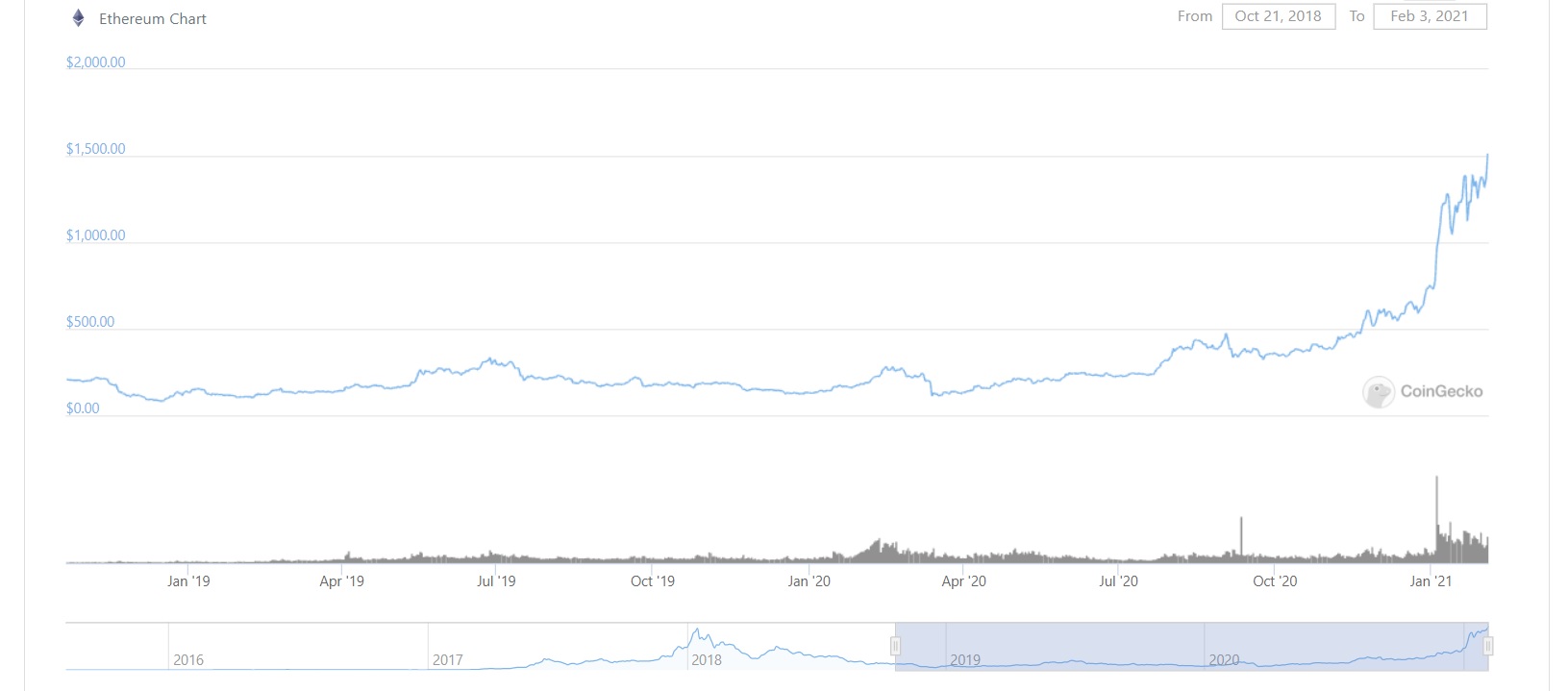

Yes, Ethereum hit a new ATH; here’s what’s next

Ethereum’s price tested its resistance level for a few weeks, before hitting a new all-time high of $1,540 on the charts, based on data from Santiment. In fact, at the time of writing, on-chain and technical analysis pointed to a short-term top ahead of the CME Futures listing.

Another positive sign observed on the charts was the implied volatility, with the same noticeably elevated ahead of the listing. While the aggregate daily volume for ETH Futures, at press time, was well below $20 billion, dropping from last week’s level, with the ETH Futures listing on CME inching closer, there may be a significant hike soon.

Source: CoinGecko

ETH’s price may rally further and continue its price discovery, alongside an increase in Open Interest, since the active supply has consistently dropped to a three year low. To build further on the supply shortage, the value on the ETH 2.0 contract recently hit an ATH too.

Most of these metrics underlined a bullish turn in Ethereum’s price rally, suggesting that after hitting a new ATH, there may be discovery beyond $1,540, leading to an extended rally. With the cryptocurrency noting a 15 percent hike in 24 hours, the sentiment seemed bullish, with the crypto expected to continue the same until it hits a short-term top.

This growth may be attributed to DeFi’s explosive growth and increasing TVL, however, the price depends on several other factors apart from DeFi’s activity. What’s also interesting is that over 95 percent of ETH wallets were profitable at press time, and with further price discovery, the likelihood of 100 percent profitability in the future remains high. Additionally, since the beginning of 2021, there has been an increase in the number of whales and whale wallets holding Ethereum.

Since the CME is one of the biggest market institutions, it is likely that Ethereum Futures’ listing may offer an opportunity for an increase in investment flow into Ethereum from institutions as part of their capital allocation strategy. Though it is only second to Bitcoin, based on market capitalization, it is likely that the realized market capitalization will continue to grow with greater investment flows. With the Realized market capitalization hitting an ATH earlier this week, it will be instrumental to derivatives exchange activity and Ethereum’s price rally beyond the new ATH.