1,053% Bitcoin Cash rally could be a testament to your risk tolerance

Bitcoin Cash was one of the most successful forks at one point in time. Not to forget, the altcoin was hitting the highs of $1,550 as of last May.

The market crash dragged BCH from its all-time high to the current lows. Now, despite the improving market conditions, the altcoin does not seem to have the capacity to reach those highs again.

Bitcoin Cash trapped

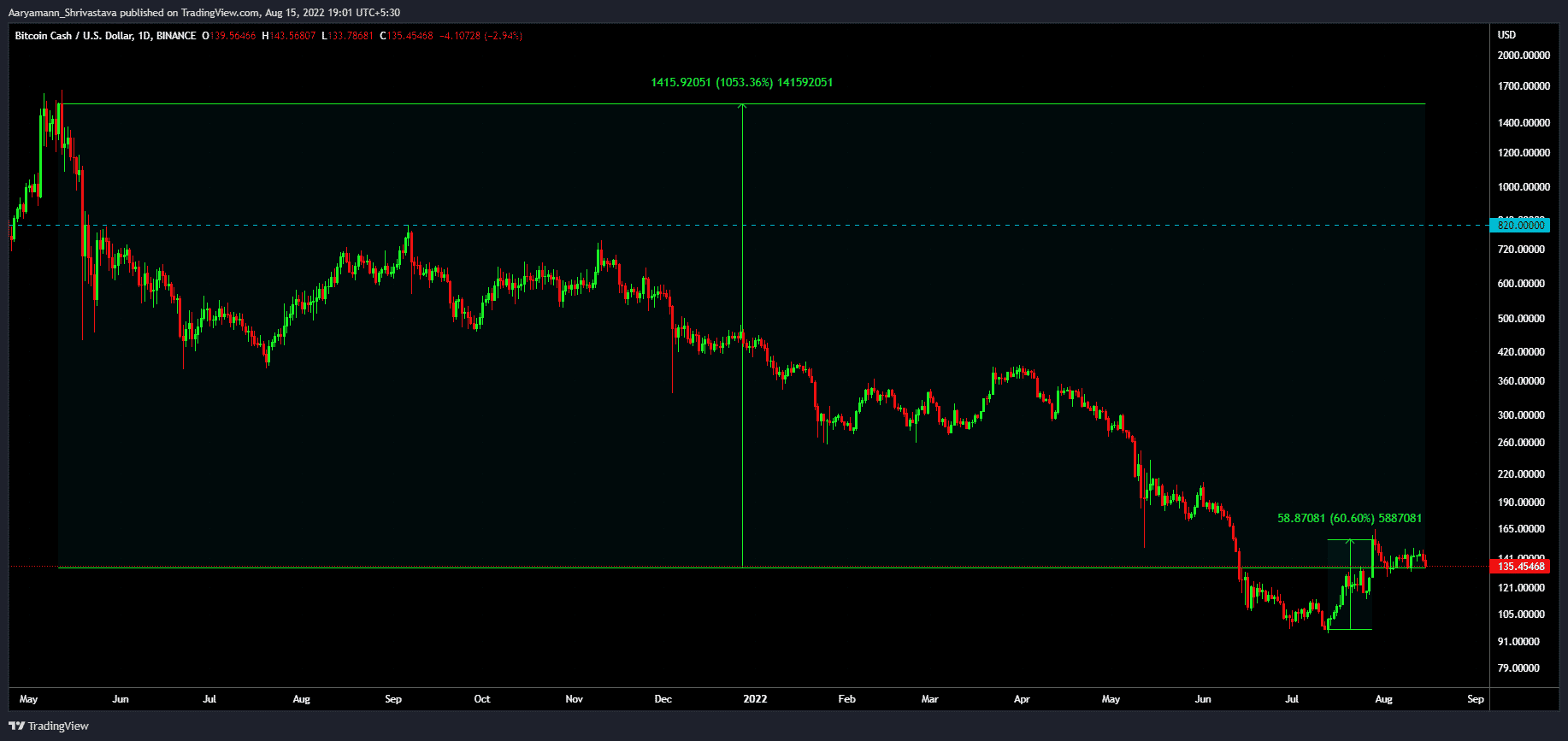

On 15 August, at press time, the altcoin was trading at $135. It had managed to recover by more than 60% in July after the market crash in June. But the price moved downwards and failed to rise since.

While many altcoins have already recovered their June losses, BCH is struggling to follow the path of recovery.

Bitcoin Cash price action | Source: TradingView – AMBCrypto

But it’s not just the price action that is indicating a difficult recovery, the network statistics point in the same direction.

The downfall of the asset due to the rise of DeFi supporting blockchains, Layer 2 chains, and DeFi protocols’ native tokens is also a contributing factor to the lack of use cases for the likes of Bitcoin Cash.

On-chain, the number of transactions per day has declined from the highs of almost 361k to just 31k as of 15 August.

Bitcoin Cash transaction stats | Source: Coinmetrics – AMBCrypto

Investors’ lack of interest and the consistent drawdowns combined with the weak recovery has led to lower network participation despite the mild rise noted over the last two months.

There is a way to bring a wave of recovery by bringing aboard new investors. However, they would need a big bait to be lured in, BCH lacks that as well.

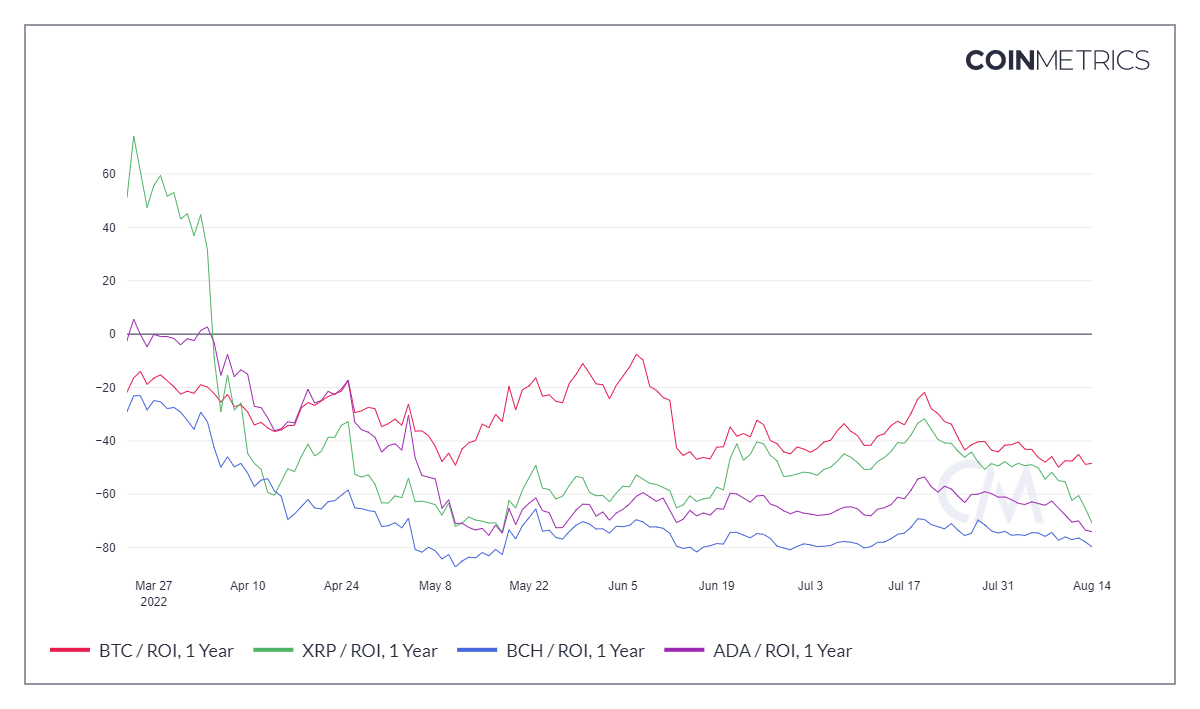

The return on investment for the asset is almost -80% which is lower than not just Bitcoin itself but even lower than the likes of Cardano and XRP.

Bitcoin Cash ROI | Source: Coinmetrics – AMBCrypto

Thus, recouping the 60% losses from two months ago is a difficult task for Bitcoin Cash. And, expecting a 1,053.36% rally to its all-time high is absolutely crazy.