Memecoins crash: DOGE, PEPE, FLOKI face $20M wipeout, now what?

- DOGE, WIF, and PEPE saw price declines in the last 24 hours.

- This resulted in significant long liquidations in their futures markets.

Leading meme assets Dogecoin [DOGE], Pepe [PEPE], and dogwifhat [WIF] witnessed a surge in long liquidations following the general market decline on the 30th of April, Coinglass data showed.

Liquidations occur in an asset’s derivatives market when a trader’s position is forcefully closed due to insufficient funds to maintain it.

Long liquidations happen when the value of an asset suddenly drops, and traders who have open positions in favor of a price rally are forced to exit their positions.

Per CoinMarketCap, the prices of DOGE, PEPE, and WIF have declined by 9%, 14%, and 10%, respectively, in the last 24 hours.

DOGE liquidations totaled $12.48 million during that period, with long liquidations amounting to $12 million.

For PEPE, out of the $6 million worth of closed positions, long positions accounted for over $4 million. WIF experienced total liquidations of $2.06 million, with long liquidations reaching $1.8 million.

The meme assets are at risk of further price declines

The decline in DOGE’s price in the last 24 hours and the ensuing long liquidations have led to a spike in short trades opened.

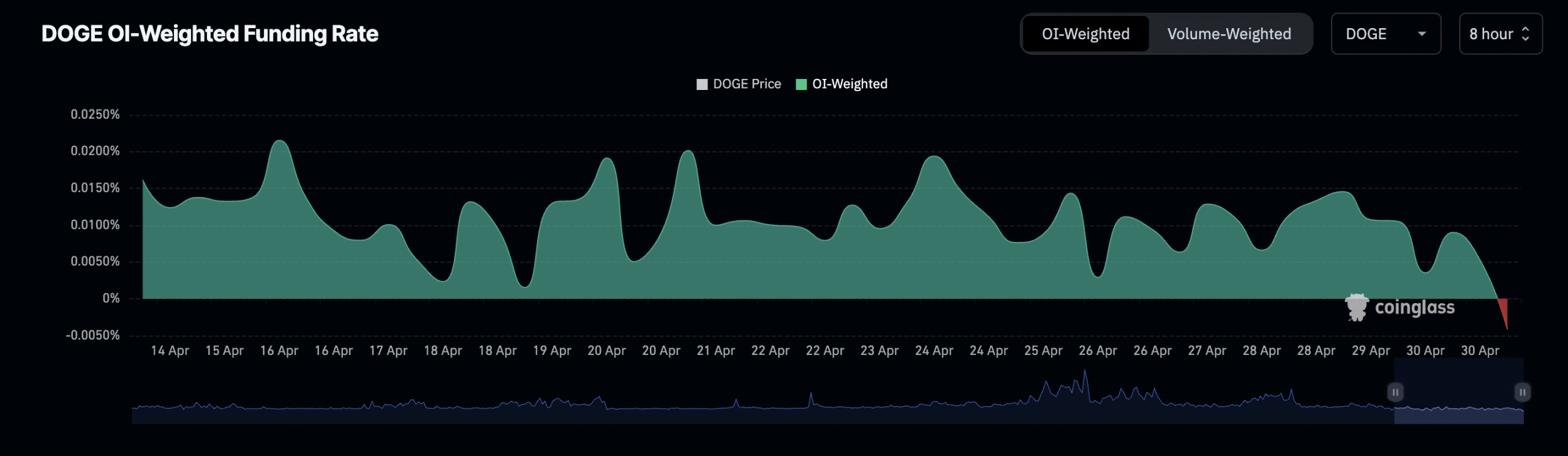

The coin’s Funding Rate has returned a negative value for the first time since the year began, according to Coinglass.

Funding Rates are a mechanism used in perpetual futures contracts to ensure that the contract price stays close to the spot price.

An asset’s Funding Rate is positive when its contract price is higher than its spot price, and traders who hold long positions pay a fee to traders shorting the asset.

On the other hand, when the Funding Rate is negative, it means the asset’s contract price is lower than the spot price, and short traders pay a fee to traders holding long positions,

DOGE’s negative Funding Rate showed that there are more traders in its derivatives market expecting its price to fall than there are traders buying the meme coin with the expectation of selling at a higher price.

WIF’s Futures Open Interest has declined to a multi-month low. At press time, it was $249 million, having fallen by 60% since the 1st of April.

The decline in the meme coin’s Futures Open Interest showed a rise in the number of traders who have exited their positions without opening new ones.

Read Shiba Inu’s [SHIB] Price Prediction 2024-2025

As for PEPE, despite a similar trend of price decline, the token’s Futures Open Interest has rallied by 79% in the last ten days, per Coinglass.

However, its negative Funding Rate showed that more people are placing their bets in favor of a decline in the price of the frog-themed meme asset.