XRP whales buy the dip – Analyzing impact on price action

- XRP has declined again after a slight rebound in the last trading session.

- Whales remained in the accumulation mode despite price decline.

Ripple’s [XRP] recent price decline has caught the attention of large investors, with on-chain data revealing significant whale accumulation.

Coupled with a neutral MVRV ratio and stabilization at key support levels, these developments suggest a potential bullish reversal for the token.

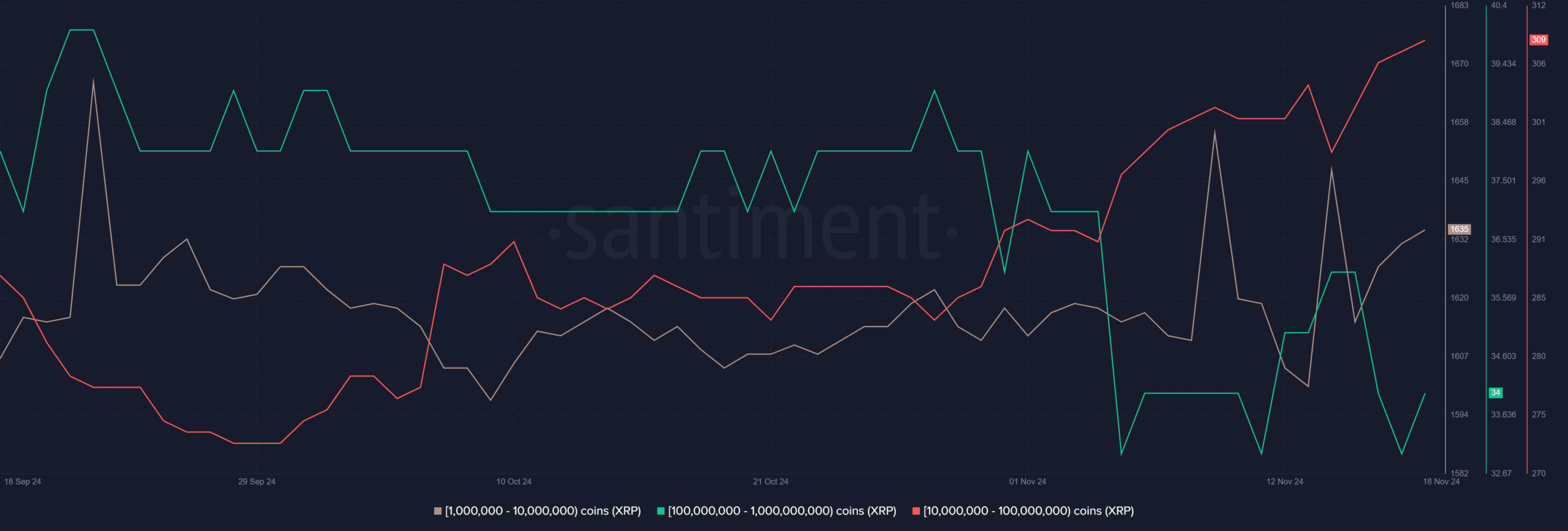

Ripple whale accumulation in full swing

The Whale Holdings Distribution chart shows a steady increase in Ripple‘s balances among large holders. Analysis of wallets holding 1 million to 100 million XRP indicates an increase in accumulation.

This accumulation phase intensified as XRP’s price faced downward pressure, reflecting a classic “buy the dip” strategy among major investors.

Historically, whale accumulation during market downturns has often signaled upcoming price recoveries. Large holders tend to position themselves strategically, anticipating significant bullish reversals.

The current trend highlights growing confidence in XRP’s medium-to-long-term recovery.

Key support levels provide stability

Ripple’s price has found strong support at $2.32, bolstered by the 50-day Moving Average at $1.59, as shown in the XRP Price chart.

Despite struggling to break above the $2.46 Fibonacci retracement level, the token’s ability to maintain its position above key moving averages reflects underlying bullish sentiment.

Trading volume remains strong, indicating sustained market interest. The confluence of whale accumulation and reduced sell-side pressure enhances XRP’s ability to navigate its current resistance levels, paving the way for a potential rebound.

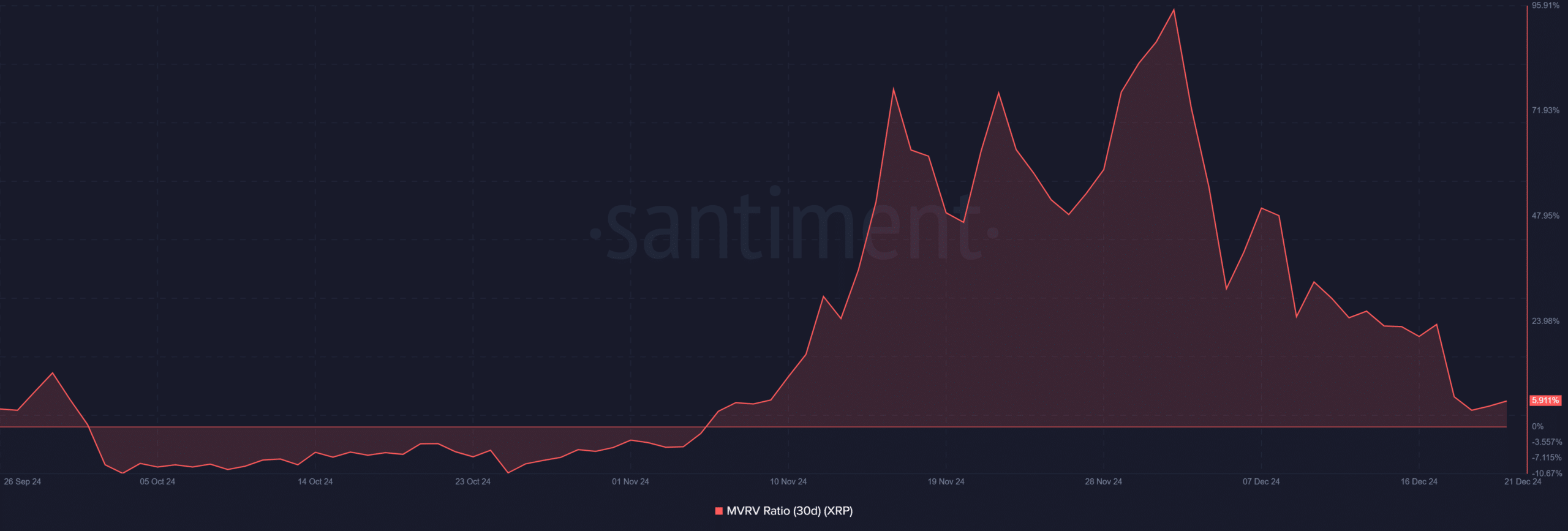

MVRV ratio indicates waning sell pressure

The 30-day MVRV Ratio chart, according to Santiment, reveals a significant decline to approximately 5.91%. These metrics signal diminished profit-taking by Ripple holders who acquired the token within the past month.

A neutral or low MVRV ratio reduces the likelihood of short-term selling, aligning with the ongoing accumulation phase by whales.

The convergence of reduced profit-taking, increased whale activity, and stabilization above key support levels suggest a cautiously optimistic outlook for XRP.

While resistance near $2.46 persists, these indicators collectively hint at the possibility of a price recovery in the coming weeks.

– Realistic or not, here’s XRP market cap in BTC’s terms

XRP’s current market dynamics, characterized by whale accumulation and reduced selling pressure, provide a solid foundation for a potential recovery.

As the token stabilizes at critical levels, the market’s focus shifts to whether it can overcome resistance and extend its gains. The next few trading sessions will likely reveal whether XRP’s resilience translates into a sustained bullish breakout.