XRP’s exchange reserves soar – Price crash incoming?

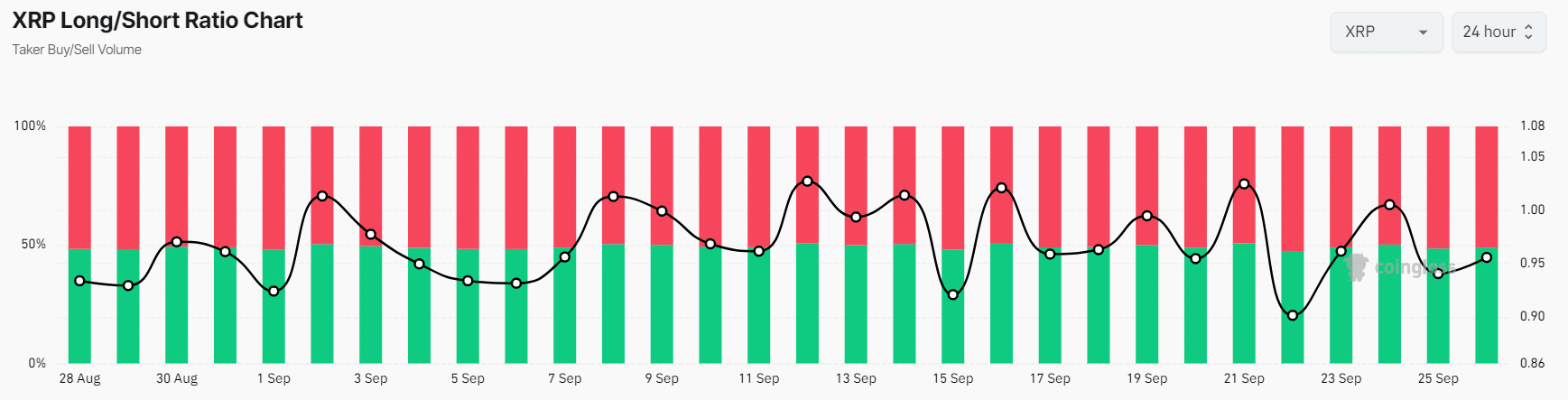

- XRP’s Long/Short Ratio was 0.955 at press time, indicating bearish market sentiment.

- If XRP closes a daily candle below the $0.545 level, it could potentially decline to $0.464.

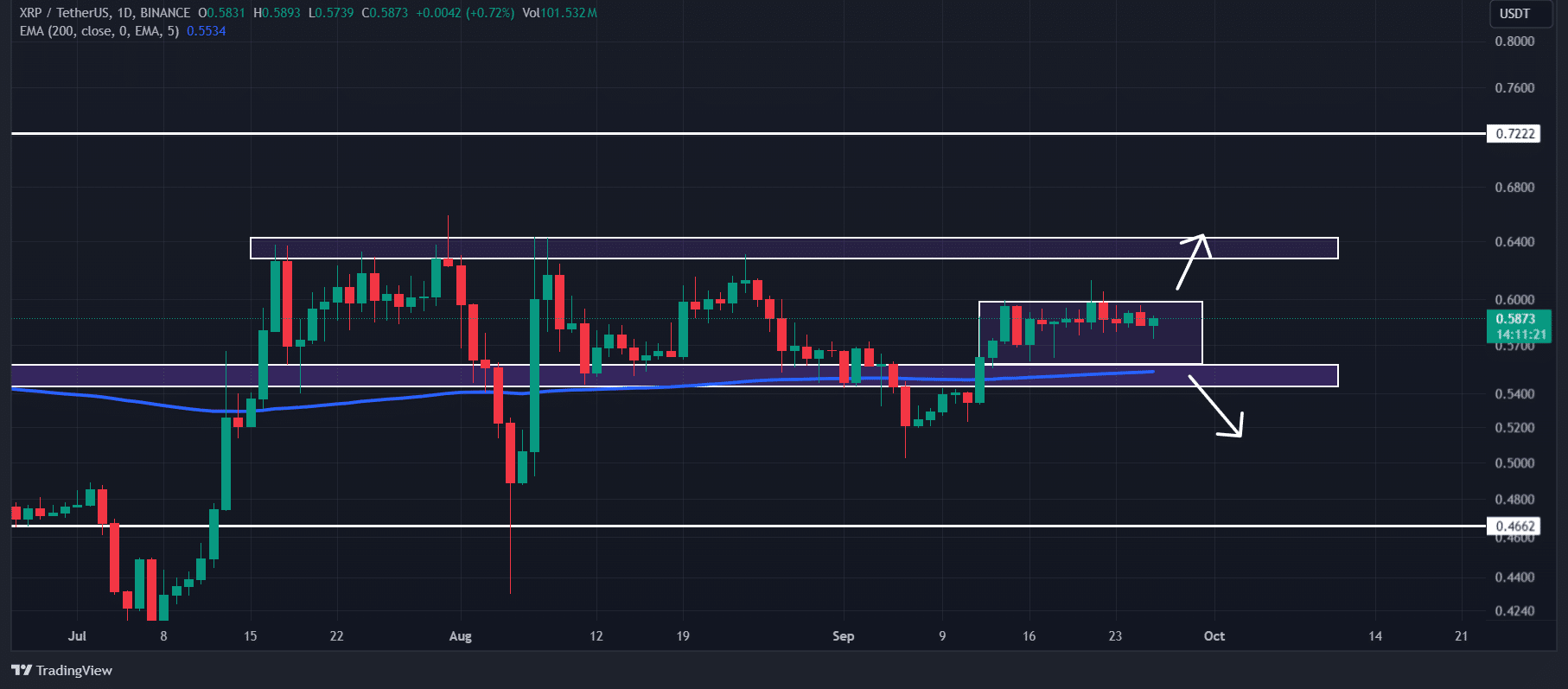

In this ongoing price correction across the cryptocurrency market, XRP’s on-chain metrics are flashing bearish signals. Since the 14th of September, the token has been in a consolidation zone between $0.558 and $0.598.

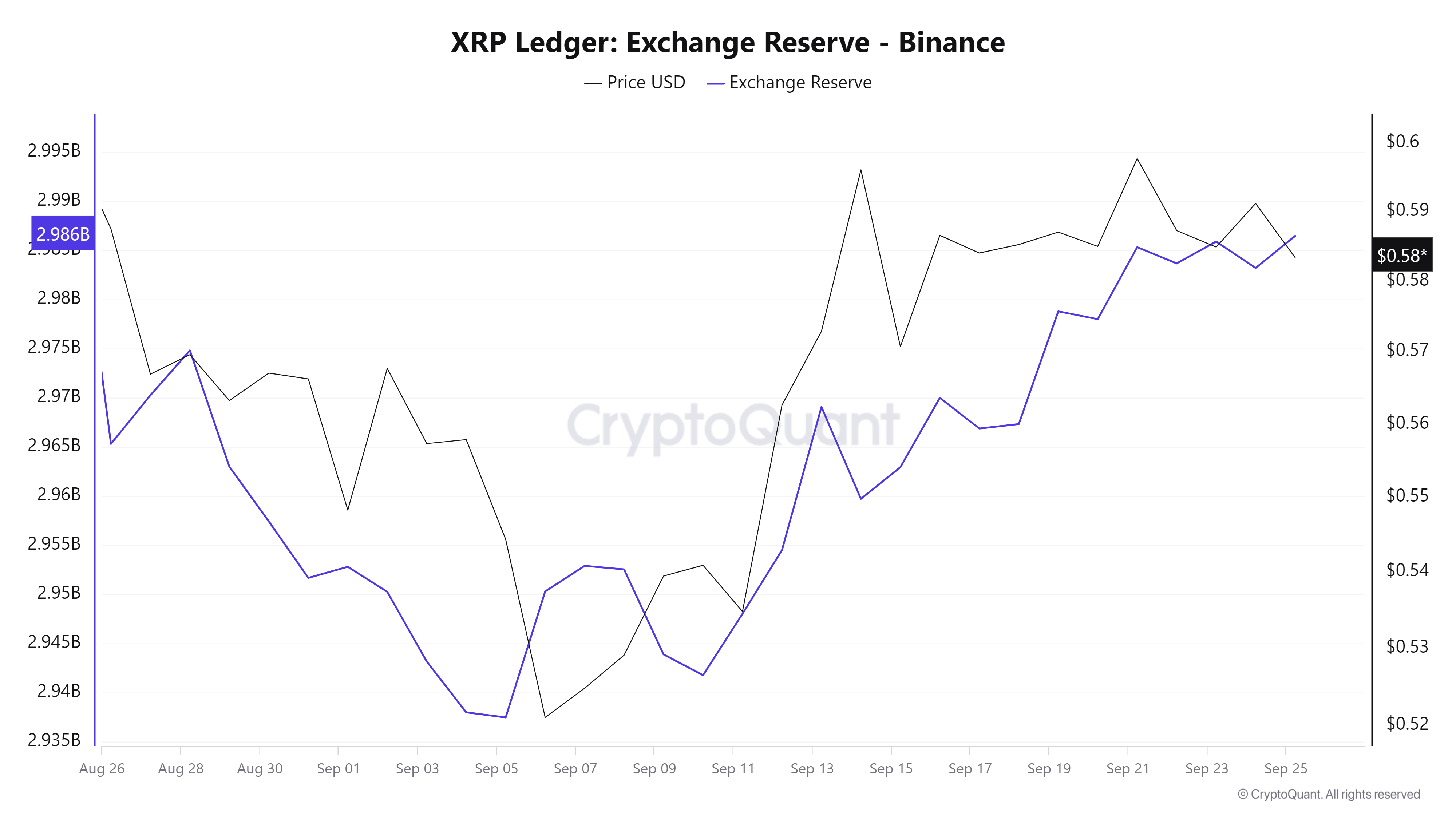

Increase of XRP exchange reserves

During this consolidation period, XRP’s exchange reserves have significantly increased, according to data from an on-chain analytics firm, CryptoQuant.

If the exchange reserves continue to rise, it suggests higher selling pressure and further price decline.

Traders and investors consider an increase in exchange reserves a potential sell-off signal, as it indicates that whales and institutions are moving their holdings to exchanges for potential sell-offs, thereby increasing exchange reserves.

XRP’s current price momentum

Despite the increase in exchange reserves, XRP’s price remains. As of press time, it is trading near $0.586 and has experienced a modest price decline of 0.45% in the past 24 hours.

Meanwhile, XRP’s trading volume during the same period has dropped by 4.8%, indicating lower participation from traders, potentially due to the ongoing price correction.

Technical analysis and key levels

AMBCrypto’s technical analysis suggests that XRP is in an uptrend as it trades above the 200 Exponential Moving Average (EMA) on a daily time frame.

The 200 EMA is a technical indicator that traders and investors use to determine whether an asset is in an uptrend or downtrend.

Given the recent increase in XRP’s exchange reserves, it will be very crucial to understand whether the token will rally or crash in the coming days.

Based on the price action, if XRP breaks out of this consolidation zone and closes a daily candle above the $0.60 level, there is a high possibility it could soar to the $0.72 level.

However, if it breaks down from this consolidation zone and closes a candle below the $0.545 level, it could potentially decline to the $0.464 level.

Read XRP’s Price Prediction 2024–2025

XRP’s bearish on-chain metrics

This negative outlook is further supported by the on-chain metrics, According to the on-chain analytics firm Coinglass, XRP’s Long/Short Ratio was 0.955 at press time, indicating bearish market sentiment among traders.

Additionally, its Futures Open Interest has remained stable with no major changes, suggesting that traders are still waiting for a breakout from this consolidation zone.