Bitcoin sails past $30k, but how far can BTC go from here?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

– The daily structure was strongly bullish.

– Above $32k it could be thin air up to $37.5k.

Bitcoin dominance metric has been rising since September 2022. Each strong move upward on Bitcoin was accompanied by a rise in this metric, which highlighted the fact that capital flow was likely directed toward BTC in the market.

Read Bitcoin’s [BTC] Price Prediction 2023-24

If this were the case, a breakout past $30k meant BTC bulls could make large gains in the coming weeks.

Despite facing FUD, Bitcoin continued to consolidate around the $28k area before heading higher.

A move downward will likely cause large liquidations, making a deep pullback a likelihood. Traders can remain bullish until a drop below $26.8k, which would shift the structure to bearish.

Bitcoin breaks above the $29k level and is headed toward $32k next

In May and June of 2022, Bitcoin was trading at the $28.8k-$32k region. This area also represented the lows of a range that BTC established in 2021. Therefore, it is a zone of resistance on the higher timeframe charts.

However, the king of crypto had a strong bullish impetus throughout 2023, interrupted by some severe pullbacks such as the early March drop to $20k. The move back above the $25.2k level and the recent breakout past $28.8k-$29.2k meant bulls remained dominant.

To the north, the $32k area was highlighted in red to show a daily bearish order block. Above that, the next significant resistance lay at $37.5k-$38k.

Back in May 2022, BTC crashed straight below $38k to end up at the $30k support, which supported the idea that significant resistance might not impede BTC bulls on the way up to $38k.

Is your portfolio green? Check the Bitcoin Profit Calculator

In the 1-day timeframe, both the RSI and the Directional Movement Index showed a bullish trend in progress. A daily session close below $26.8k will break the market structure, and buyers would have to wait for a deeper retracement to $25k or lower.

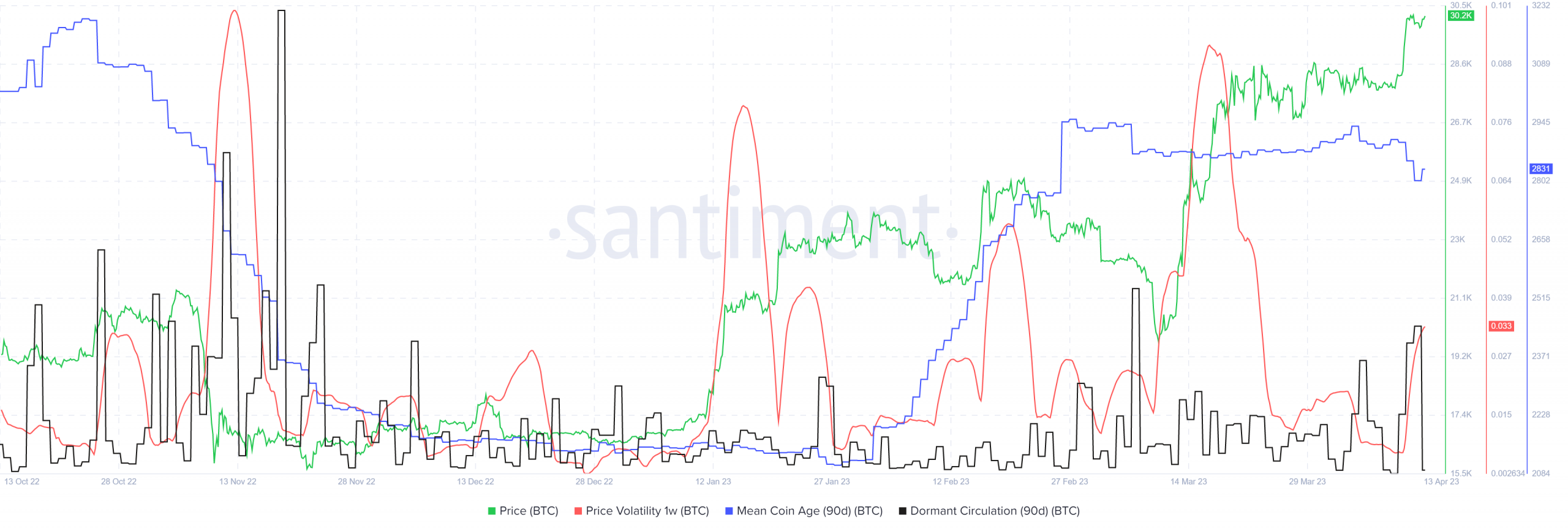

A spike in the circulation metric could presage some selling pressure

Source: Santiment

The 90-day mean coin age began to slide downward over the past two weeks, although the price has gone higher. This suggested increased coin movement between addresses and could be followed by some selling pressure. The rise in dormant circulation also pointed to the same.

The price volatility was on the rise once again after falling since mid-March. At that same time, BTC knocked multiple times on the $28.8k level and steadily pushed higher.

Therefore, a breakout past $30k could see a strong push higher, as expansions after a period of low volatility can be very strong.