XRP’s network activity shrinks, but traders remain unmoved

XRP’s volatility has been contracting, leading to a decrease in Open Interest. A lack of liquidity in the derivatives market is becoming a cause of concern as well.

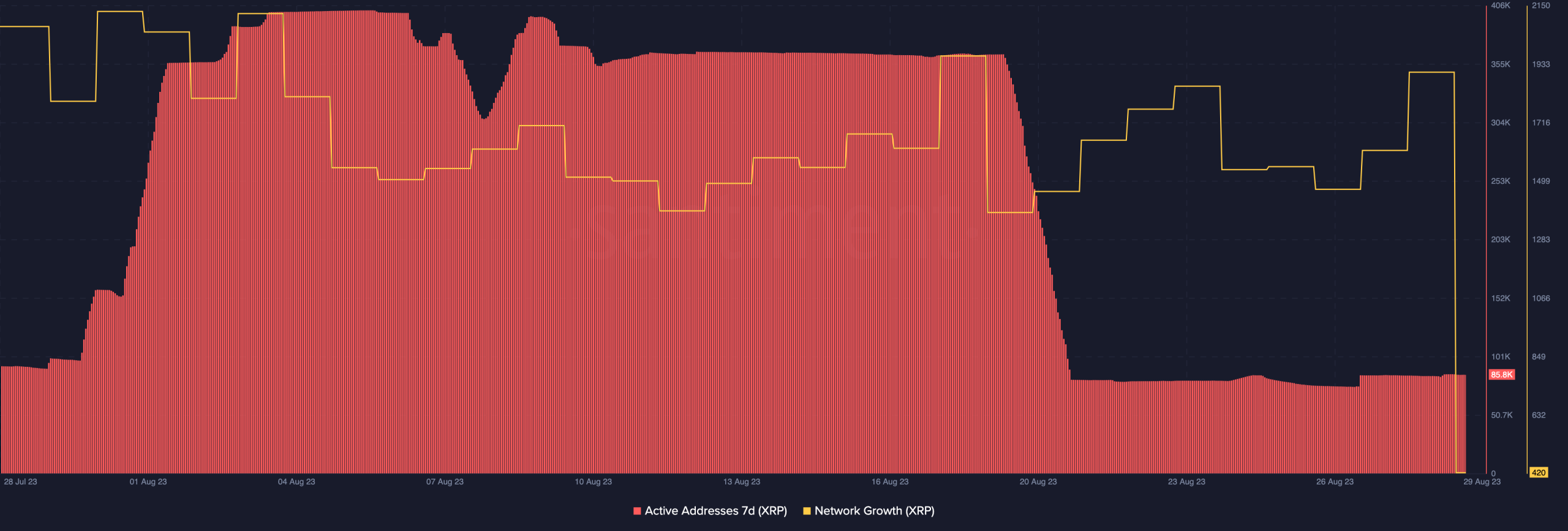

- XRP’s active addresses and network growth decreased.

- Open Interest fell, but traders were bullish on the long-term price action.

Ripple’s [XRP] network growth has not been one to be excited about lately, despite the partial win over the U.S. SEC in July. According to Santiment, the network growth, as of press time, had decreased to 420.

How much are 1,10,100 XRPs worth today?

For a metric that was over 2,000 in the last week of July, the press time state was disappointing.

XRP: Not attractive enough

The network growth measures the rate of adoption of an asset by considering new addresses interacting with the underlying network. So, an increase in network growth implies a surge in traction.

However, XRP’s fall in this regard suggests that new addresses have not been flocking to the Ripple network. And for those who have joined, XRP transfers have not been impressive. Like the network growth, XRP’s seven-day active addresses took a big tumble on 19 August.

Since then, the active addresses have flattened around 85,800. Active addresses show the level of speculation around a token. Therefore, the decrease implies that very few distinct addresses were participating in transfers or trading of the token.

The lackluster attention given to XRP also spread to the derivatives market, as indicated by Open Interest. As an indicator to determine market sentiment and strength behind prices, the Open Interest takes into consideration the total number of futures contracts held daily.

Doubts in the short term, bullish for the long

At press time, XRP’s Open Interest was down to $475.08 million. A high Open Interest indicates a rising trader confidence in the price action. On the other hand, a decreasing Open Interest suggests that traders are either unmoved or skeptical about the direction the price of an asset moves.

This decrease highlights how there was a decreasing liquidity in contracts linked to the token. And if the Open Interest continues to decrease, there might be no strength to back up XRP above $0.51.

Despite rising to become the fifth asset in terms of market capitalization, XRP’s performance over the last seven days has remained almost the same. According to CoinMarketCap, the token value was $0.51— a less than 1% increase within the aforementioned period.

But irrespective of the performance, it seemed that traders would rather be bullish than bearish on the price action. One metric that confirms this bias is the

funding rate. Funding rates are paid between short and long-positioned traders in a bid to keep their contracts open.Read Ripple’s [XRP] Price Prediction 2023-2024

A positive funding rate indicates that more traders are taking long positions and expect the asset price to rise in the future.

Conversely, a negative funding rate suggests that more traders have a bearish outlook. In XRP’s case, the funding rate was 0.001%, meaning that the long-term performance expected from XRP was for its price to increase, not the other way around.