>1.17M stakers for Cardano, but what else should ADA holders know about

Cardano is one of the fastest-growing projects in the cryptocurrency space. Its ecosystem underwent several upgrades in 2021, including the Alonzo hard fork.

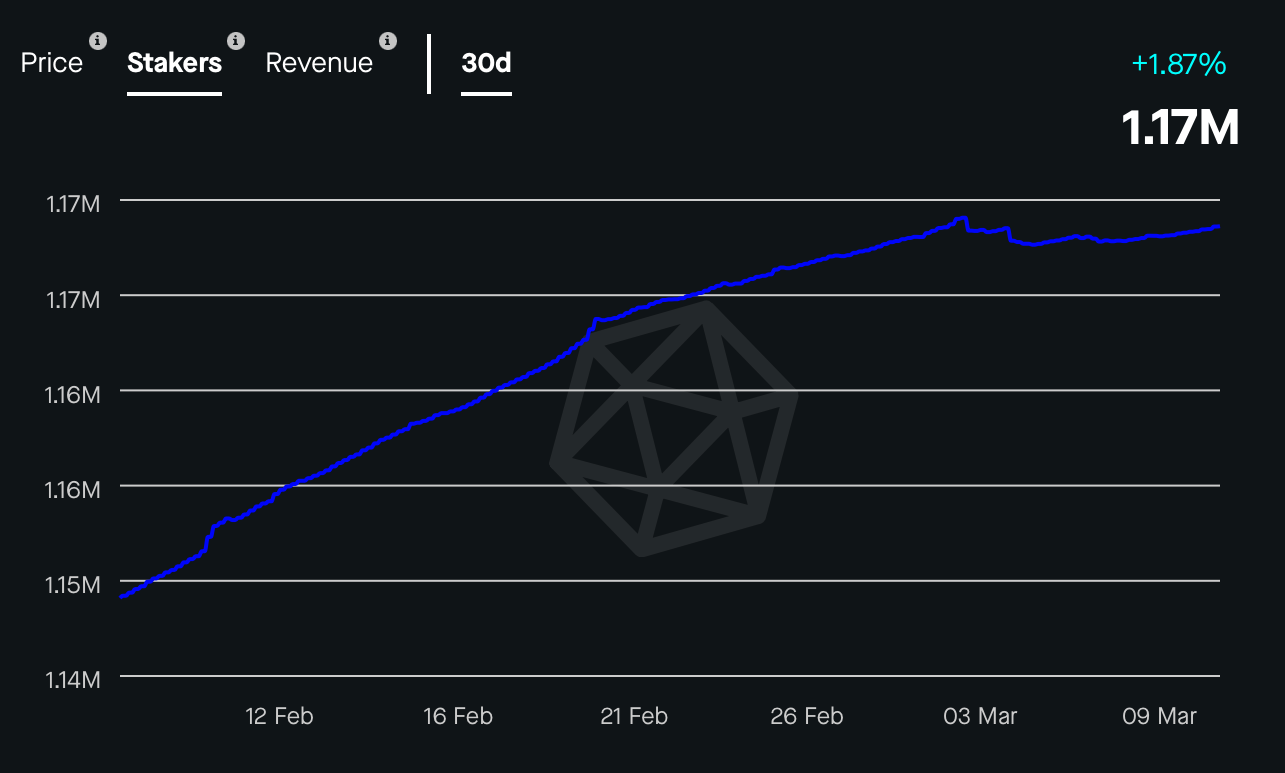

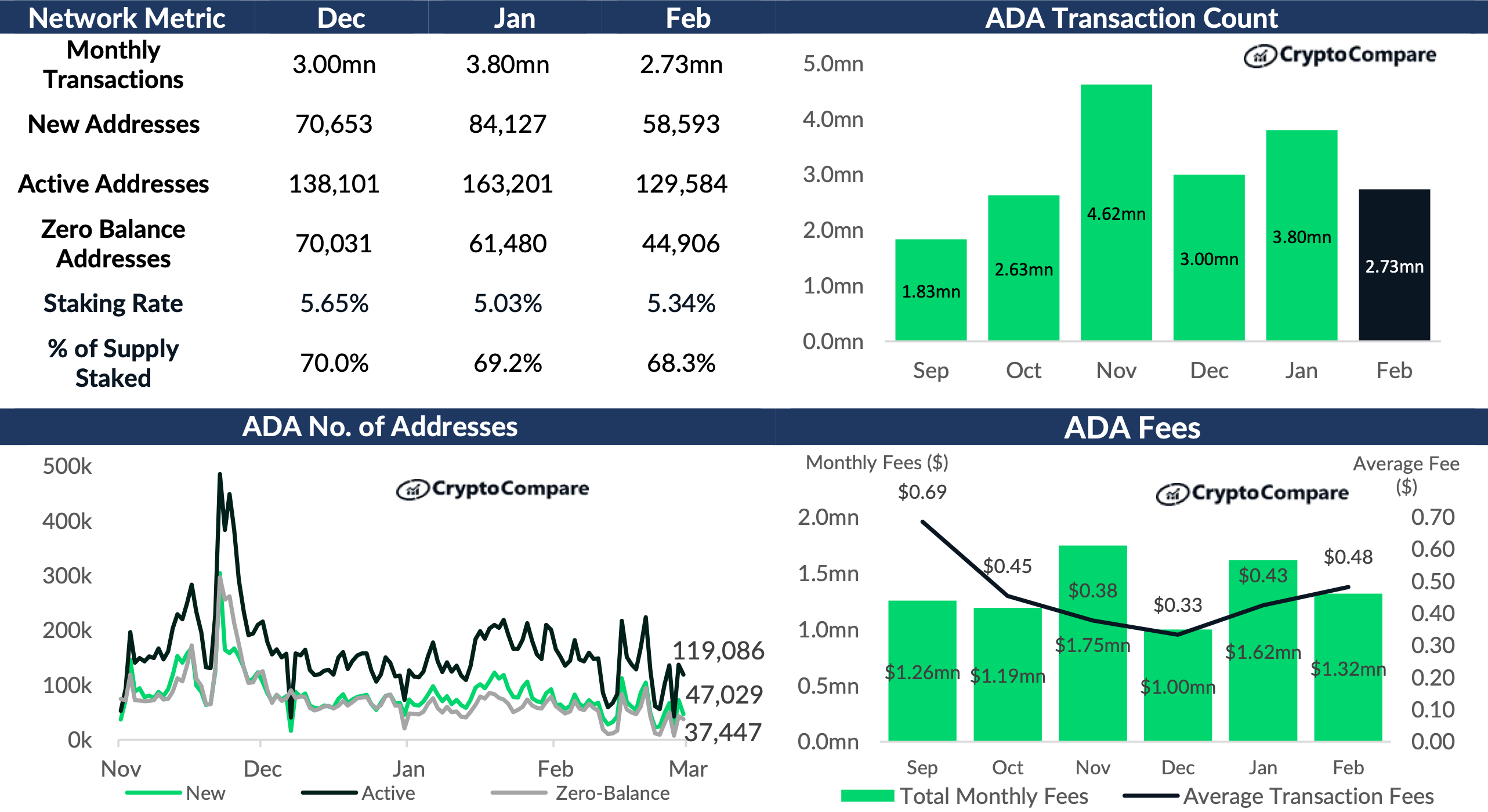

Interestingly, the demand for ADA for staking purposes has seen an uptick of late, especially in February 2022. Does that give us the full story though? Well, other indicators seemed to suggest otherwise.

Overlooking Ethereum now

ETH, SOL, and ADA are three of the largest cryptocurrencies by market capitalization. Notably, Cardano has managed to stretch its lead over Ethereum in terms of the total number of stakers.

Cardano’s network concluded the second month of 2022 with 1.17 million stakers. This finding underlined a 2% increase in the number of stakers, up from 1.14 million in January 2022.

Source: Stakingrewards.com

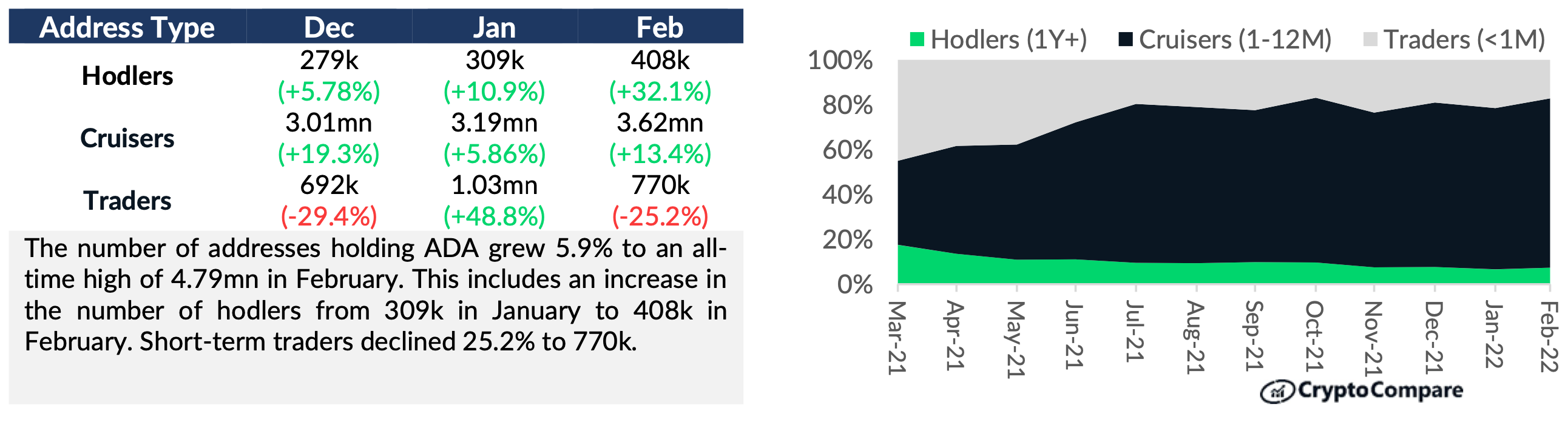

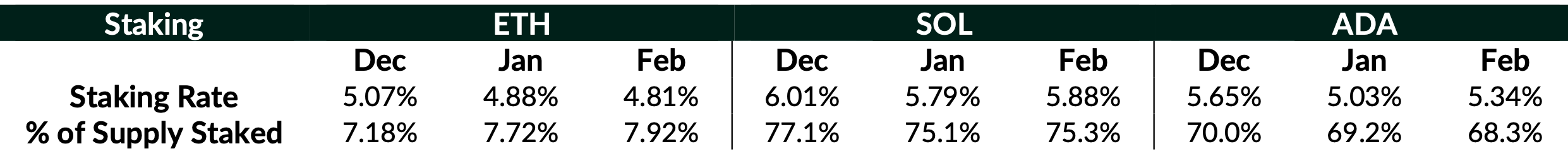

Here, it is interesting to note that ADA holders had 68.3% of the total supply staked by the end of February. However, ETH had just 7.92% for the same.

The total number of stakers on Ethereum was 54,772 on the first day of 2022. On 18 January, this number fell to 54,768 and remained constant throughout February.

Based on the statistics previously mentioned, it’s clear that Cardano led Ethereum by more than 20 times its total number of stakers in February. Here’s the tabulated list of the same –

Source: CryptoCompare

Furthermore, the number of HODLers (Wallets that have held ADA for more than a year) grew by 32.1% to hit a new all-time high of 408k in February. Meanwhile, the number of cruisers (wallets holding ADA for 1 month – 12 months) grew by 13.4% to 3.62M.

The grass wasn’t green on the other side

Despite such bullish scenarios, activity on the blockchain actually declined in February “as the excitement of the SundaeSwap DEX faded out and scalability issues persisted,” according to a CryptoCompare report. In fact, monthly transactions fell by 28.0% to 2.73 million – The lowest in four months.

Surprisingly, the number of addresses also fell in February with an average of 129k daily active addresses. This accounted for a 20.6% decrease from the previous month.

Source: CryptoCompare

That’s not all either.

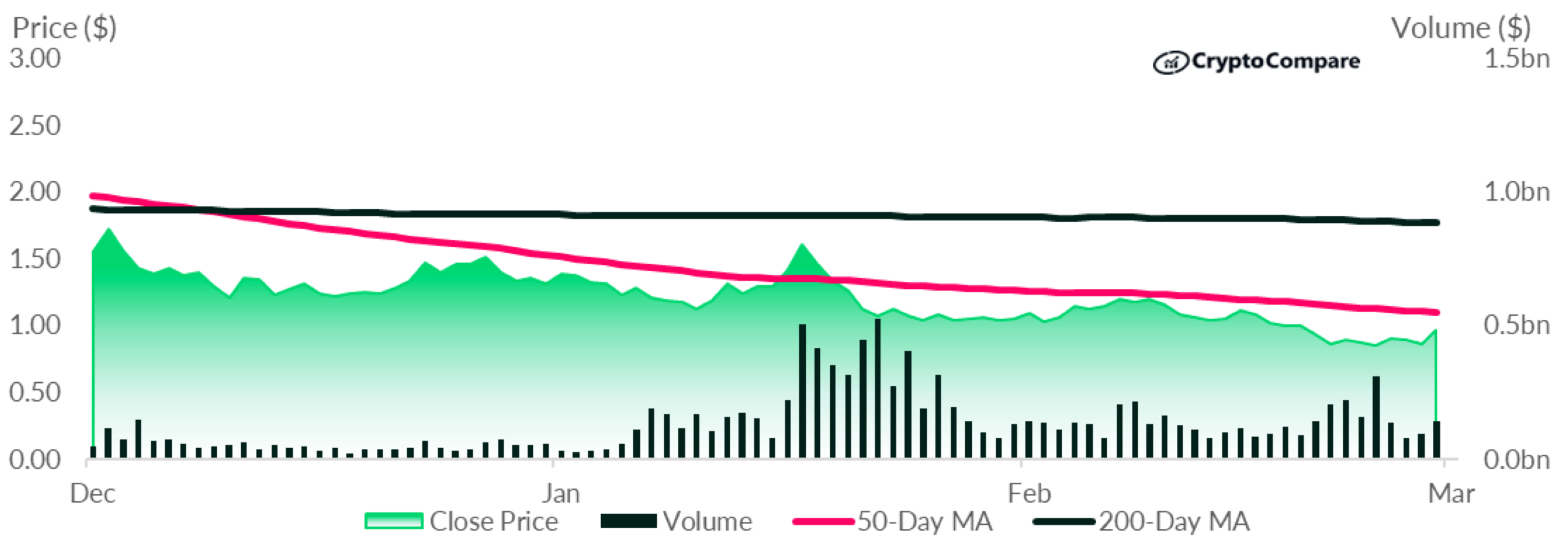

In February, ADA recorded six straight months of losses as it closed at $0.96 after a fall of 8.33% from $1.05 in January.

According to the aforementioned graph,

“ADA failed to capture the 50-day moving average after retesting it during the month. ADA also remains below its 200-day moving average, which acted as a key resistance level over the second half of 2021. Average daily USD volumes fell 31.1% to $137M.”

Now, the pertinent question remains – Would ADA revive these losses that occurred in February? Well, at press time, it did show some signs of recovery. The #8 largest token was recording a 4.5% surge in 24 hrs as it traded just shy of the $0.85-mark.