Did Ethereum’s breach of $2,400 have ANY impact on Cardano, Uniswap

Ethereum confirmed a strong bullish signal yesterday after it closed a daily candle above $2,400. In fact, the crypto-asset crossed above its psychological resistance for the first time since 14 June. Historically, when this has happened, Ether has triggered minor altcoin rallies too.

We analyzed some of the top correlated assets with Ethereum to understand if top altcoins are collectively showing any signs of revival. (Note: We are analyzing altcoins that share a correlation of 0.85 or higher with Ethereum)

Ethereum clearing levels

For this article, we will be looking at Uniswap and Cardano since these assets share a correlation of more than 0.85 with Ethereum. Ethereum Classic will also be looked at, primarily because it offers a genuinely interesting case study when juxtaposed against the rest.

These correlations are based on the long-term price movements between these altcoins. Hence, they are developed over a period of time.

ETH/USDT on Trading View

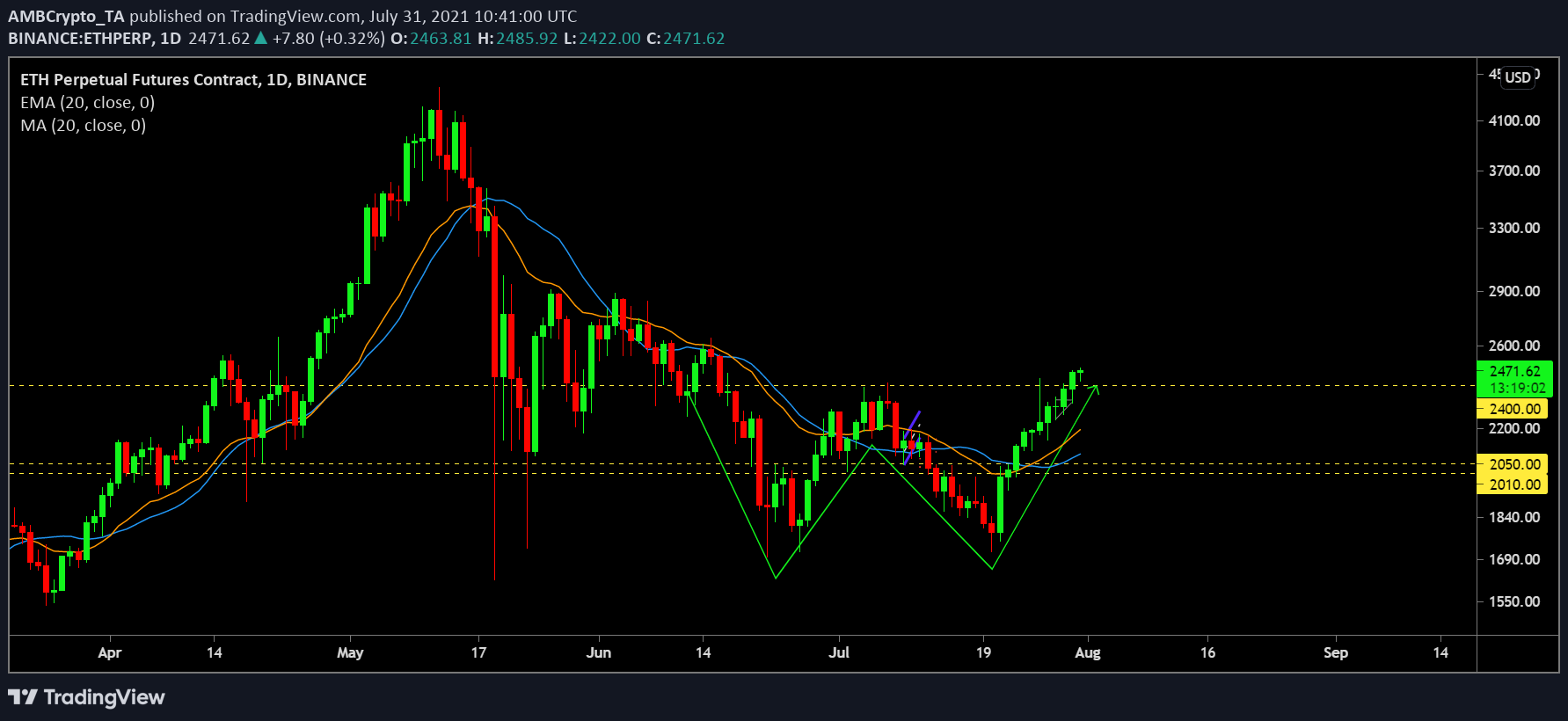

Now, when observing Ethereum’s 1-day chart, it is clear that the asset is breaking above a double bottom pattern, one where the token closed above $2400. Ethereum has hiked for 10 days straight and this is suggestive of stronger bullish momentum.

In comparison, Cardano is still lagging behind its immediate resistance of $1.5. What this means is that buying pressure hasn’t pushed its valuation above the safe zone yet. In comparison, volumes have also been on the lower side for the competing asset.

ADA/USDT on Trading View

With Uniswap, the difference seemed much higher, with the crypto trading well under the $25 resistance. Now, while the Relative Strength Index or RSI did point to a surge in buying pressure, it was yet to clock in a bullish trend reversal.

UNI/USDT on Trading View

The case for Ethereum Classic

One particular asset that needs to be mentioned here is Ethereum Classic. ETC, according to Skew, had a particularly low correlation of 0.535. However, since 19 May, ETC has closely followed Ether’s price movement. What this suggests is that a newer correlation might be unfolding in the industry.

Hence, it can be inferred that Ethereum isn’t triggering an altcoin rally yet because the trend is still extremely finicky with respect to establishing a strong bullish foundation.

Bitcoin, at the time of writing, was trading well above $41,000. If it continues to do so, the wider crypto-market will take notice. As far as Ethereum is concerned, a strong altcoin rally might unfold once ETH breaches $3,000 since that would bring more liquidity and capital across the broader altcoin market.