Zcash price prediction: As bulls slow down, will ZEC fall below $30?

- Zcash achieved impressive gains underpinned by robust demand, but short-term profit-taking intensified.

- We explored the possibility of discounted short-term prices and more potential upside in the long-term.

Zcash [ZEC], one of the top privacy coins, has delivered an impressive bullish performance in the last two months. Traders that were exposed to this coin in the last six weeks and held on have enjoyed a 175% gain.

However, a Zcash is due for a retracement.

Zcash’s performance in the last six weeks has been nothing short of impressive. It even managed to achieve a robust bounceback after the crash at the end of July and the start of August.

For perspective, this privacy coin traded as low as $15.78 on the 5th July and peaked at 43.44 during the trading session on the 12th of August. Let’s take a look at Zcash’s price prediction.

Zcash price prediction

While Zcash demonstrated impressive bullish momentum, a natural pullback is due. There are multiple signs indicating a high possibility of a reversal.

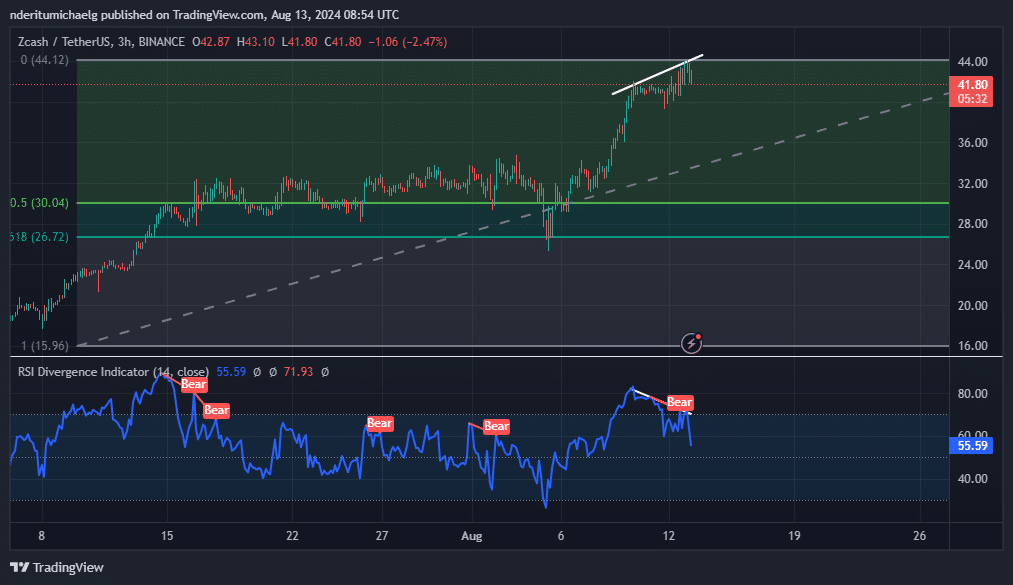

For instance, Its RSI formed divergence against the price in the 3-hour chart, indicating that the bullish momentum was weakening.

In addition, the RSI had already pulled back from the overbought zone, signaling a rapid buildup of sell pressure. ZEC had a $41.52 press time trading price, equivalent to a 5.67% pullback from its recent high.

This could be the start of a broader pullback, given the extent of the asset’s recent rally.

A strong pullback may push prices towards the $26.71 and $30.10 before resuming its upside. This range is based on Fibonacci retracement from the current monthly low to its recent highs.

The range is within the 0.5 and 0.618 Fibonacci levels.

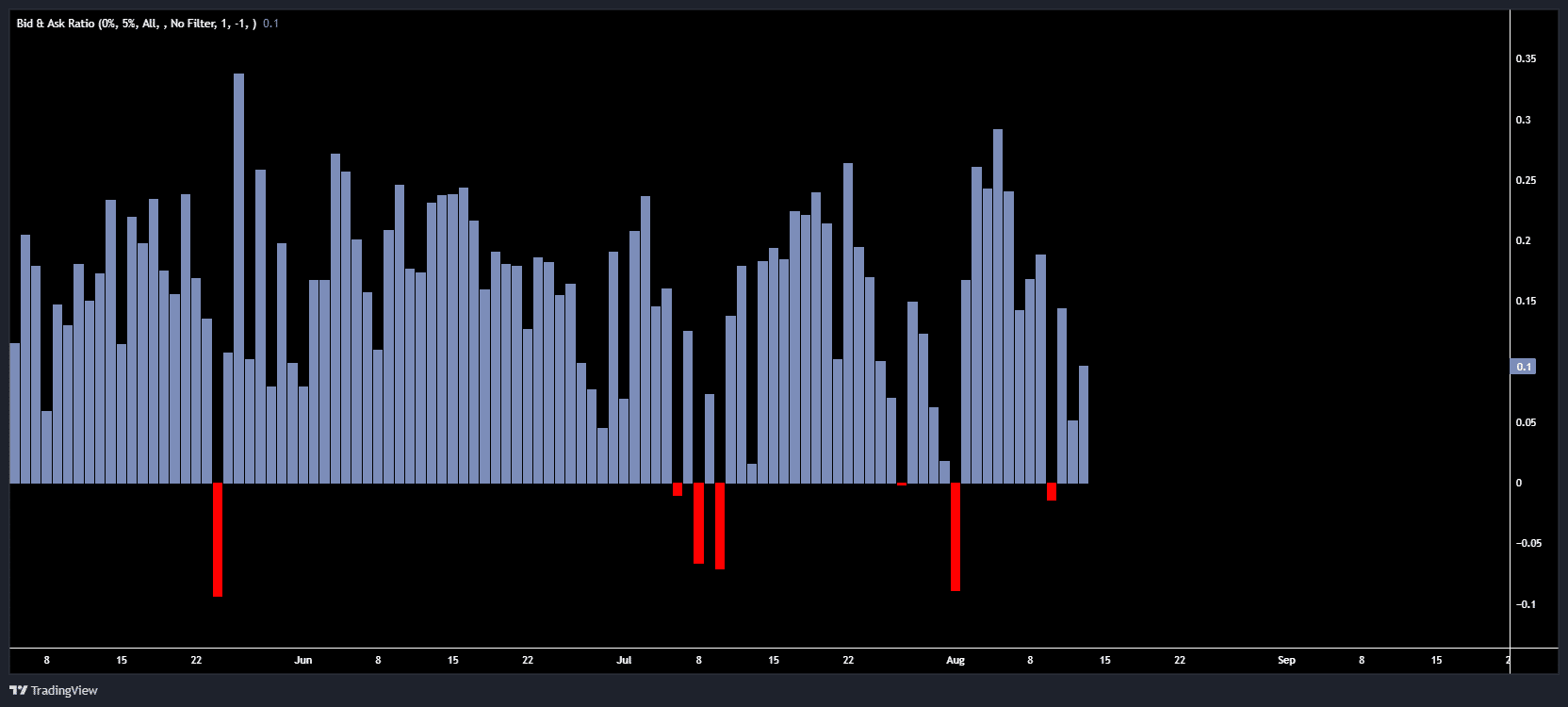

ZEC’s bid/ask ratio highlighted just how strong the bulls have been. Strong demand was evident even at recent market dips. However, the same indicator revealed that bids have been declining in the last few days.

Will Zcash remain bullish long term?

Zcash’s strong momentum undercut most top coins. This robust performance suggested that the bulls may deliver more upside in the long-run if it can sustain demand.

This could be the case, especially now that ZEC was receiving support from key figures.

In other news, Gemini’s co-founder Tyler Winklevoss recently demonstrated his support for Zcash, describing it as,

“Important and underrated.”

Zcash can still be viewed as underrated in the long term, despite the recent rally. At press time, it had a circulating supply of 15,328,269 coins, which means it is more scarce than BTC currently.

Its maximum supply is 21 million coins, on par with Bitcoin [BTC]. The low circulating supply suggests that its bulls have a lot of legroom if ZEC can achieve sustained robust demand.