Zcash inflows spike as price hits resistance level: A sell-off signal?

- ZEC’s long/short ratio indicates a strong bearish sentiment among the traders.

- Currently, 52% of top traders hold short positions, while 48% hold long positions.

ZEC, the native token of Zcash, is making waves in the crypto market with its impressive performance over the past week. With the upside momentum, it appears that the sentiment among whales and traders has been shifting as reported by on-chain analytics firm Coinglass.

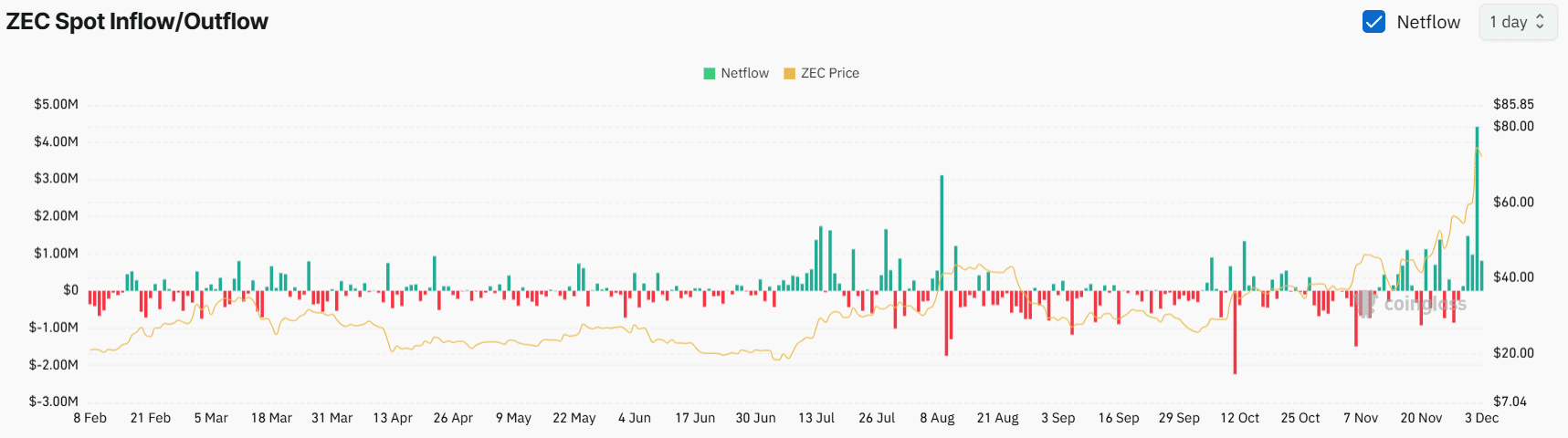

Zcash’s $7.8M inflow

According to Coinglass’ ZEC inflow/outflow data, exchanges in the last four days have witnessed a significant $7.85 million inflow, indicating that the asset has been deposited into the exchanges.

In the cryptocurrency context, inflow refers to a sell-off signal and hints potential price decline in the coming days.

This inflow into the exchanges is potentially caused due to the significant 115% upside momentum in the ZEC price and the bearish price action pattern, which suggests potential profit booking in the assets.

Besides long-term holders, traders also appear to follow the same thing as reported by Coinglass data. ZEC’s long/short ratio currently stands at 0.89, indicating a strong bearish sentiment among the traders.

Currently, 52% of top traders hold short positions, while 48% hold long positions.

The combination of on-chain metrics hints that bears began to control and hints at potential price correction or price decline in the coming days.

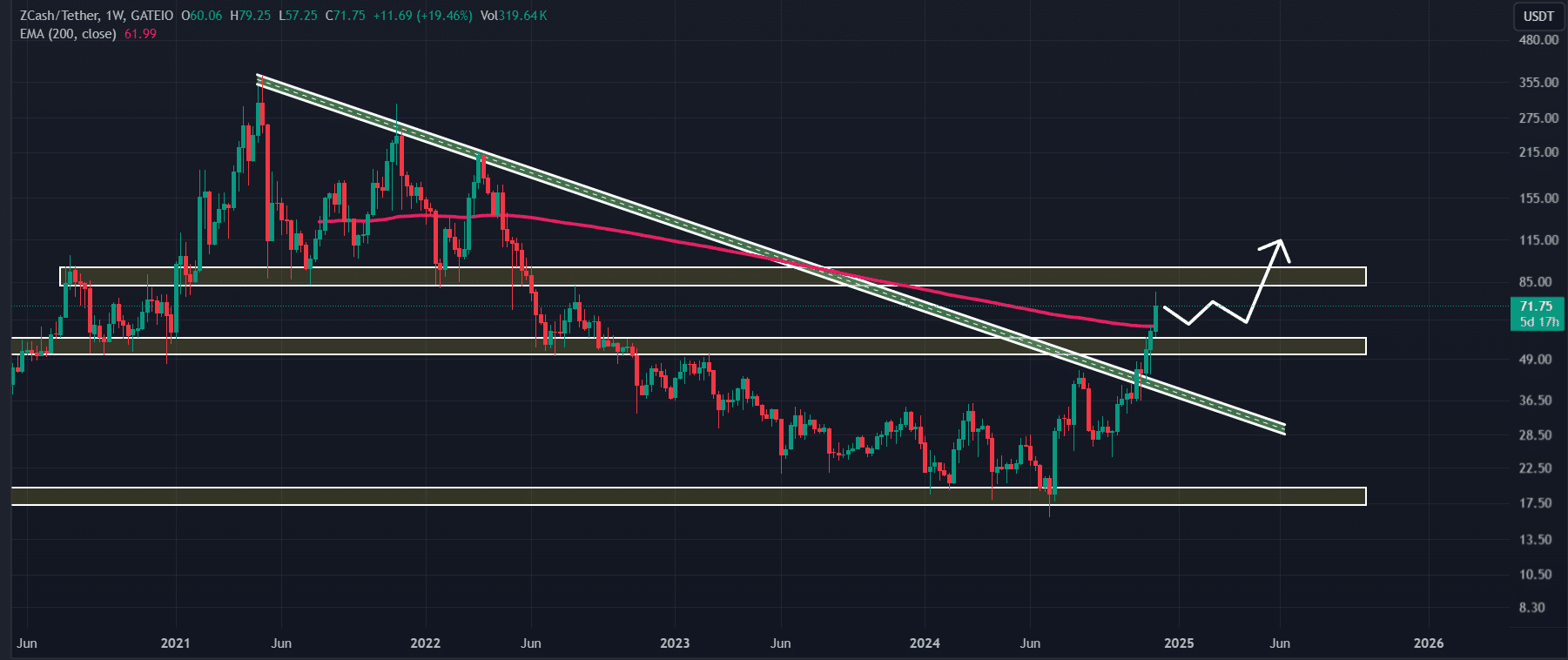

ZEC technical analysis and key levels

According to AMBCrypto’s technical analysis, ZEC is currently at a strong resistance level of $80 and is facing rejection.

Last time, when the altcoin reached this level it witnessed selling pressure and price reversal, however whales and traders expecting the same as reported by on-chain metrics.

Based on the recent price action, there is a strong possibility that ZEC could experience a price decline or price correction in the coming days.

However, the altcoin’s Relative Strength Index (RSI) is at 78, indicating that it is in overbought territory hinting potential price reversal in the coming days.

At press time, ZEC was trading near $72.70 and has registered a price gain of over 21% in the past 24 hours.

Meanwhile, during the same period, its trading volume jumped by 120% indicating heightened participation from traders and investors, compared to the previous day.

![Solana [SOL] - Is there any good news after trading volume hits 2024 low?](https://ambcrypto.com/wp-content/uploads/2025/03/Solana_Abdul-400x240.webp)