1.28 BTC bought for every Bitcoin sold: Is a new ATH coming?

- Since September, a persistent imbalance in the buy-to-sell ratio has strengthened BTC’s bullish outlook.

- Investors are acquiring $80 billion worth of BTC monthly, underscoring demand and growing confidence in the asset.

Bitcoin’s [BTC] upward trend could persist despite minor retracements, as observed in the daily time frame. The asset recently experienced a 0.28% decline, which appears to be a natural pullback within its broader rally.

AMBCrypto highlights this price fluctuation as part of BTC’s extended rally, which is analyzed in greater detail below.

Short-term holders prevent major BTC price decline

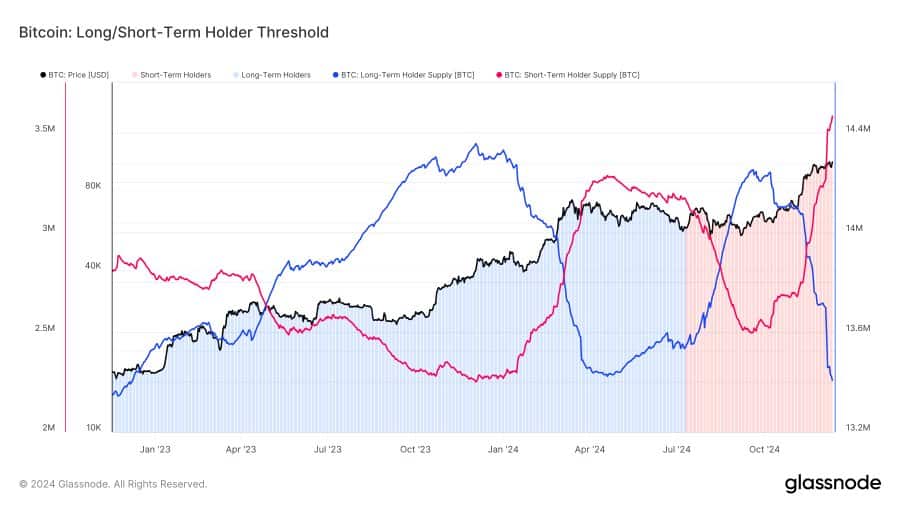

A recent report from analyst James Van Straten reveals significant trading activity in the BTC market since September, helping to stabilize BTC’s price. The Long/Short-term holder threshold currently stands at 1.28, suggesting a strong preference for accumulation.

This means that for every 1 BTC sold, buyers are stepping in to purchase approximately 1.28 BTC, which is indicative of persistent demand.

A closer analysis shows that long-term holders (LTH)—addresses holding BTC for over two years without transacting—were responsible for most of the sell-offs. Meanwhile, short-term holders (STH) or early investors actively drove the buying activity.

Between September and now, a total of 843,113 BTC was sold, while 1,081,633 BTC was accumulated. On a daily basis, buyers acquired 12,432 BTC, compared to 9,690 BTC sold.

This imbalance in favor of buying reflects bullish market sentiment, as increased accumulation prevents BTC from experiencing a sharp price decline. The sustained demand has likely helped BTC maintain its position above the $90,000 range following its recent all-time high.

Historic moment for BTC

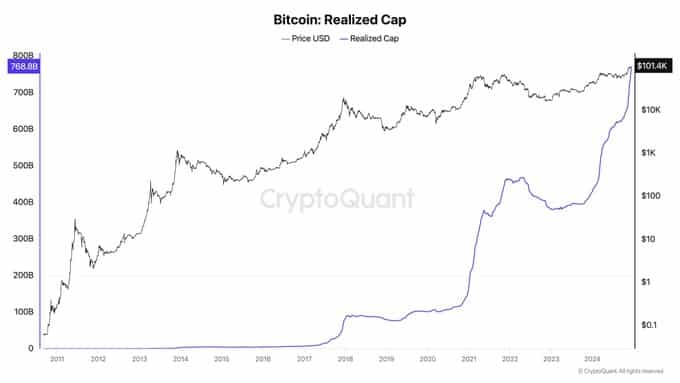

According to analyst Ki Young Ju, Bitcoin has seen a significant influx of funds, with buying activity reaching $80 billion per month.

This development is a highly bullish indicator for BTC, suggesting that adoption is steadily increasing. More retail investors are entering the market, purchasing BTC in greater quantities than ever before.

Ki Young Ju highlighted this momentum, stating:

“Nearly half of the capital that has entered the Bitcoin market over the past 15 years was added this year.”

If this trend continues, BTC’s long-term outlook remains strong, positioning the asset for sustained upward movement.

AMBCrypto also analyzed BTC’s immediate market activity to assess its short-term outlook.

BTC maintains bullish momentum

Despite a 0.28% dip in BTC’s price over the past 24 hours, market indicators continue to signal a bullish outlook.

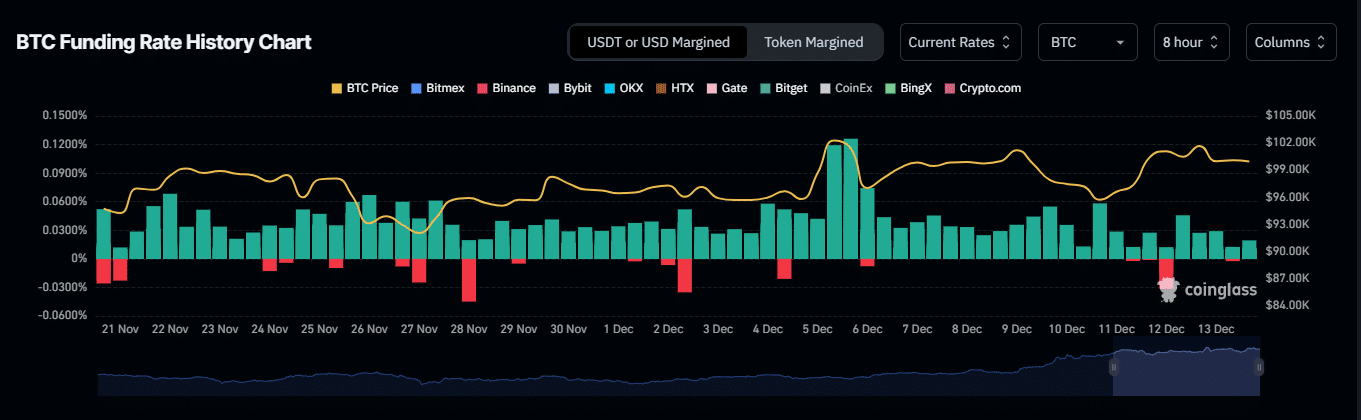

As of this writing, BTC’s funding rate remains positive at 0.0100% over the last eight hours, according to data from Coinglass.

A positive funding rate suggests that long traders maintain price stability in both spot and futures markets, reflecting an overall bullish sentiment and creating opportunities for further price growth.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Additionally, an analysis of BTC’s long-to-short contract ratio shows it remains neutral at 1. A move above or below this level could determine the market’s next directional bias.

Considering BTC’s long-term outlook and the positive funding rate, the current fluctuation appears to be a minor retracement, with the bulls maintaining an advantage.