XRP’s 8% price hike and what 130 billion tokens had to do with it

- XRP’s Age Consumed rose to an all-time high on 1 May

- This suggested that a local price bottom had been reached on the charts

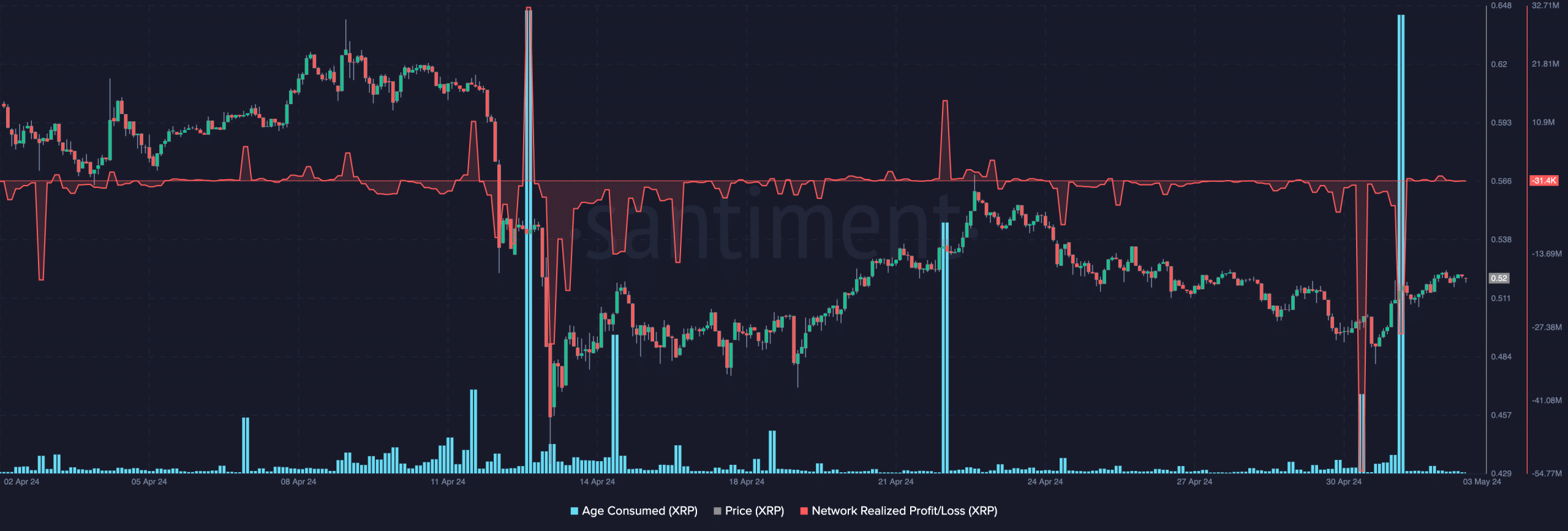

XRP‘s Age Consumed metric is in the news today after it climbed to its highest level during the intraday trading session on 1 May, according to data from Santiment.

? #XRPLedger has been seeing an abundance of dormant tokens moving to open up May. Our Token Age Consumed metric indicates that this was a remarkably similar spike in old coins being moved compared to the April 13th spike, just before markets tanked and $XRP dropped -16% in… pic.twitter.com/vHpaDuJNaE

— Santiment (@santimentfeed) May 2, 2024

An asset’s Age Consumed tracks the movement of its dormant coins. This metric is important because it offers insight into the behavioral shifts of long-term holders. This cohort of cryptocurrency investors rarely moves their dormant coins around, but when they do, it often precipitates a shift in market trends.

When the metric climbs, it means that a large number of tokens are changing hands after being left idle for an extended period of time. On the other hand, when it falls, it means that idle coins are left unmoved.

The metric is a good marker of an asset’s local price top or bottom, depending on how its price moves after such movements.

Is a rally in the books for XRP?

According to Santiment, 130 billion dormant XRP tokens were moved on 1 May. This was followed by a rally in XRP’s price. At press time, the altcoin was valued at $0.52, with its price climbing by 8% in just 2 days, as per CoinMarketCap.

A combined reading of the spike in XRP’s Age Consumed metric and the ensuing price rally may suggest that a price bottom was reached on 1 May when the token’s price fell to a low of $0.48. Following the same, the altcoin initiated an uptrend on the charts.

This was confirmed by the significant dip in XRP’s Network Realized Profit/Loss (NPL) metric on the same day. This metric measures the difference between the price at which tokens were last spent and their current market price.

When this metric sees a significant decline, it signals the short-term capitulation of paper hands and a surge in new demand. This often means that a price bottom has been reached, as NPL dips tend to coincide with local bouncebacks and periods of price recovery.

On 1 May, XRP’s NPL fell to a low of -54 million, its lowest level since December 2022.

Realistic or not, here’s XRP’s market cap in BTC’s terms

XRP sees sustained demand

An assessment of XRP’s price movements on the 1-day chart confirmed the possibility of a price hike in the short term. In fact, at the time of writing, the token‘s key momentum indicators were rallying, depicting a surge in demand.

For example – XRP’s Chaikin Money Flow (CMF), which tracks the flow of money into and out of an asset, was on an uptrend at 0.28. A positive CMF value above zero indicates market strength – A sign of low capital flight.