XRP’s recovery push: 18% hike, but here’s how far $1 is really

- XRP bulls managed to defend the long-term range lows

- The momentum was on the bulls’ side but a drop in trading volume gave a hint for what was likely to come next

Ripple [XRP] trended upward over the past five days, registering gains close to 18% from the lows on the 19th of April. An earlier AMBCrypto report revealed that this could be due to accumulation.

The number of XRP wallets holding at least 1 million XRP neared their all-time high. If history repeats itself, a large price appreciation might be inbound.

The range lows have responded well so far

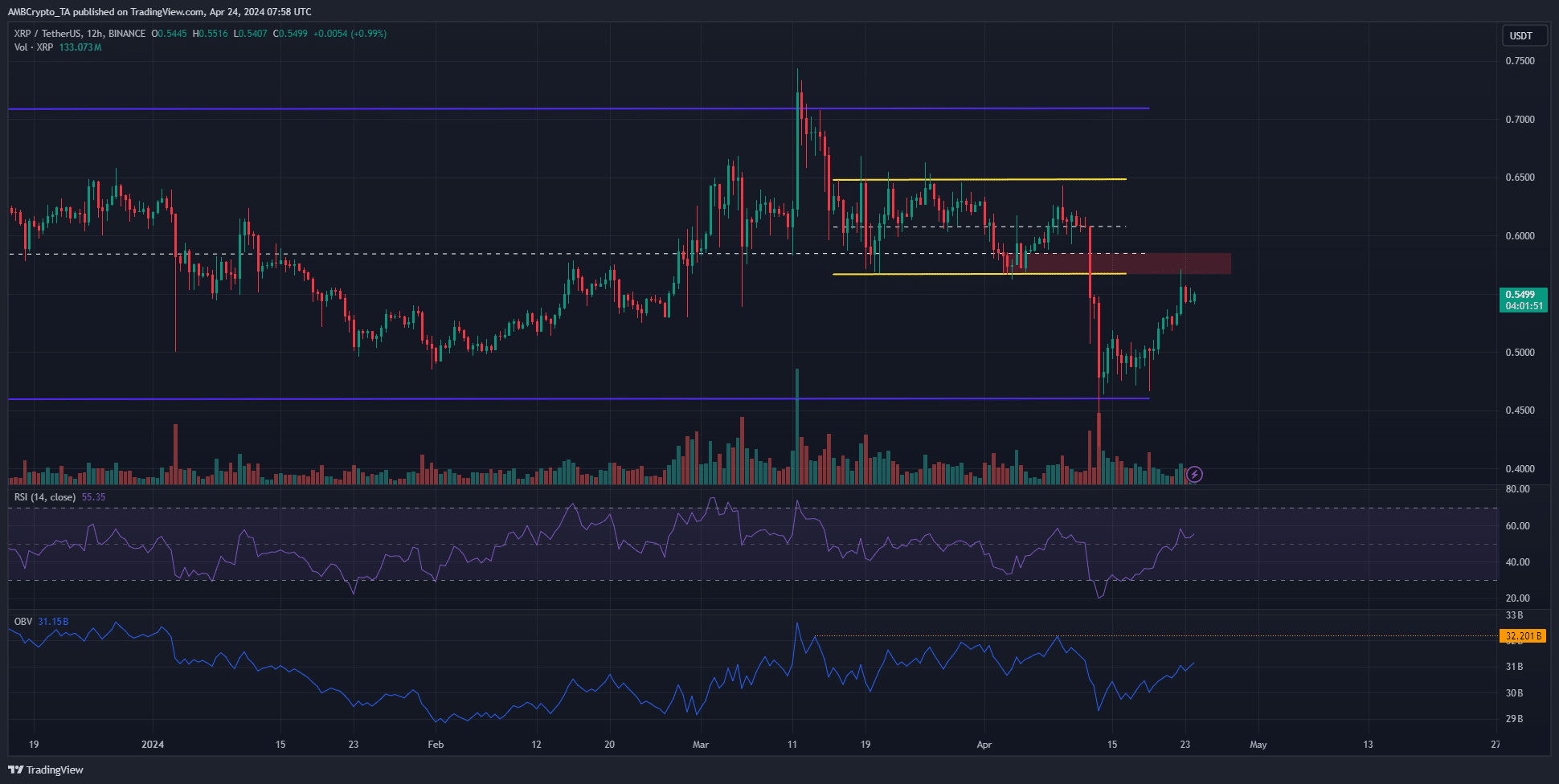

Highlighted in purple was an eight-month-long range from $0.46 to $0.71. In the past six weeks, the bulls tried valiantly to defend the mid-range mark at $0.585 (dotted white). A smaller range (yellow) was formed above this long-term support.

Eventually, the bearish pressure won and forced XRP to drop to $0.45. Since then, the bulls have recovered well from the plunge. Yet, the bearish breaker block (red box) at the $0.56-$0.58 zone remained.

The OBV was well below the local highs but trended upward in the past week to reflect increased buying pressure. The RSI on the 12-hour chart was also above neutral 50 to indicate bullish momentum.

The trading volume has been low, and overall, despite the recent gains, a bullish recovery could take some time to begin.

More evidence for an extended consolidation phase

Source: Coinalyze

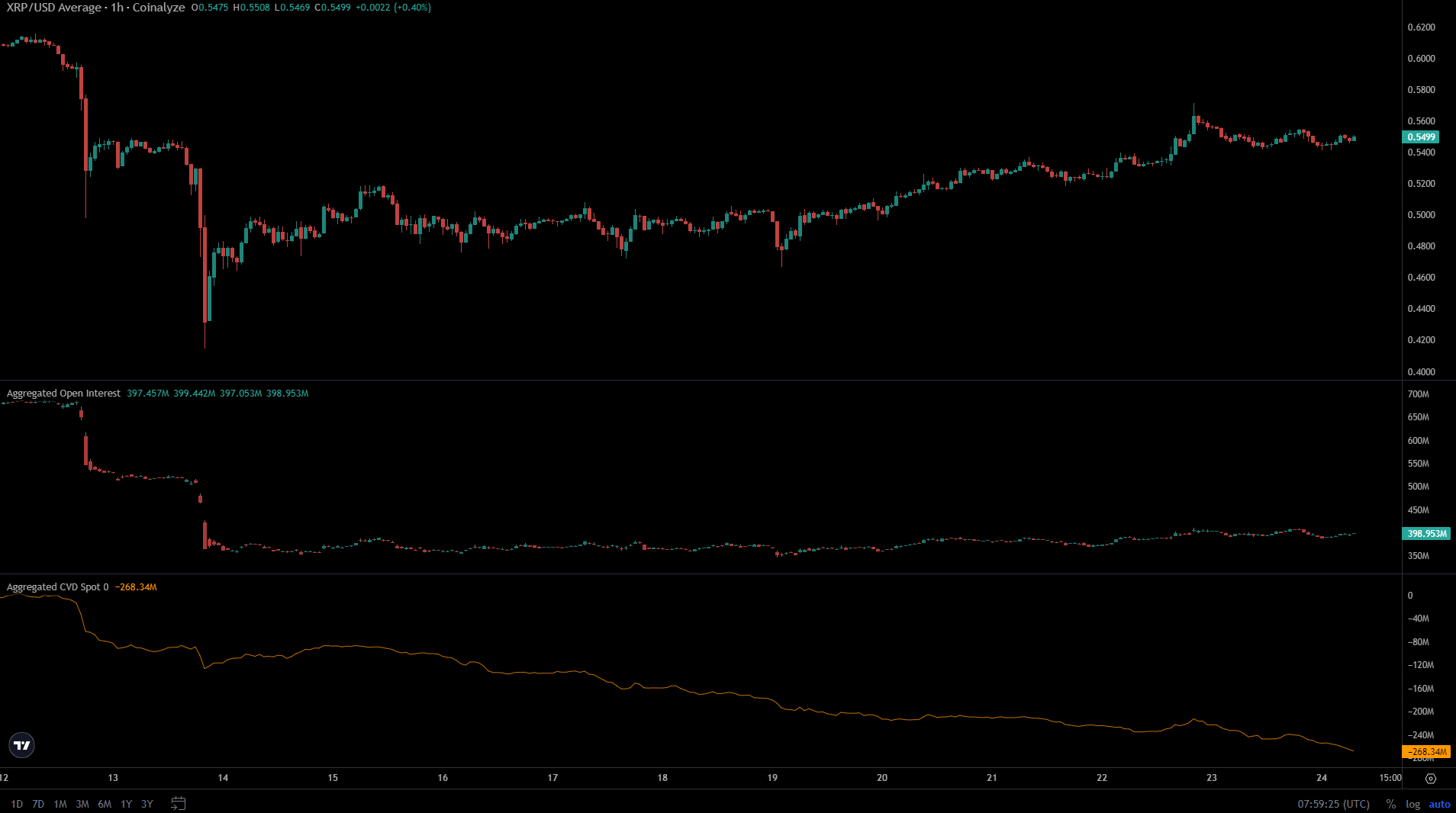

As XRP rose higher in the past few days, the Open Interest also slowly ticked higher. It climbed from $360 million to $398 million in the past five days as XRP also moved 10% in the same period.

Read Ripple’s [XRP] Price Prediction 2024-25

On the other hand the spot CVD was in a crushing downtrend. This was a strong sign of a lack of demand for XRP in the spot markets. Therefore, even though speculators were willing to bet on continued gains, it was not backed by organic demand.

Hence, XRP bulls might take a longer while to break out past the $0.56 resistance region.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.