XRP’s path to new ATH: Why a repeat of 2017 could be the key

- If XRP mimics its 2017 bull rally, then it might reach an ATH in the coming months.

- It’s crucial for the token to first go above $0.58 before it breaks above the pattern.

Like most cryptos, XRP bears remained dominant in the market last week. However, the token did show signs of a slight recovery in the past 24 hours. The token’s price was on the verge of breaking above a bull pattern.

XRP is consolidating

While last week was somewhat of a setback for XRP investors as the token’s price plummeted by 5%, the coming days might be different. This was the case as a long-term bullish symmetrical triangle appeared on the token’s chart.

Amonyx, a popular crypto analyst, posted a tweet revealing this pattern. To be precise, the pattern emerged in 2018, and since then, the token’s price has been consolidating inside it.

It was interesting to note that a similar pattern appeared on the token’s chart back in 2015.

During that time, XRP managed a bullish breakout in 2017, allowing the token to reach an ATH in the coming months. Therefore, if history repeats itself, then investors might once again witness a similar episode of XRP reaching new highs over the coming months.

The token at press time was testing the support of the bull pattern, and a successful test could allow the token to begin its journey towards the resistance.

At the time of writing, the token was trading at $0.5304 with a market capitalization of over $29.8 billion, making it the 7th largest crypto.

Assessing the likelihood of XRP breaking out soon

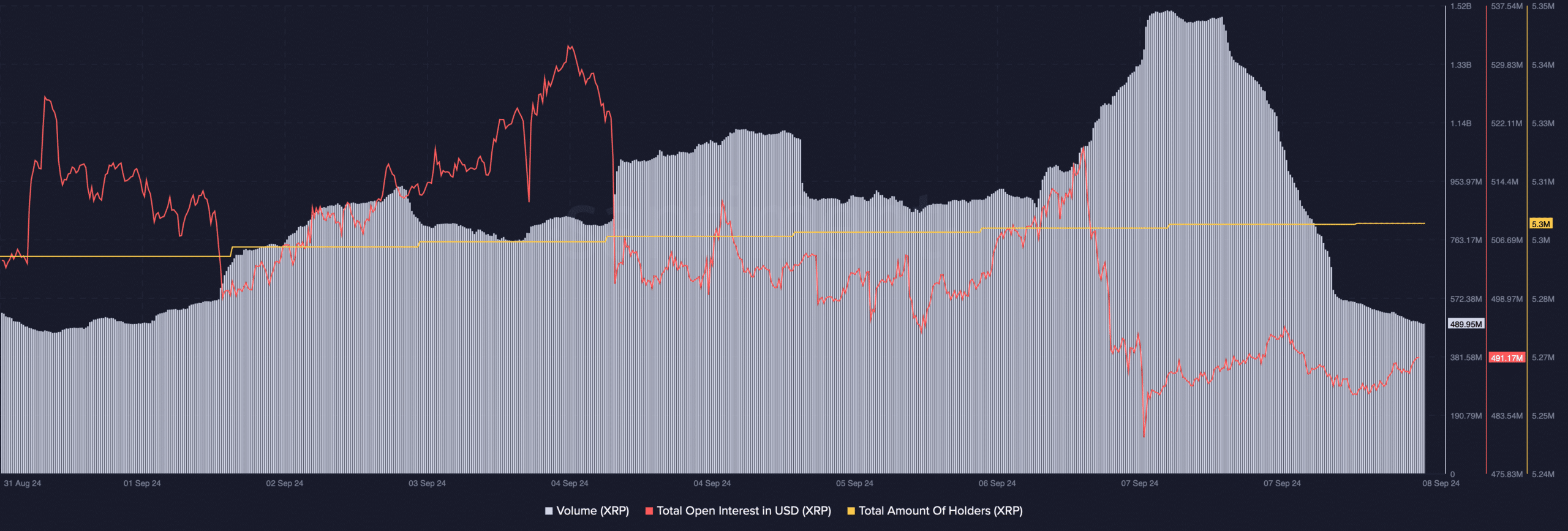

Since the chances of a bullish breakout were high, as suggested by the history, AMBCrypto checked the token’s on-chain data. As per our analysis of Santiment’s data, XRP’s trading volume fell along with its price during the last few days.

Additionally, its open interest followed a similar declining trend. Generally, a drop in open interest indicates a trend reversal, which in this case was a bullish signal.

In fact, investors’ confidence in XRP also seemed to have risen slightly over the last week as the total amount of holders increased and reached 5.3 million.

Read Ripple’s [XRP] Price Prediction 2024-25

Another bullish metric was the long/short ratio, which increased. This meant that there were more long positions in the market than short positions.

However, an analysis of Hyblock Capital’s data revealed that XRP must first cross $0.58 in order to manage a bullish breakout.