Yield farming: Is it worth taking a chance on SUSHI, ALGO, SNX, CAKE now

34.5%, 33.2.6%, 20.79%, 20.3%: This is explicitly how the weekly returns of Synthetix, SuhshiSwap, Algorand and PancakeSwap looked like at press time. All the aforementioned tokens have a commonality – they sustain yield farming. People from the community usually generate additional income by farming. As such, whenever HODLers lock up their cryptos or provide liquidity, they are rewarded. Yield farmers typically keep moving their funds from different protocols in search of high yields.

Even though the weekly returns seemed to be fairly decent for these tokens, their daily returns explicitly stood below 1% at the time of writing. So, as the bullish narrative is intensifying in the broader crypto market, is the yield farming craze fading away?

Deciphering what the metrics indicate

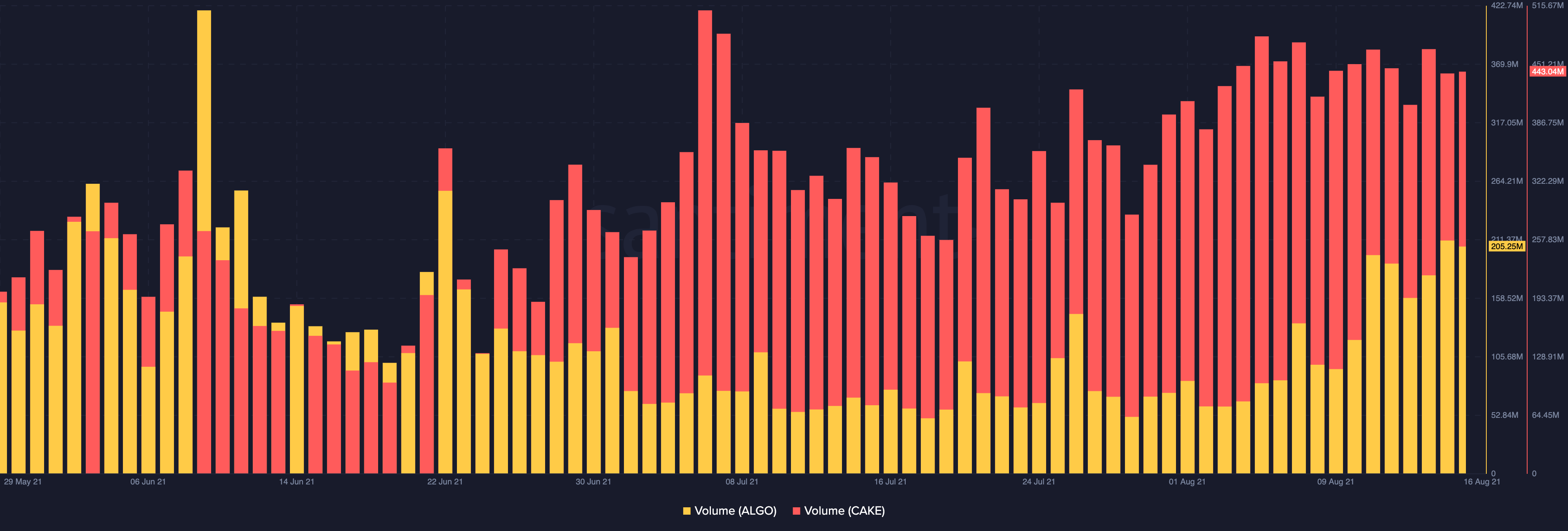

As a matter of fact, to yield farm, one has to lock up the native token for a stipulated period of time. Interestingly, the volumes of most of the DeFi tokens have been increasing of late. Take, CAKE and ALGO, for instance. As can be seen from the chart attached, their volume has nearly doubled since mid-July. Trade volume usually takes into account both buy and sell volumes. However, keeping the recent price action in mind, it can be said that these tokens are in demand.

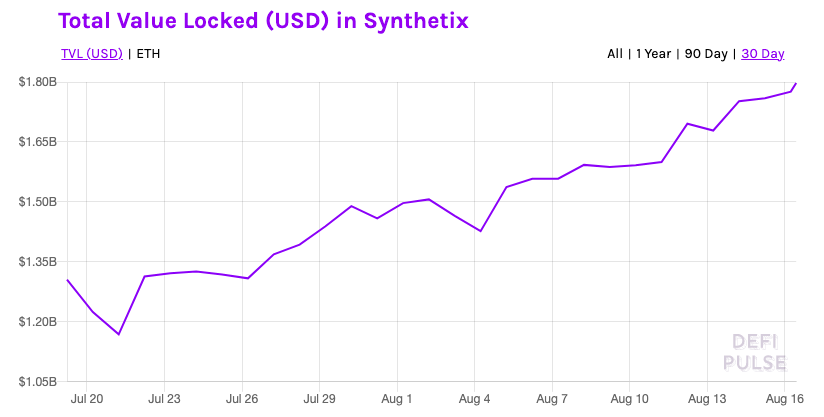

Total value locked up is another key metric that helps in analyzing the growth in the DeFi space. By and large, it is the aggregate liquidity in liquidity pools. DeFiPulse’s data pointed out that the same has been on the rise lately. Naturally, the more the value locked, the more yield farming may be going on in a particular ecosystem.

Towards mid-July, for instance, SNX’s TVL was hovering in the $1.05-$1.2 billion bracket. The same, at the time of writing, stood slightly above $1.80 billion. SUSHI’s TVL too, for that matter, has risen from $2.5 billion to $4 billion. Now, this essentially implies that the DeFi yield farming scene is a good state.

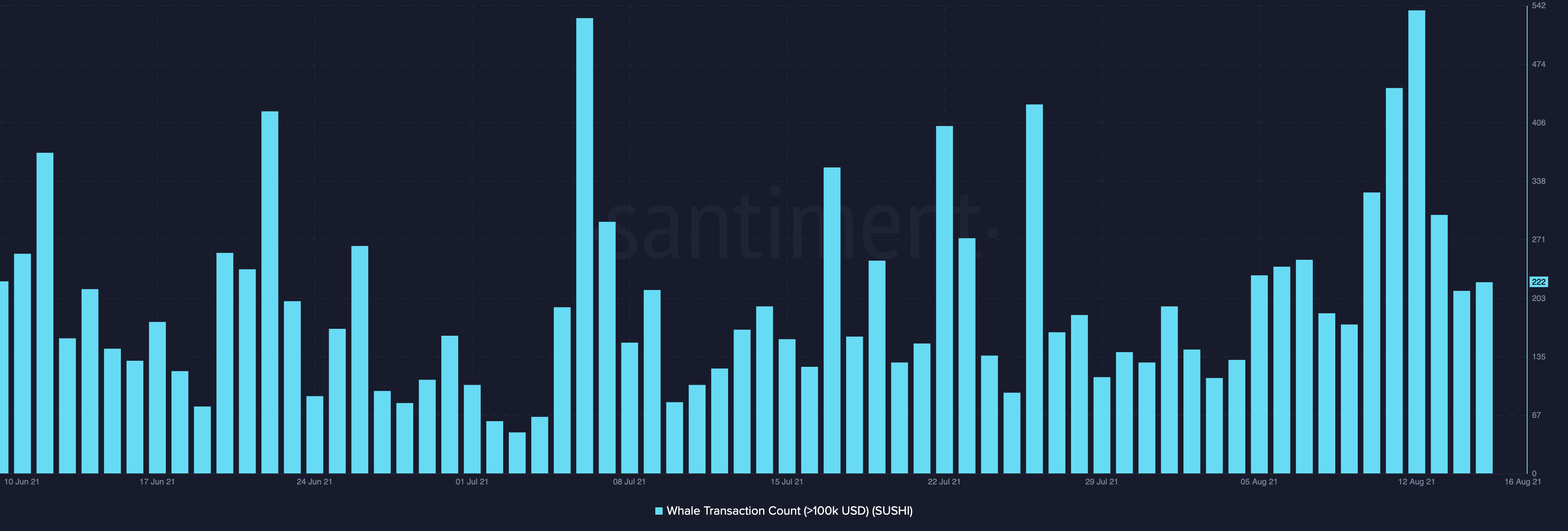

As a matter of fact, yield farming is generally more suited to those who have a lot of capital to deploy i.e. whales. Interestingly, the number of whale transactions have been on the rise of late. As can be seen from the chart attached, the number of large transactions for SUSHI breached the 500 mark on 12 August and has fairly remained high when compared to the initial few days of August.

The state of the metrics, by and large, assert that the yield farming mania is here to stay. The same, in retrospect, would help in warranting the long-term valuation of the aforementioned DeFi tokens.