XRP’s $2.60 level – Here’s why altcoin’s short sellers may be at risk

- XRP’s $2.60 press time price level saw heavy short positions, raising concerns about a possible squeeze

- Market makers may exploit concentrated leverage, triggering liquidations, and driving XRP’s price higher

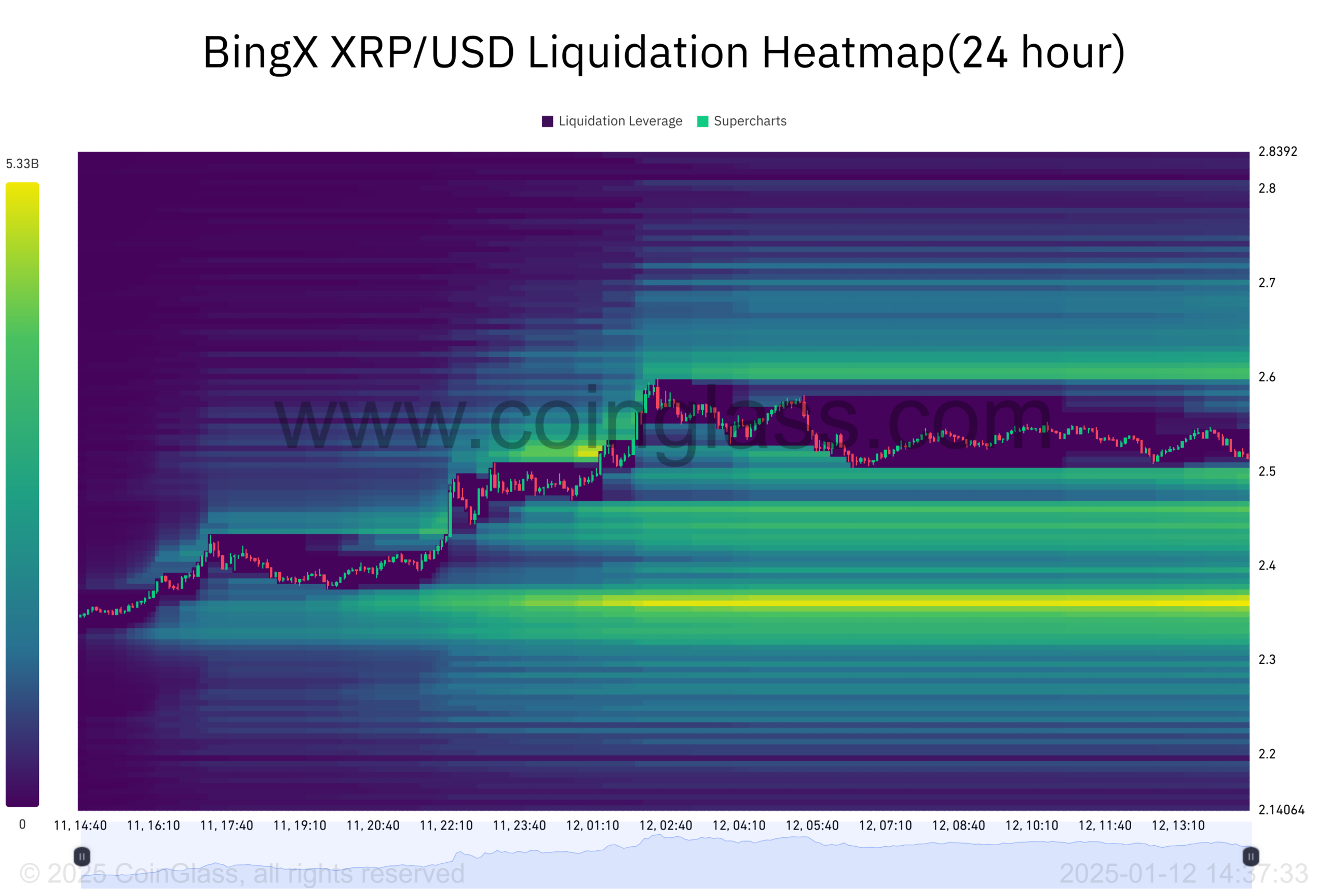

Recent developments in XRP have raised concerns about a potential liquidity trap for short sellers. With a significant number of short positions open around the $2.60-price level, the concentration of these trades has created a potential liquidity trap.

This has set the stage for market makers to exploit this situation, potentially triggering a cascade of liquidations if the price moves against these short positions.

XRP and its current short positions

XRP has seen a surge in short positions clustered around the $2.60-level. As highlighted by analyst Ali Martinez, these short positions have created a significant liquidation zone.

The heatmap highlighted high leverage and significant volume concentrated at this level. This accumulation can be seen as a sign of growing bearish sentiment among traders, who are likely betting on a price correction or a reversal. However, this scenario may carry unforeseen consequences for those holding short positions.

The short squeeze risk

A short squeeze happens when the price of an asset rises unexpectedly, compelling short sellers to buy back their positions to limit their losses. In the case of XRP, the $2.60-level has emerged as a critical trigger point.

Should XRP’s price break above this threshold, it could spark a chain reaction of forced buybacks, driving the price even higher. This cascading effect would put short sellers in a vulnerable position, potentially liquidating leveraged positions and exacerbating their losses. As more shorts are squeezed out, the price could escalate quickly, amplifying the pressure on those who bet against it.

However, market conditions are fluid, and while the short squeeze risk is prominent, factors such as broader market trends, news, or regulatory developments could also influence XRP’s price movement.

The role of market movers

Market makers often seize the opportunity created by concentrated leverage. The high short interest presents a potential window for market makers to push the price upwards, essentially “hunting” for the liquidation of over-leveraged positions.

By triggering these liquidations, market makers can profit from the margin calls, capitalizing on the forced buybacks and generating significant returns. This tactic amplifies volatility. It also intensifies the pressure on short sellers, creating a cycle that can rapidly escalate the asset’s price.

Read Ripple [XRP] Price Prediction 2025-2026