FLOKI price prediction – Traders, should you prepare for the worst now?

- Breaking through a certain level may push FLOKI’s price down to or even below its August low of 0.00009585

- Technical indicators pointed to further declines, with the MACD notably forming a death cross

FLOKI has been seeing significant losses across various timeframes lately. While it fell by 19.95% over the past month, it also saw losses of 12.13% and 2.27% on the weekly and daily charts, respectively.

This bearish trend could intensify if the major support, which previously acted as a buying catalyst, fails to sustain buying pressure. However, previous instances suggested FLOKI should have rallied higher instead.

FLOKI’s price action contingent on key support level

Prior expectations for FLOKI included a bullish upswing to $0.00021116 following a breakout from a descending line pattern — A symbol that precedes a bullish move.

However, as the crypto market took a downturn, FLOKI also declined. At press time, it was approaching a major support zone at $0.0010932, which previously marked the breakout from the descending line.

This support level has historically triggered significant rallies, as seen on 6 March and 13 April. FLOKI surged by 185.34% and 217.59%, respectively, after hitting this level on both these occasions.

Should this support fail to hold, FLOKI faces potential declines to two key targets – First of all, to $0.00009585 — A level last seen on 5 August and potentially further to $0.00009112, marking the altcoin’s lowest point since 5 March.

Can FLOKI’s price drop further?

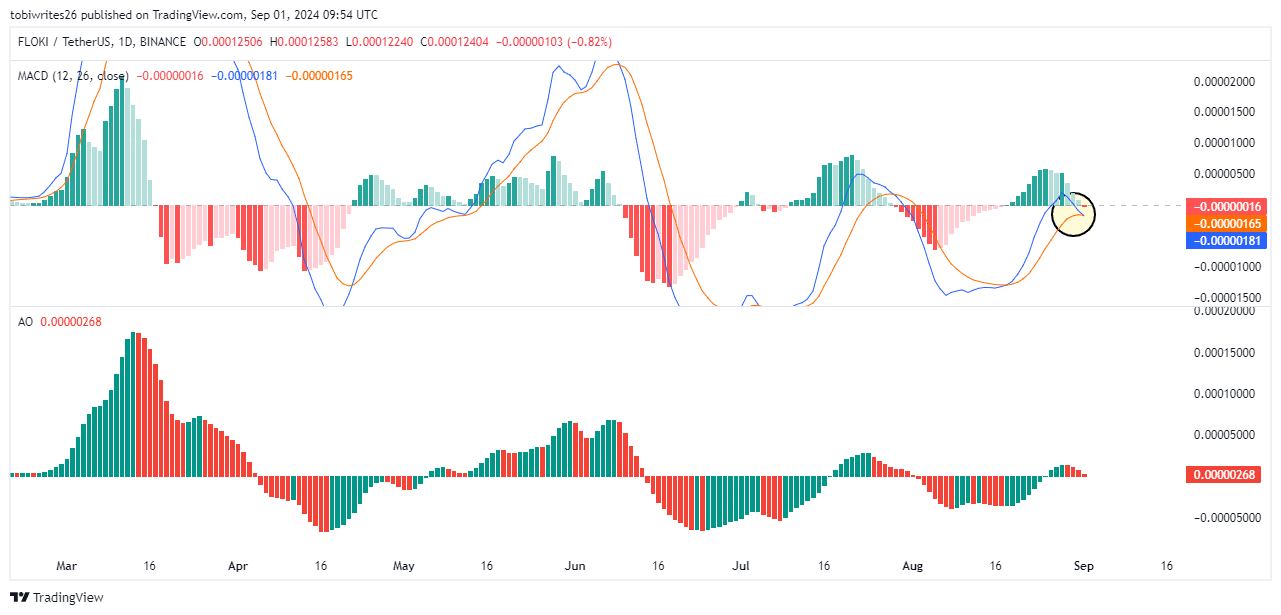

Technical indicators, including the Moving Average Convergence Divergence (MACD) and the Awesome Oscillator (AO), both projected a potential drop in FLOKI’s price.

The MACD formed a ‘death cross,’ indicated by the MACD line (blue) crossing below the signal line (orange) and moving deeper into negative territory. This can be interpreted as a sign of increasing selling pressure as buyer interest fades.

Additionally, AMBCrypto’s analysis of the altcoin’s identified a shift towards bearish momentum. Here, it’s worth noting that this indicator compared recent price action with longer-term market trends.

If this downward pressure continues, the AO could dip below zero. This would mean a further decline in FLOKI’s price to its previously mentioned targets.

To counteract these potential losses, a hike in buying pressure, possibly driven by external factors, would be necessary to push the market back upwards.