XRP whale bags 52 mln tokens as THIS signals potential upside

- XRP could soar by 17% to reach the $0.65 level if it closes a daily candle above the $0.558 level.

- Combining these on-chain metrics with the technical analysis, it appears that bulls are dominating the asset.

Amid ongoing bullish market sentiment across the cryptocurrency landscape, XRP has finally broken out of a prolonged consolidation phase and is signaling a potential upside.

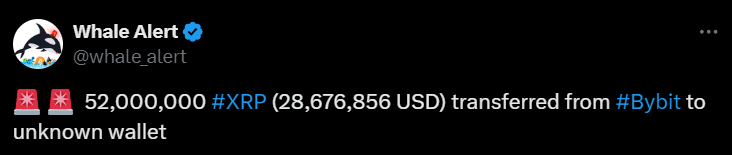

Whale adds 52 million XRP tokens

Blockchain-based transactions tracker Whale Alert made a post on X (Previously Twitter) that a crypto whale withdrew a significant 52 million XRP tokens worth $28.67 million from a South Korean cryptocurrency exchange Bybit.

Despite the market rallying, XRP has lagged in gains until now, but on-chain metrics are indicating a shift.

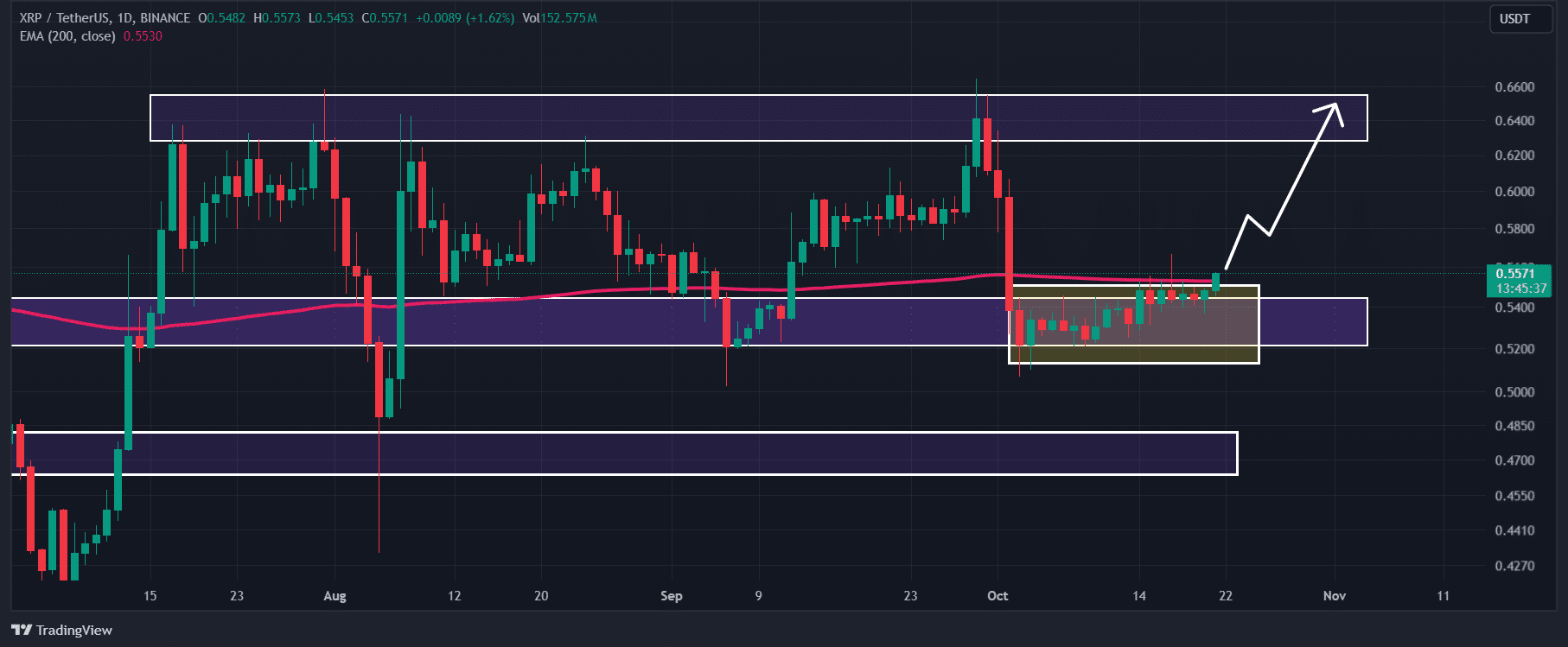

XRP technical analysis and key levels

According to AMBCrypto’s technical analysis, XRP appears bullish as it has broken out from a three-week-long consolidation zone and the 200-day Exponential Moving Average (EMA).

Despite this bullish outlook, it remains uncertain whether the asset will rally or continue to consolidate until XRP closes its daily candle.

Based on recent price action and historical momentum, if XRP closes a daily candle above $0.558, there is a strong possibility the asset could soar by 17% to reach the $0.65 level in the coming days.

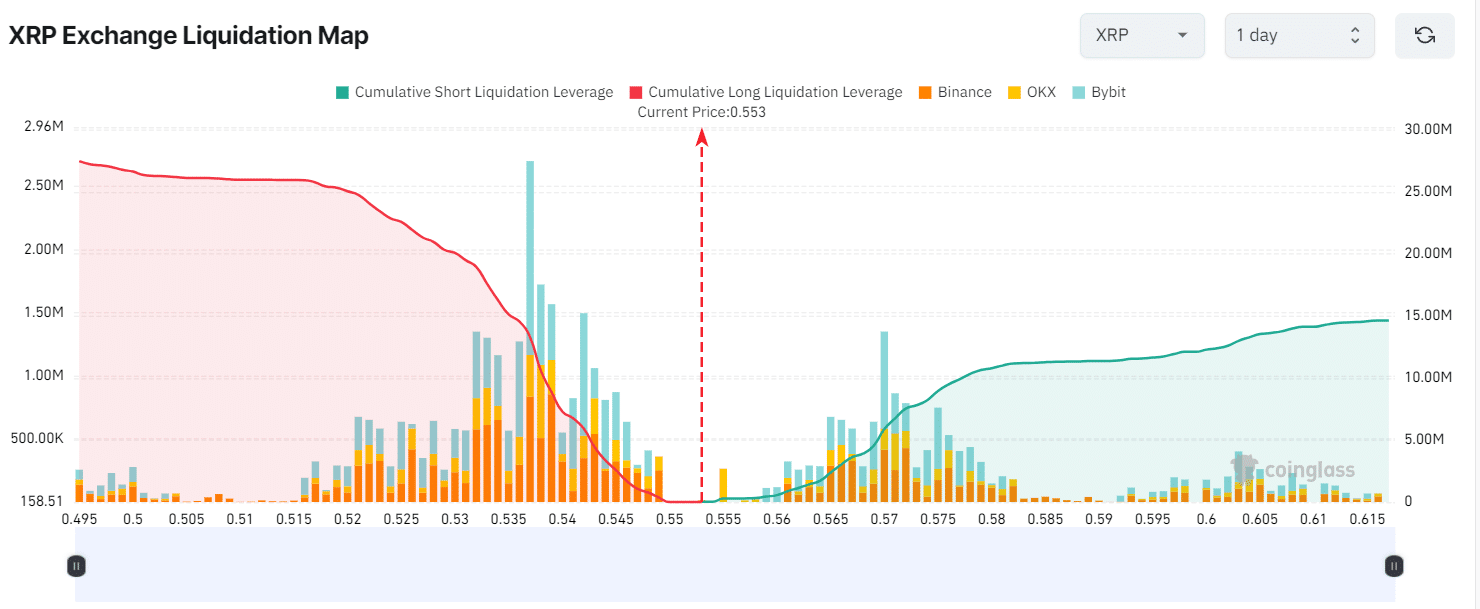

Bullish on-chain metrics

As of press time, XRP’s major liquidation levels were at $0.537 on the lower side and $0.57 on the upper side, with traders over-leveraged at these levels, according to the on-chain analytics firm Coinglass.

If the sentiment remains bullish and the price rises to $0.57, nearly $5.88 million worth of short positions will be liquidated.

Conversely, if the sentiment shifts and the price drops to the $0.537 level, approximately $13.3 million worth of long positions will be liquidated.

Currently, XRP’s Open Interest has risen by 2.5% in the last 24 hours, suggesting growing traders’ interest following the breakout. In fact, it appears to be a bullish sign for XRP holders.

On the other hand, XRP’s long/short ratio stands at 0.98, at press time, suggesting weak trader interest.

Combining these on-chain metrics with the technical analysis, it appears that bulls are currently dominating the asset, though their strength remains relatively weak.

However, the overall sentiment for XRP is currently bullish.

Read XRP’s Price Prediction 2024 – 2025

Current price momentum

At press time, XRP was trading near $0.5532 after a price surge of over 2.35% in the past 24 hours.

During the same period, its trading volume has skyrocketed by 115%, indicating significant participation from traders and investors, likely due to the recent breakout.