XRP’s on-chain clue: A rally in waiting or just hype?

- XRP maintained a higher timeframe bullish structure.

- Its inability to fight beyond the short-term range was concerning.

Ripple [XRP] noted some gains in the hours before press time as Bitcoin [BTC] jumped from $69.2k to $71.2k. The move was less than 3% for XRP, but it made for a bullish start to the week.

Buying pressure was on the rise, but a higher timeframe uptrend was not in place. The token has traded within a range from August 2023 to the present.

There were some signs of accumulation- should investors start buying more XRP?

The Fibonacci support levels were critical for XRP bulls

The rally from $0.485 to $0.744 earlier this year saw a sizeable pullback. The 78.6% retracement level was not yet tested after the local high was formed.

Meanwhile, the OBV continued to trend upward since February.

This was a strong sign of buying pressure. It indicated accumulation was likely going on, and that XRP is due for a rally sooner or later. However, it might not be ready for it yet.

The RSI was at 49 and has meandered about the neutral 50 line for a month. This showed a persistent lack of momentum on the daily chart. XRP has also been unable to get out of the $0.57-$0.64 short-term range.

On-chain metrics show selling pressure was prevalent

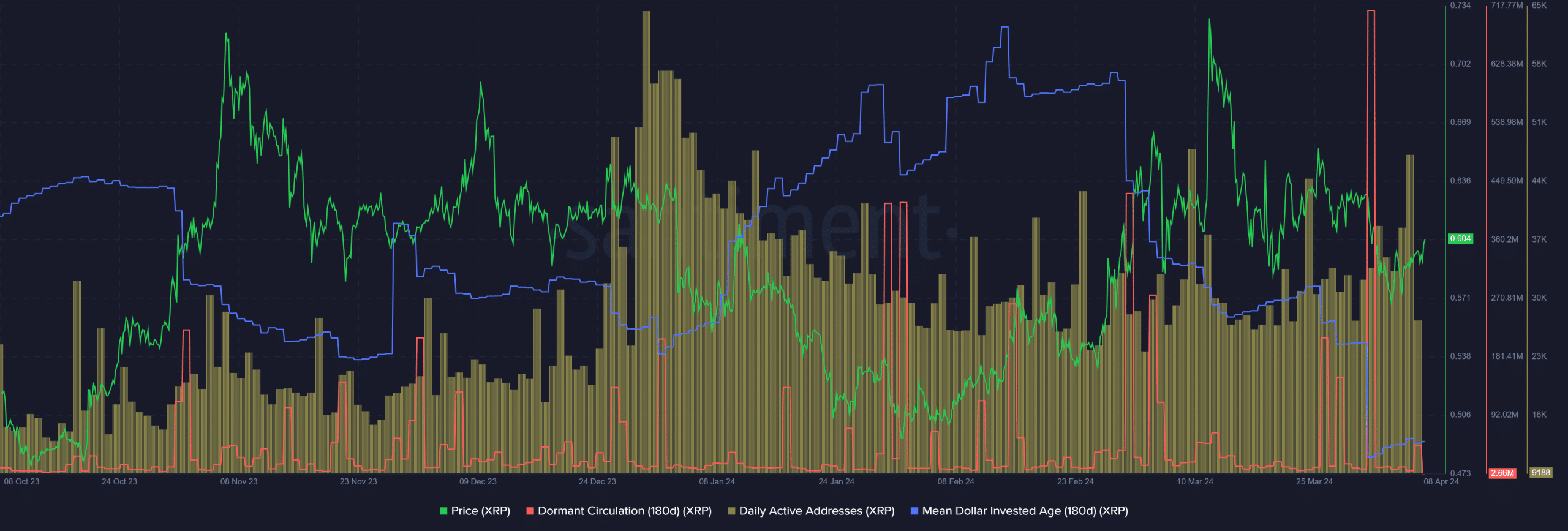

Source: Santiment

The daily active addresses slowly trended upward since February. The losses of the past month notwithstanding, the metric continued to push its way higher.

It showed increased user engagement and a healthy network.

Is your portfolio green? Check out the XRP Profit Calculator

On the other hand, the mean dollar invested age (MDIA) saw a steep decline in the past two months. At press time, it has not yet climbed higher or established an uptrend. If it does so, it would be a sign of accumulation.

The dormant circulation saw a massive spike on the 1st of April, bigger than any seen in 2024. It showed that selling pressure was intense, and was a sign of a lack of faith from holders.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)