Yuga Labs’ TwelveFold auction had this effect on Apecoin [APE]

- The 24-hour TwelveFold auction raised 735 BTC, or about 16.45 million at press time market price

- Technical indicators sounded a bearish alarm for APE at the time of writing

Yuga Labs is in the news after it concluded the much-publicized auction of its inaugural Bitcoin-based non-fungible token (NFT) collection – TwelveFold. The top 288 bidders won one NFT each and will receive their inscriptions within a week, according to an update from Yuga Labs.

The TwelveFold auction has ended. Congratulations to the top 288 bidders – you will receive your inscription within one week. Valid bids that did not rank in the top 288 will have their bid amount returned to their receiving address within 24 hours.

— Yuga Labs (@yugalabs) March 6, 2023

In fact, TwelveFold went on to add that the 24-hour auction raised 735 BTC or about $16.45 million, as per the press time market price. Also, the highest successful bid was 7.1159 BTC – Worth $159,282.

Yuga Labs added that unsuccessful bids that could not feature in the list of the top-288 will have their bid amount returned to the user’s receiving addresses in 24 hours.

Read ApeCoin’s [APE] Price Prediction 2023-24

Auction hype fails to lift APE

The hype associated with auction failed to lift the spirits of Apecoin [APE] investors, however. Consider this – According to CoinMarketCap, the altcoin fell by 1.7% over a 24-hour period, at the time of writing.

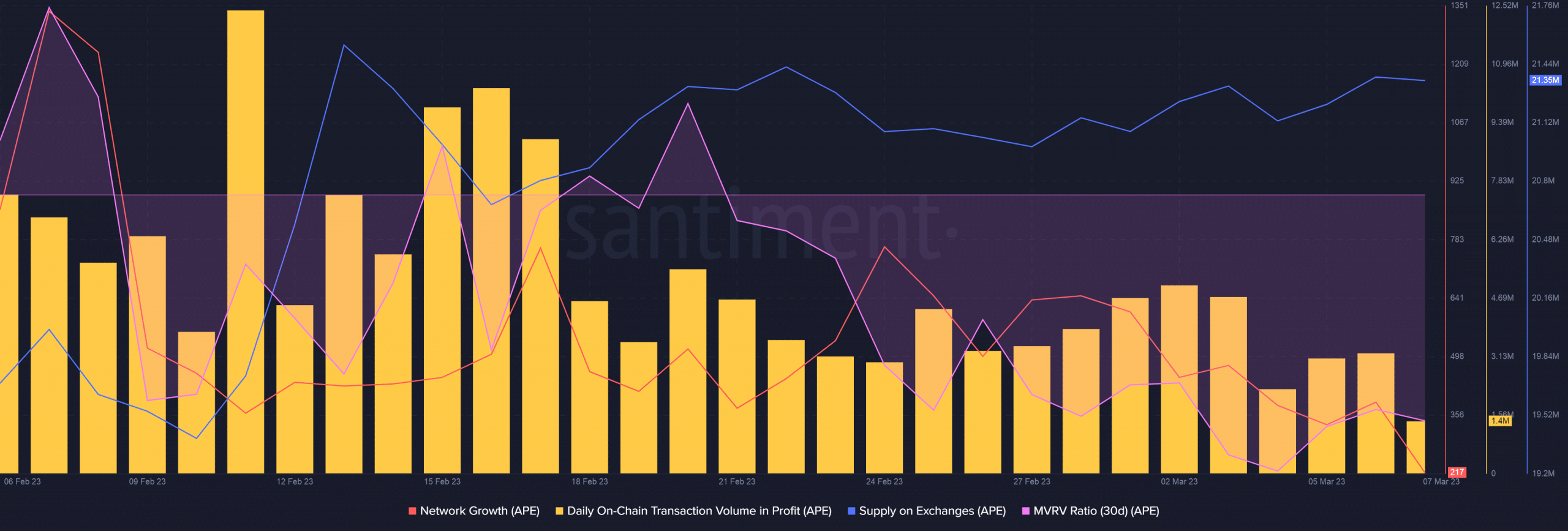

Additionally, it’s worth pointing out that network growth went downhill after spiking in the early part of February. This indicated that new addresses were not too keen on amassing APE.

One reason could be the sharp drop in daily transaction volume in profit. Figures for the same contracted from $8.95 million in mid-February to just over $3.2 million, as of 6 March.

The negative MVRV Ratio supported the aforementioned deduction. The possibility of making losses on their holdings deterred new participants from joining the network.

At the same time, supply on exchanges increased over the past week, which could increase selling pressure in the short term.

APE in bears’ grasp?

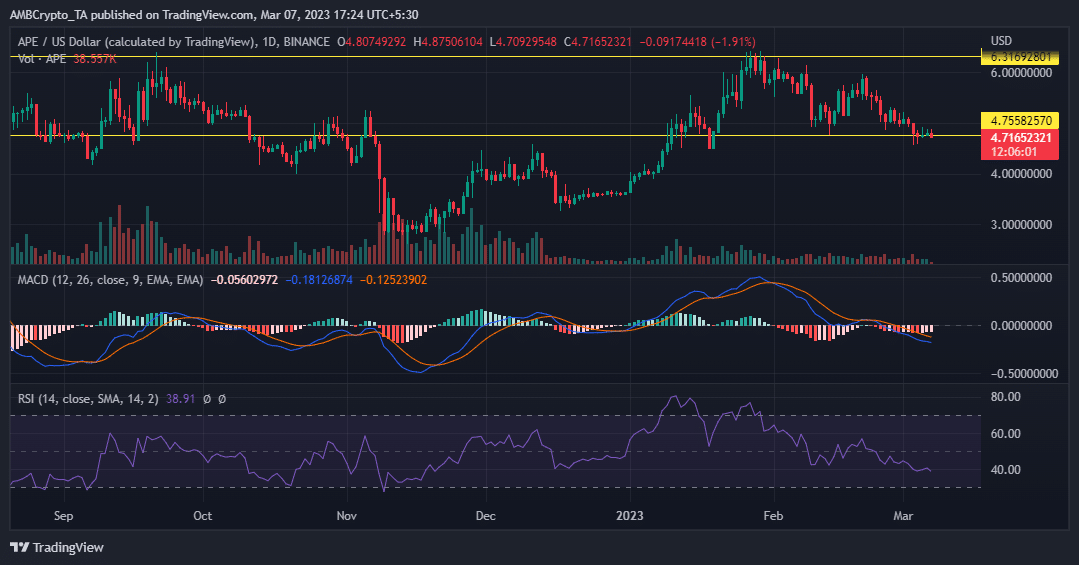

APE moved within the indicated range for the most part of February. At the time of writing, the bulls were struggling to defend the range lows, however. A move below this will tilt the market in the bears’ favor.

The Moving Average Convergence Divergence (MACD) traversed inside the negative territory, sounding a bearish alarm. The Relative Strength Index (RSI) inched towards the oversold territory, implying that selling pressure has remained high too.

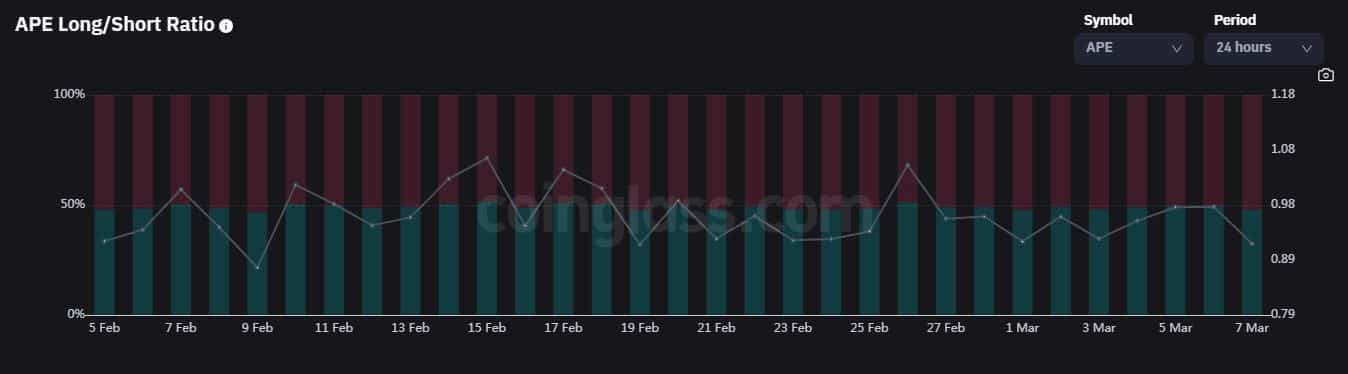

Finally, investors were turning pessimistic as the number of short positions for the crypto hiked over the last two days, according to Coinglass. In fact, the Longs/Shorts Ratio was 0.92, at the time of writing.

How much are 1,10,100 APEs worth today?

While largely successful, Yuga Labs got some flak from users for the way it conducted the auctioning process. Casey Rodarmor, the creator of Bitcoin Ordinals, criticized the process, one which involved sending the entire bid amount in order to be considered for the auction.