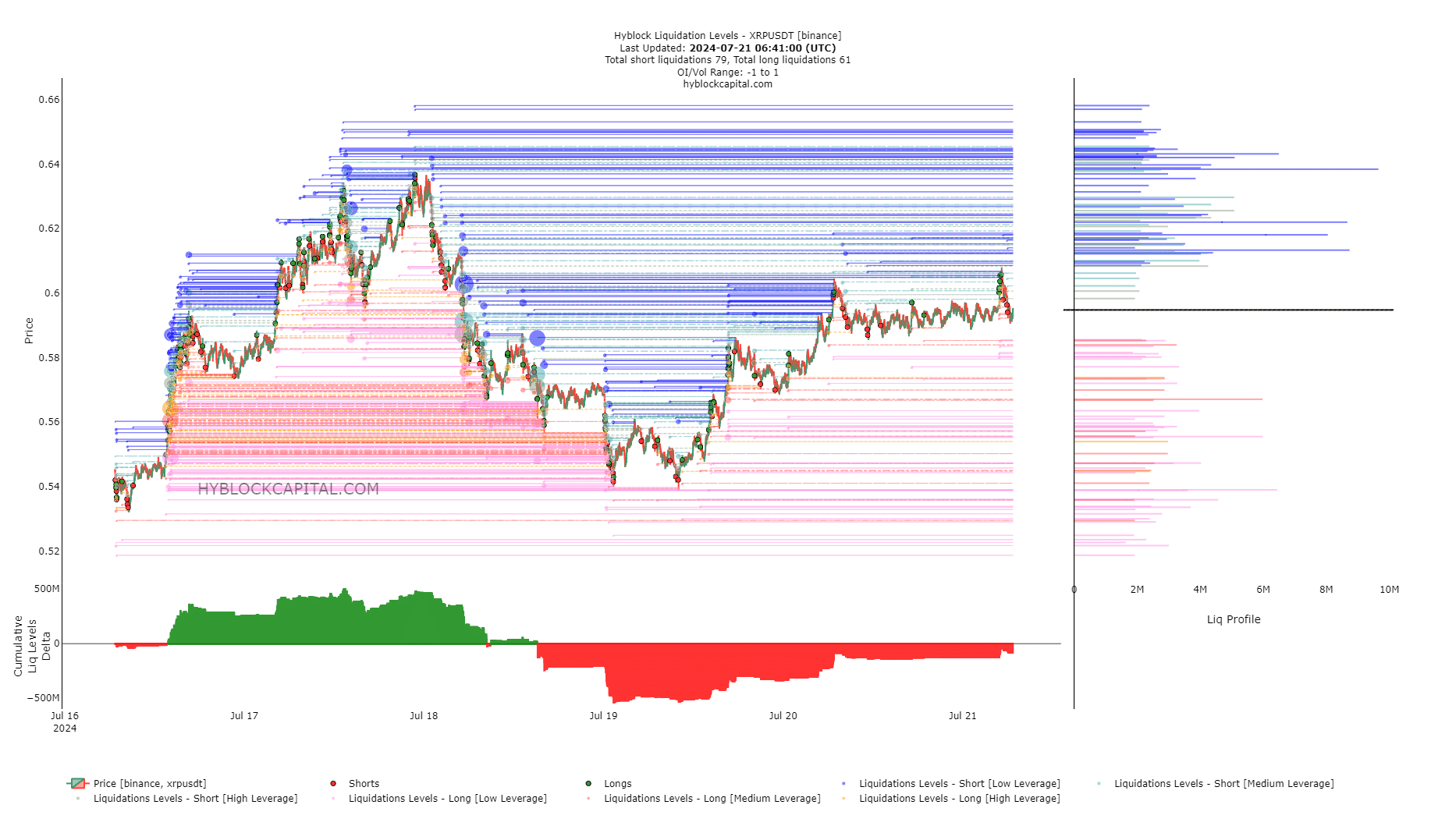

Source: Hyblock

AMBCrypto’s analysis of the liquidation levels showed that traders can expect the token price to spend some more time consolidating around the $0.59 level. The cumulative liquidation levels were slightly negative.

Read Ripple’s [XRP] Price Prediction 2024-25

The short-term liq levels were not overwhelmingly bullish or bearish. This could change during Monday’s trading session.

The $0.567 and $0.638 levels are the ones where a bullish or bearish reversal, respectively, could commence based on the market sentiment on Monday.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.