XRP’s long-term price targets: Can it repeat 2017 and 2021’s performances?

- The low profitability could benefit XRP’s price in the long run

- A rising coin age might trigger a fall below $0.50 in the short term

EGRAG Crypto, a popular crypto-analyst on X, believes that XRP could repeat its price performance from 2017 and 2021. According to the analyst, XRP’s dominance, as it stands, is retesting its historic support lines.

If sustained, the price of the token might target pumps that have not been seen in almost three years. For EGRAG Crypto, if XRP register a 17.39% hike in the short term, the prediction could be validated.

In 2017, the seventh-most valuable cryptocurrency rose from $0.18 and ended the year at around $1.12. In 2021, the price of XRP jumped from $0.26 to an incredible $1.59 in a matter of months.

However, the altcoin has not been able to replicate that kind of performance since. In fact, this year, XRP’s value has fallen by 17.18%. The last 24 hours have been different though, with the price appreciating by 4.04%.

Losses breed something better

For XRP to potentially hit the start of the move to its historic high, the value has to hit $0.58 first. At the same time though, that is not a guarantee that the token will have a magnificent outing again.

AMBCrypto analyzed the potential by looking at the supply in profit. It is no news that the project has one of the highest token supplies out of the top 10.

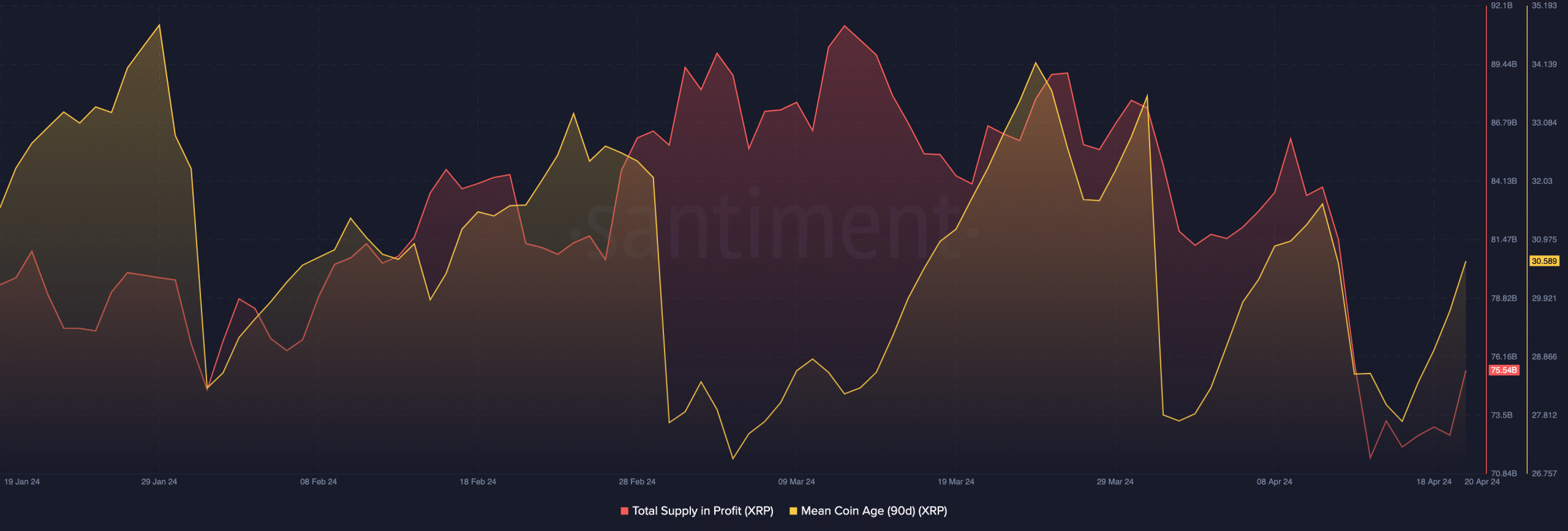

However, the last time almost 100% of the 99.99 billion XRP tokens were in profit was back in 2021. At press time, only 75.54 billion of the supply had gains, according to data from Santiment.

Typically, a high level of the metric coincides with market tops. Therefore, the fall in investor profitability aligns with a bullish projection.

Additionally, we examined the 90-day Mean Coin Age (MCA). The MCA simply shows the movement of coins into or out of cold wallets.

A low coin age indicates the accumulation and retirement of tokens to self-custody. However, XRP’s MCA spiked, indicating that some old tokens have been moved.

In most cases, this movement suggests that holders plan to sell. A further spike could drag the price down while a fall in the coin age could set the stage for a parabolic move on the charts.

First off — XRP to $0.48

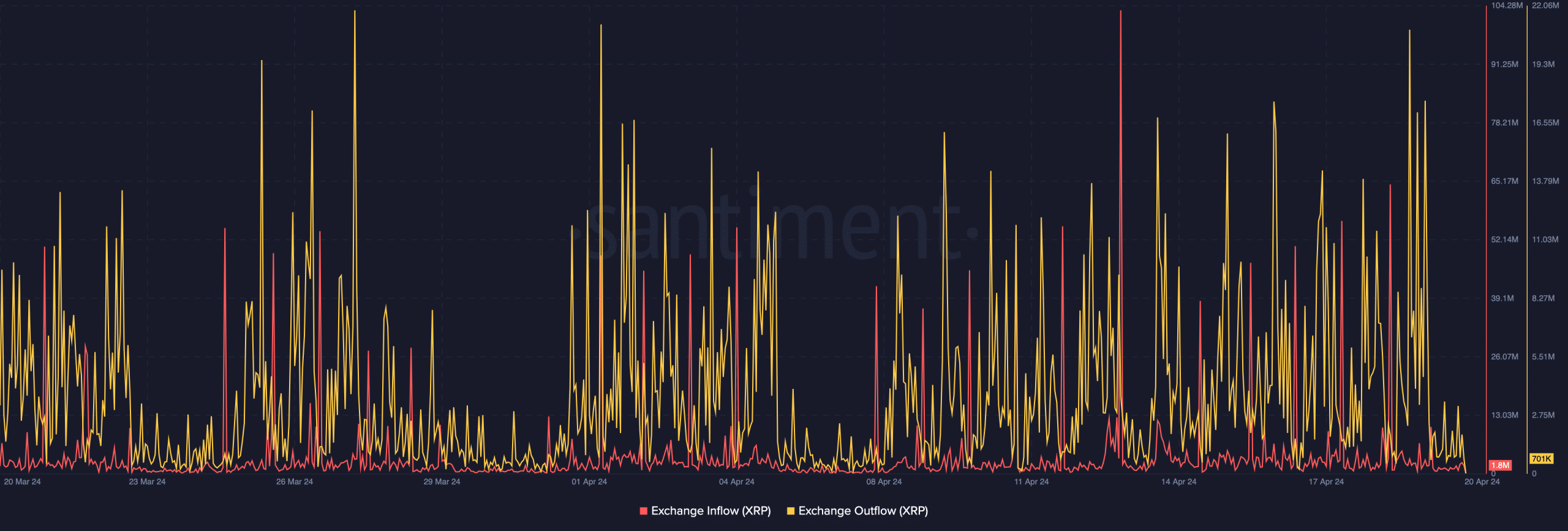

For the time being, XRP might not continue its uptick as a fall to $0.48 could be next. Furthermore, the exchange flow agreed with this potential decline.

At press time, the exchange inflows, which indicate the movement of cryptocurrencies into exchanges, had a reading of 1.8 million. On the other hand, exchange outflows (tokens withdrawn out of exchanges) had a figure of 701,000.

Should the outflows later outpace the inflows, then XRP might continue jumping. Regardless of the cryptocurrency’s short-term run, factors that could push it higher are more than the aforementioned ones.

Is your portfolio green? Check the XRP Profit Calculator

For instance, tokens doing well this cycle seem to have specific narratives pushing them. Alas, XRP does not seem to be in any of those categories. While the value might rise, the potential to repeat its previous performances remains low.