Zapper, Zerion and DeHive’s DeFi portfolio management protocol

DeFi is short for “decentralized finance,” an umbrella term for an assortment of money-related applications in cryptocurrency or blockchain adapted toward disturbing budgetary intermediaries. DeFi draws motivation from blockchain, the innovation behind the computerized money bitcoin, which permits a few substances to hold a duplicate of a history of exchanges, meaning it isn’t controlled by a single, central source.

That is vital since centralized frameworks and human watchmen can restrain the speed and modernity of exchanges whereas advertising clients less coordinated control over their cash. DeFi is particular since it grows the utilization of blockchain from basic value exchange to more complex financial use cases.

Zapper – dashboard for DeFi

There is a simple dashboard for DeFi like the Zapper app which is essentially a speedy and simple way of paying for something utilizing your mobile phone. The benefit is set up to pay for the likes of taxes, bills, and online administrations, as well as permitting you to form a charity gift here and there, but the main goal presently is on eating out. When your bill comes in a Zapper-supporting eatery, you’ll see a QR code at the bottom. Scan the QR code using your phone’s camera and the Zapper app will handle installment from your stored credit card or PayPal account. The restaurant will at that point be informed that the bill has been paid, so you’ll walk out of the restaurant without being accosted.

Zerion – crypto portfolio manager

Source: Zerion website https://zerion.io/

On the other hand, there is Zerion, which is a non-custodial DeFi Dashboard designed for simplicity, clarity, and user-friendliness. Amongst many competitors, Zerion sets itself apart with its clean and clear interface, its support of high DeFi applications, and its minimally-invasive approach. Think of Zerion as the dashboard for your DeFi portfolio. Simply, you’ll see your balance, group action history, savings, and investments in detail. Its minimally invasive approach implies that you’ll use several of the options of Zerion while not giving it any access to your funds. With DeFi hacks happening often, this can be a very important feature..

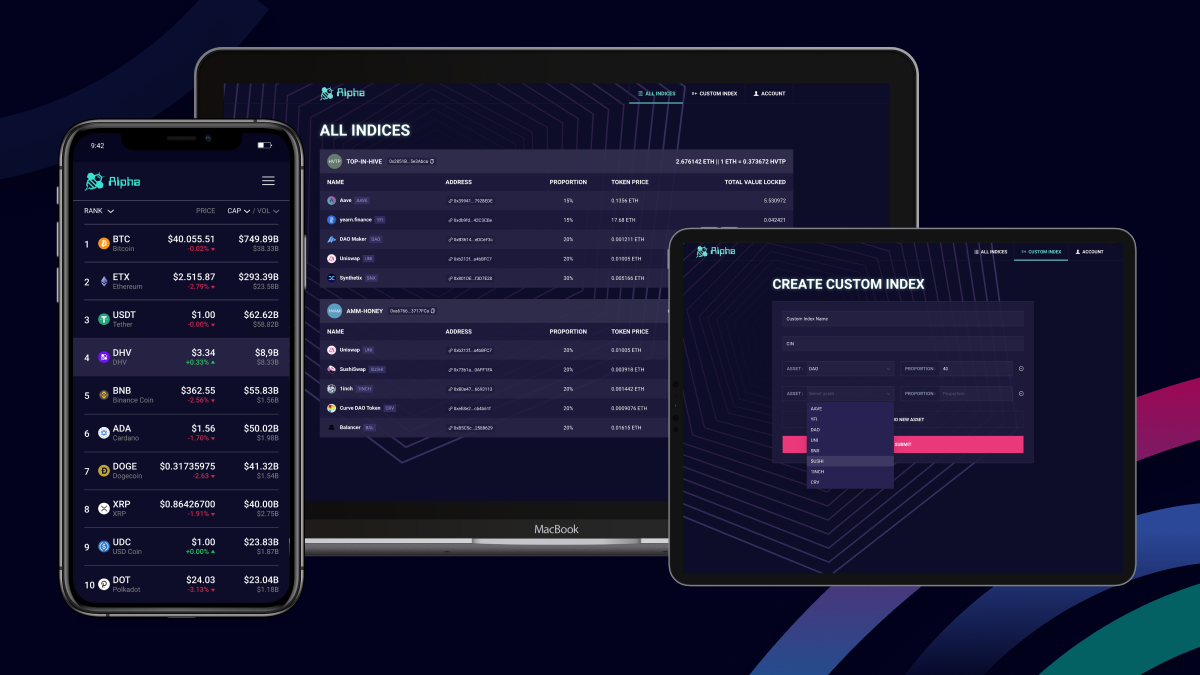

DeHive – the decentralized hive of crypto assets

Source: DeHive Demo

DeHive protocol provides its users with an economically sound and justified index of the top DeFi assets. It gives you an opportunity to wrap your funds into a single crypto-hive full of top DeFi crypto assets. Thus, the user is able to get the picture of DeFi sector development and assess the market health in general. The protocol provides crypto indexes of selected tokens presented on the DeFi market. Underlying currencies are securely stored in the smart contracts of the protocol while the user has full transparency of balances of his assets.

In a nutshell, DeFi, or decentralized finance, is a new way to execute financial transactions through applications. It cuts out traditional financial institutions and intermediaries and is conducted over the blockchain.

DeHive in this case is the best option to choose and it is a superb DeFi asset management as it allows for portfolio diversification and therefore makes it much more secure. You can also become a holder of many tokens in one click so this is very easy to use.

Disclaimer: This is a paid post and should not be treated as news/advice.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)