Bitcoin

Bitcoin spot ETFs’ ‘Zero flow’ days – All you need to know

Spot Bitcoin ETF volumes are seeing zero netflows on some platforms of late.

- Bitcoin spot ETF sees zero netflow.

- GBTC holdings continue to decline.

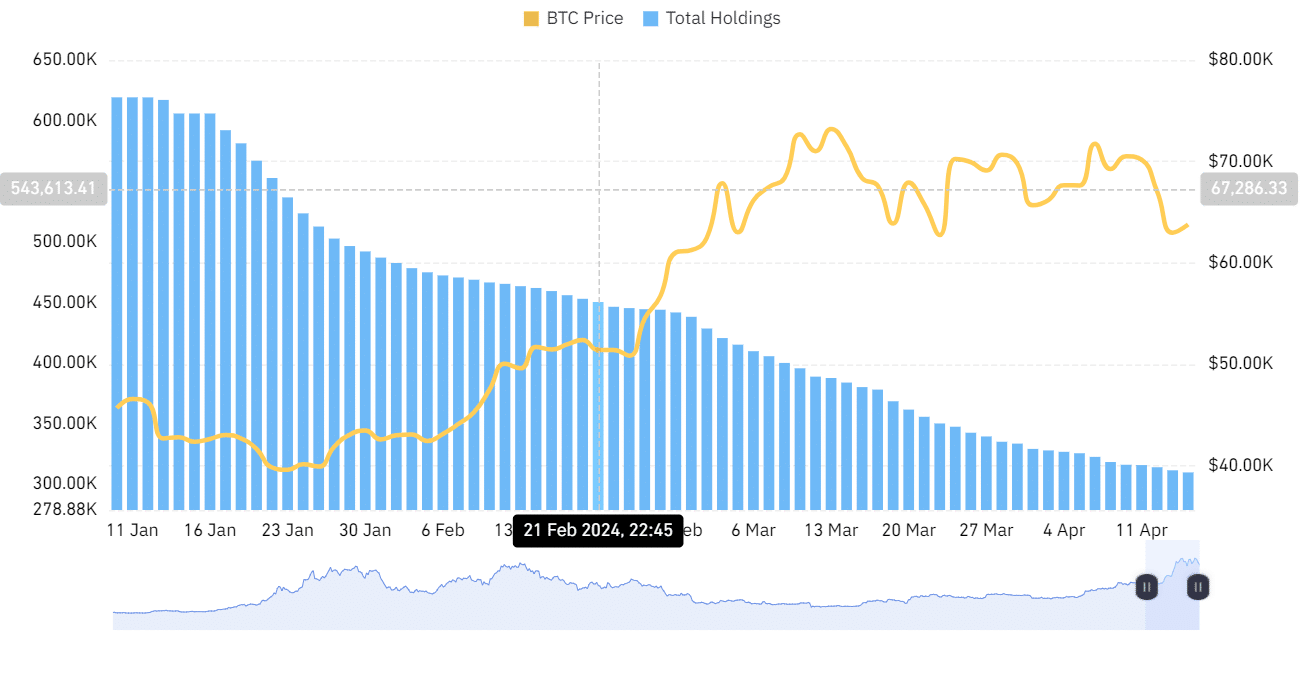

Following the approval and launch of the spot Bitcoin [BTC] ETF, Grayscale’s Bitcoin holdings have experienced a decline. After the ETF’s launch, most platforms have witnessed zero flows for the first time.

Grayscale’s Bitcoin holdings halves

An examination of institutions that recently obtained spot Bitcoin ETF approvals revealed that Grayscale held the highest BTC market capitalization.

However, a deeper dive into the data revealed a decline in the volume of BTC held by Grayscale over recent months.

Coinglass data indicated that as of January, Grayscale held over 619,000 BTC. Yet, as of press time, their total holdings stood at around 310,000 BTC.

Grayscale’s pre-existing Bitcoin Trust, GBTC, transitioned into an ETF rather than launching afresh.

Despite the decrease in Grayscale’s holdings, it has continued to experience significant volume in ETF flows. Nonetheless, certain spot ETF platforms have recently recorded zero flows.

Spot Bitcoin ETFs see consecutive outflows

An analysis of the Bitcoin

spot ETF netflow on Coinglass indicates consecutive outflows over the past few days. On the 15th and 16th of April, outflows amounted to $26.7 million and $58 million, respectively.This isn’t the first occurrence of consecutive negative flows, with the highest number observed in March. In March, data revealed consecutive outflows for five days.

Notably, BlackRock’s IBIT and Grayscale’s GBTC are the only U.S. spot BTC ETFs to record any flows since the beginning of the week.

Zero flows dominate ETF flows

Further analysis of the Bitcoin spot ETF flow revealed that on the 15th of April, GBTC experienced an outflow of $157.50 million, followed by another outflow of $109 million on the 16th of April, continuing the trend of consecutive outflows.

In contrast, IBIT saw a different flow pattern, with an inflow of $76.23 million on 15 April and nearly $26 million on 16 April.

Notably, there have been no flows from other platforms. However, James Seyffart

noted that this does not indicate the failure of the product.Read Bitcoin’s [BTC] Price Prediction 2024-25

In his post, he explained that on most days, the vast majority of all United States ETFs post zero inflows, which is considered normal for any ETF in a given sector.

As of this writing, Bitcoin was trading at around $63,170, representing a decline of over 1%.