Yearn.Finance [YFI] holders may be at the cusp of earning profits and yet…

Yield protocol Yearn.Finance [YFI] has registered a lot of green candles over the past month. But, investors’ macro behavior might indicate a very important level of obstruction for the altcoin.

Year.Finance needs this

YFI, over the last 48 hours, marked a commendable rise of 28% after having rallied by 87.6% in the third week of December. This upward trend enabled the altcoin to recover from the price fall that began in November.

The strength pictured by ADX was a sign that this trend could continue for a long while. Well, only if YFI can maintain its strong position as an investment.

YFI price action | Source: TradingView – AMBCrypto

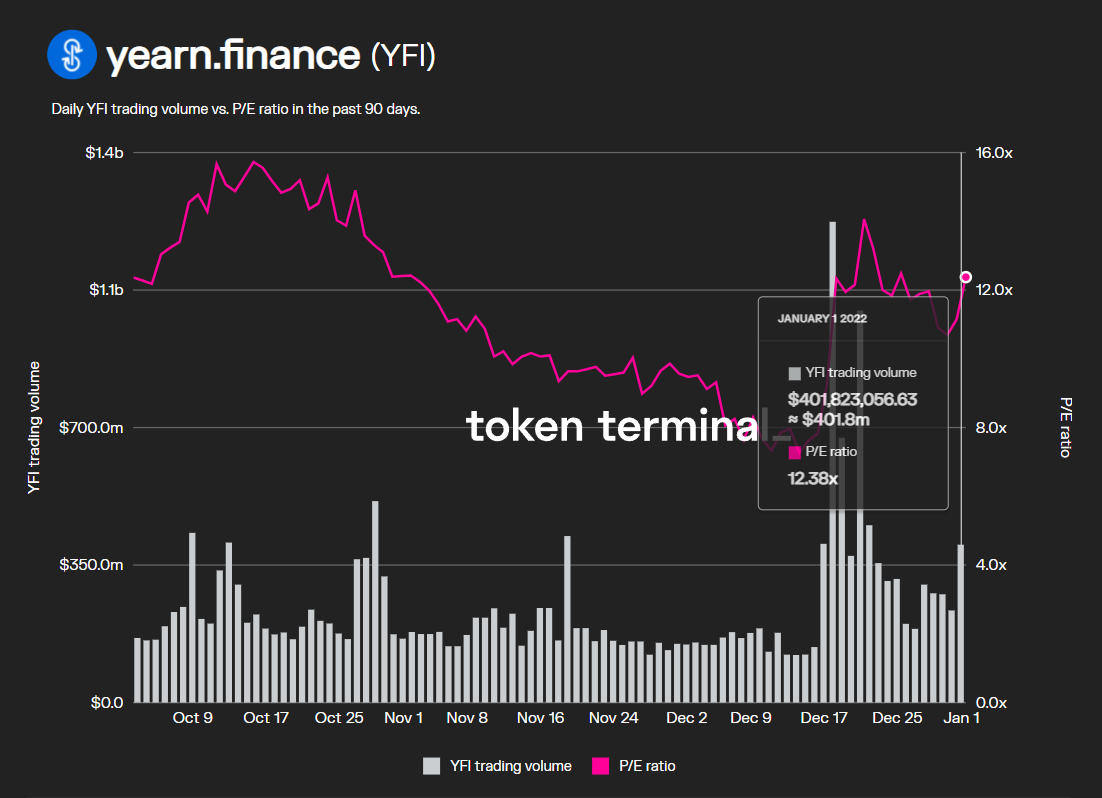

Thanks to the aforementioned rally, YFI has drawn in $401 million. Even though this figure isn’t the big deal, the interest displayed by investors has pushed the asset’s P/E ratio back upwards toward 12.4x.

YFI P/E ratio | Source: TokenTerminal

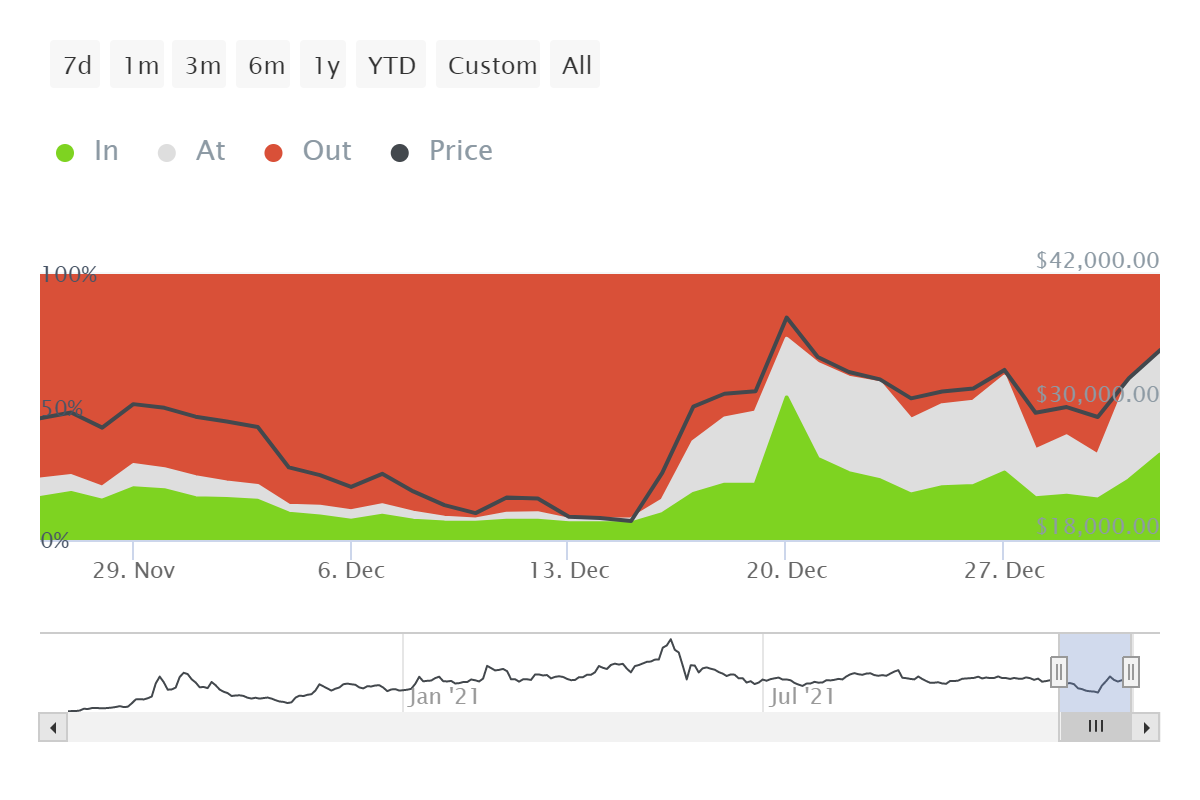

Notably, this rally underlined an interesting observation about YFI holders. Back around 17-18 December, when the aforementioned hike took YFI to $31k-33k, about 27% of YFI investors achieved the status of being At The Money. Here, the At The Money metric indicates investors who bought around the present price.

Since then, the price has been fluctuating around the $29k-$36k levels. However, it is worth noting here that when the price is around $33k – $35k, we see the cohorts’ domination rising. In fact, at the time of writing, when the price was at $35.9k, over 38% of all addresses were At The Money.

YFI investors at the money | Source: Intotheblock – AMBCrypto

This means that more than 16.3k investors have bought YFI at this range, which is where YFI has been oscillating for the last 12 months.

So, for investors to truly be in profit, YFI needs to break this barrier since this resistance has been long-standing. However, while it would be certainly difficult to do so, network developments and positive investor behavior could make it happen.

Also, the negative 0.16 correlation with Bitcoin will continue to play in favor of the altcoin, supporting any rally in the long term.

YFI correlation to Bitcoin | Source: Intotheblock – AMBCrypto