XRP’s strategic breakout levels: What traders should watch for

- XRP has been forming a symmetrical triangle, which is ready for breakout anytime.

- The RSI is in a similar consolidation, supporting the breakout.

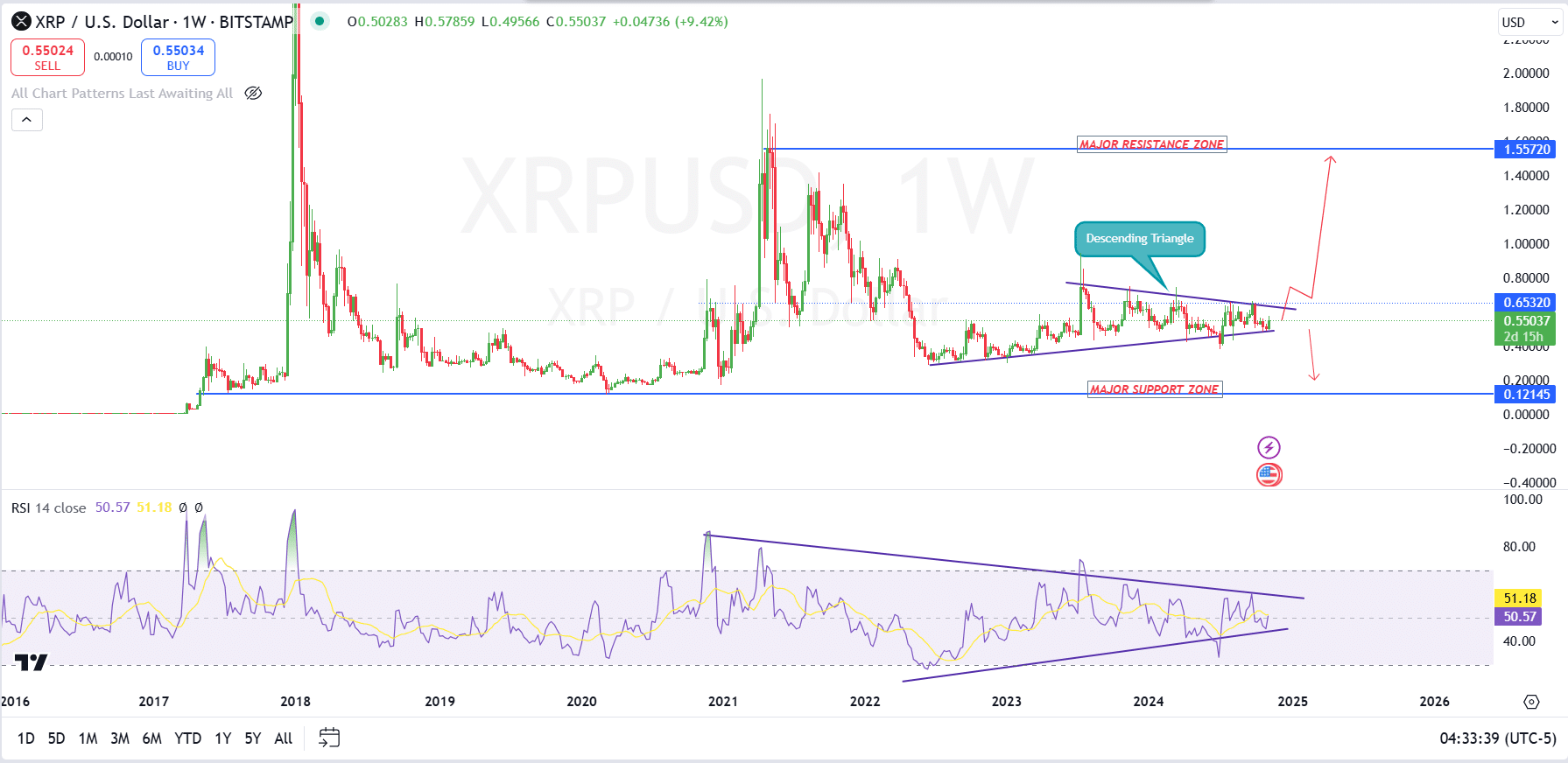

XRP has been in a range since 2022, building up momentum for a breakout, which could lock in 130% gains if it flips the $0.65 breakout level and retests it. The next zone of interest would be the $1.55 resistance level.

XRP primed for action: Triangle pattern hints at breakout!

The weekly XRP chart showed a symmetrical triangle pattern, indicating price compression towards a decisive breakout. The triangle’s upper trendline has been sloping downward since mid-2021, while the lower trendline has acted as ascending support.

AMBCrypto highlighted major support at $0.12145 and resistance around $1.55720, showing key zones that could either cap or fuel XRP’s movement based on the breakout direction.

The RSI, which was also forming a triangle pattern, mirrored the consolidation seen in the price action. The RSI has been holding a long-term upward trendline, suggesting that buying momentum has been gradually building despite the price consolidation.

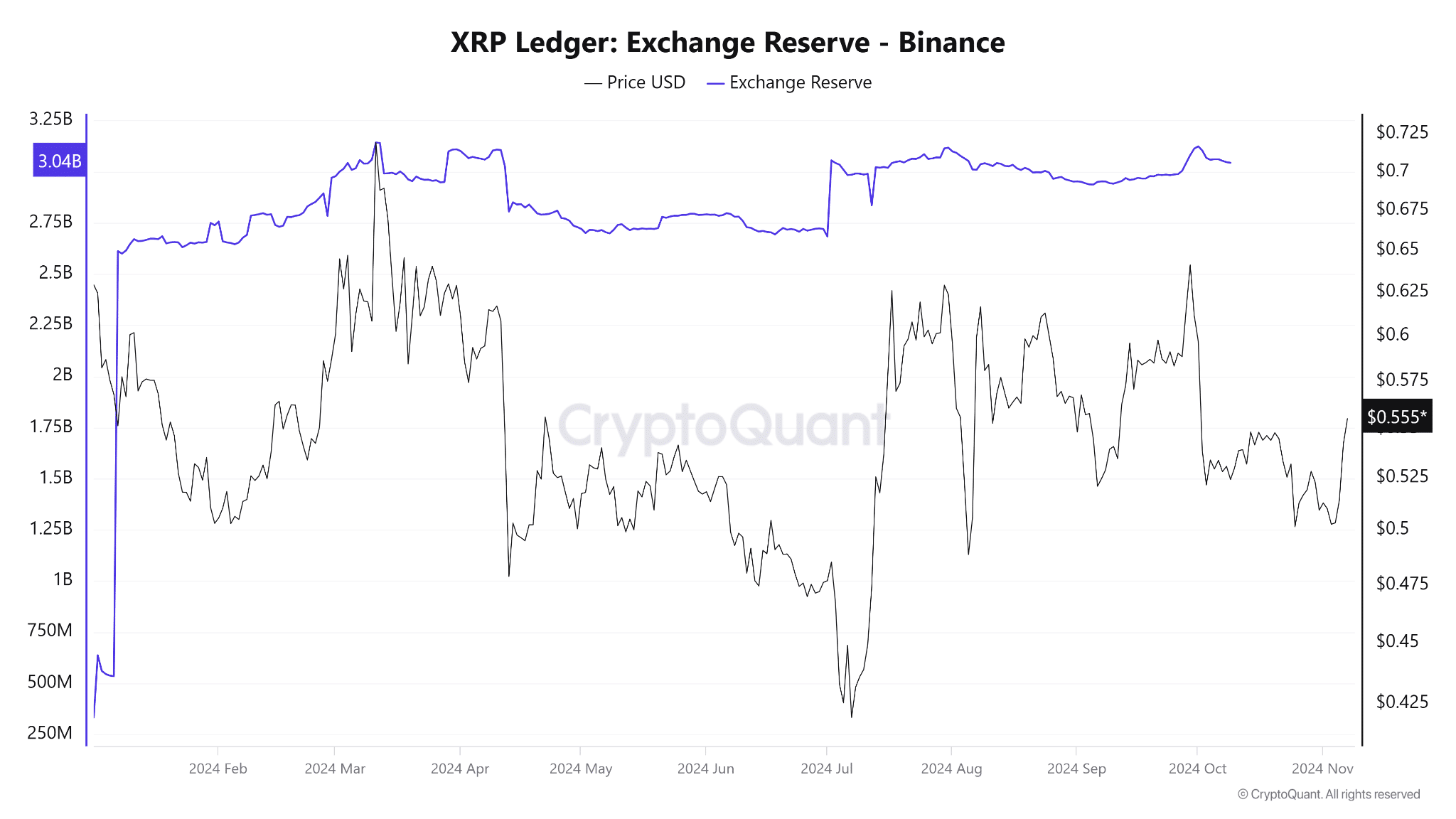

Stable XRP reserves suggest holders expect future gains

Exchange reserves have remained relatively stable at around 3 billion XRP, with minor fluctuations. However, XRP’s price (shown in black) has experienced notable volatility over this period.

This divergence, where exchange reserves stay steady while price fluctuates, suggested that traders were not heavily withdrawing or depositing XRP on Binance. Instead, the trading activity appeared to be more speculative.

This stability in exchange reserves might imply confidence among holders, possibly expecting a future price increase, or simply a lack of incentive to liquidate. Additionally, the price’s recent recovery to around $0.555 could signify renewed interest.

XRP holding steady: Are the indicators about to spark a breakout?

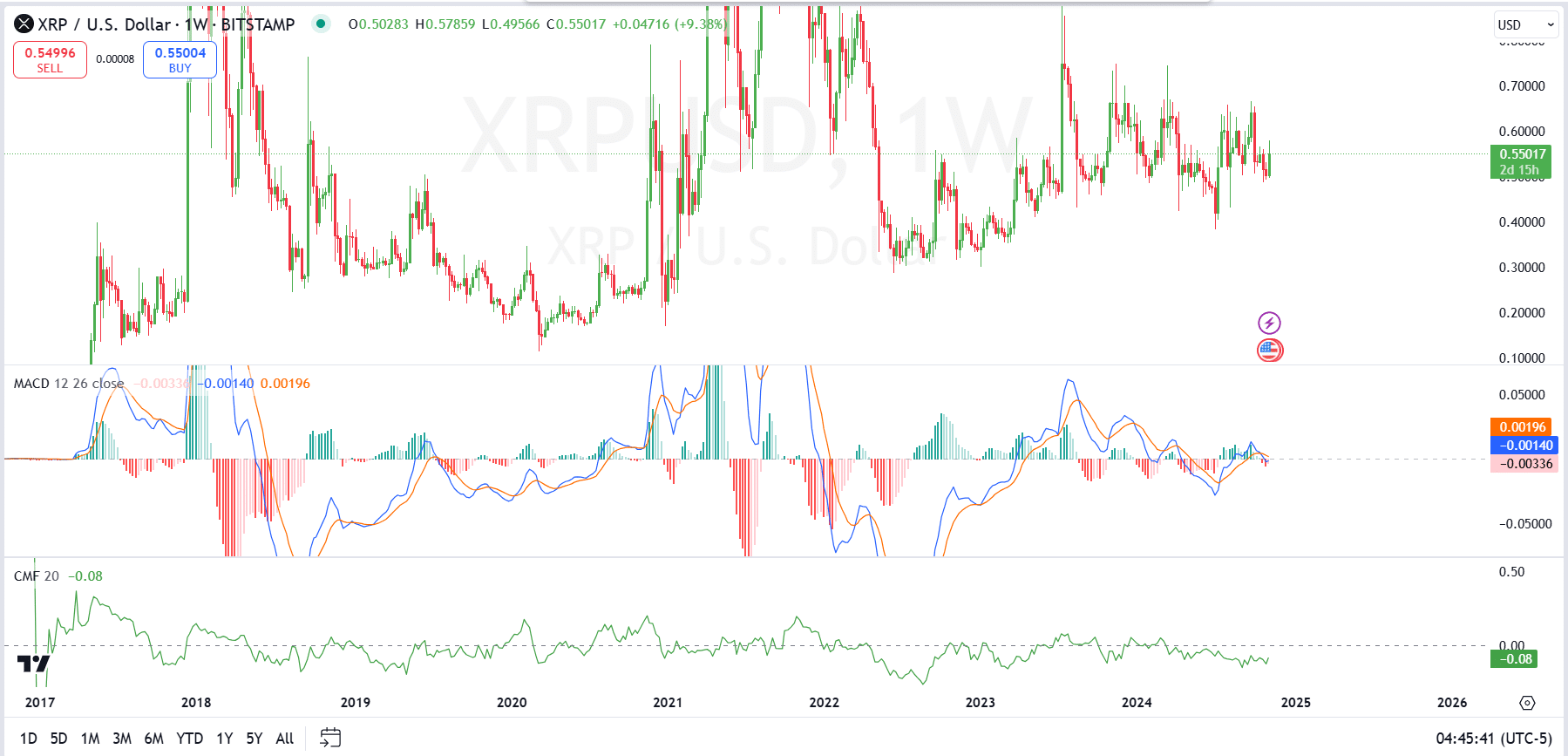

The MACD, positioned in the middle, showed a mixed outlook as the signal line (orange) was slightly above the MACD line (blue), indicating weak bullish momentum.

However, the histogram was near zero, reflecting a lack of strong directional bias. This suggested that XRP may be consolidating, with no clear trend established until a stronger momentum shift occurs in the MACD lines.

Below, the CMF indicator, which measures money flow volume, showed a value of -0.08, indicating mild selling pressure. This negative CMF reading implied that more capital was flowing out of XRP than in.

Though the intensity of this outflow wasn’t significant. The CMF’s position near the neutral line suggested a relatively balanced, albeit slightly bearish sentiment, potentially pointing to indecision in the market.

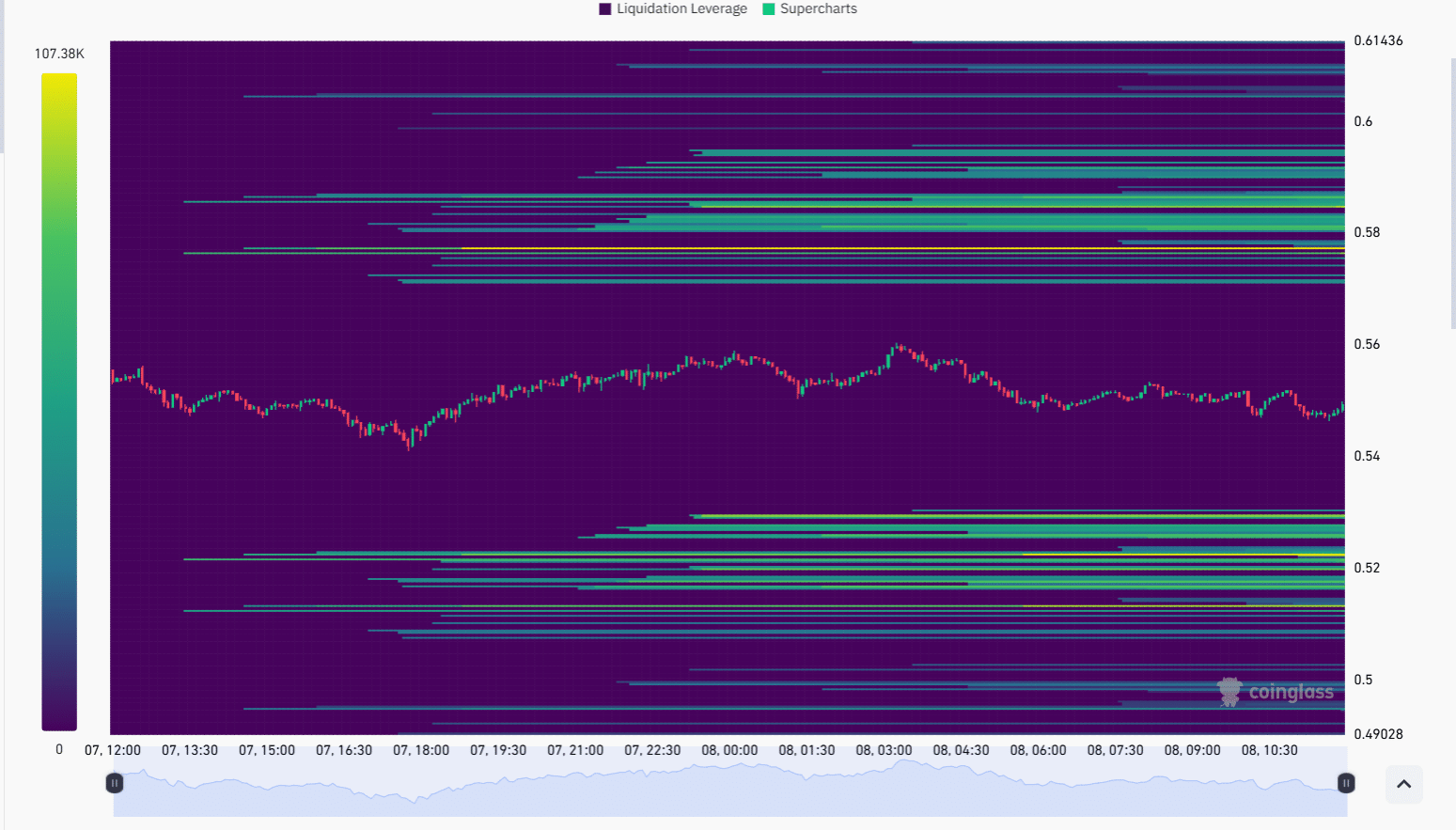

Liquidation zones at $0.54-$0.58 set stage for XRP volatility

The visual representation showed clusters of liquidity at various price levels. These particularly concentrated around $0.54 to $0.58, with significant areas above and below that range.

This distribution of liquidation zones showed where traders have set leveraged positions that may be susceptible to forced liquidations if the price moves aggressively in either direction.

Is your portfolio green? Check out the Ripple Profit Calculator

Such liquidation clusters indicate high-interest zones where price movements could trigger significant volatility. If XRP’s price approaches these dense areas, it could lead to a cascade of liquidations.

This can amplify price swings due to the forced closure of positions.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)