1INCH hits $0.214 ATL, but bullish signs emerge – What happens now?

- The 1inch Investment Fund spent $1.75M to buy 1INCH after the token plunged to all-time lows.

- 1INCH has since bounced, with on-chain and technical indicators showing an influx of buyers.

The cryptocurrency market witnessed a bloodbath on Wednesday as liquidations reached nearly $200M, per Coinglass data. However, 1inch [1INCH] defied the odds, as it bounced by 3% in the last 24 hours.

1INCH was trading at $0.241 at the time of writing. The token has rebounded after hitting an all-time low of $0.214 as the rest of the market plunged.

1inch team buys the bottom

The record low price appeared to have attracted the interest of whales, particularly the 1inch Investment

Fund. According to SpotOnChain, this team spent $1.75M worth of USDC to purchase 7.96M 1INCH tokens near the all-time low.

Over the last two months, this team has spent $5.5M to buy back 1INCH tokens at an average price of $0.245. Past trends show that the team tends to buy the bottom before selling high.

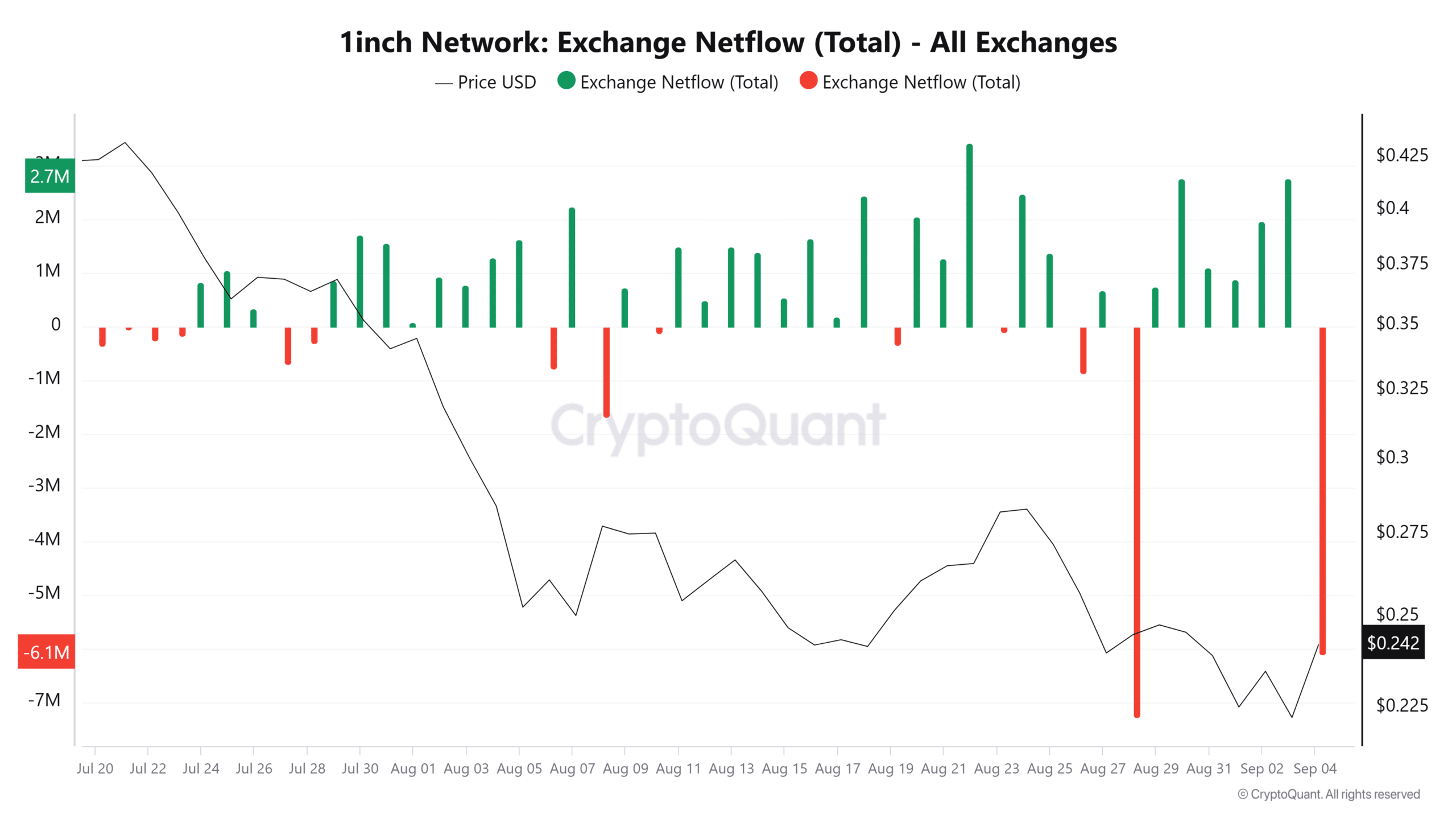

The behavior of this wallet has stirred interest in the token, and exchange data is now showing that fewer investors are interested in selling.

The exchange netflows per CryptoQuant have reached the highest level in a week, indicating that more addresses are withdrawing their tokens from exchanges, and they might not sell in the short term.

More bullish signals emerge

More bullish signals have emerged, showing the ability of 1INCH to extend its gains.

The Chaikin Money Flow (CMF) indicator was showing an increase in buying activity after making a sharp move north on the daily chart. It has also shifted from negative to positive, an indication that bulls were now in control.

The uptrend is further supported by the On Balance Volume (OBV), which increased from 815M to 854M, an indication that buying pressure is strong and that the gains could extend.

1INCH is also attempting a breakout above the descending parallel channel. A significant uptrend will be confirmed if this breakout is sustained by consecutive green candles.

More buying pressure supported by the broader market could also see 1INCH target a critical resistance level at $0.43.

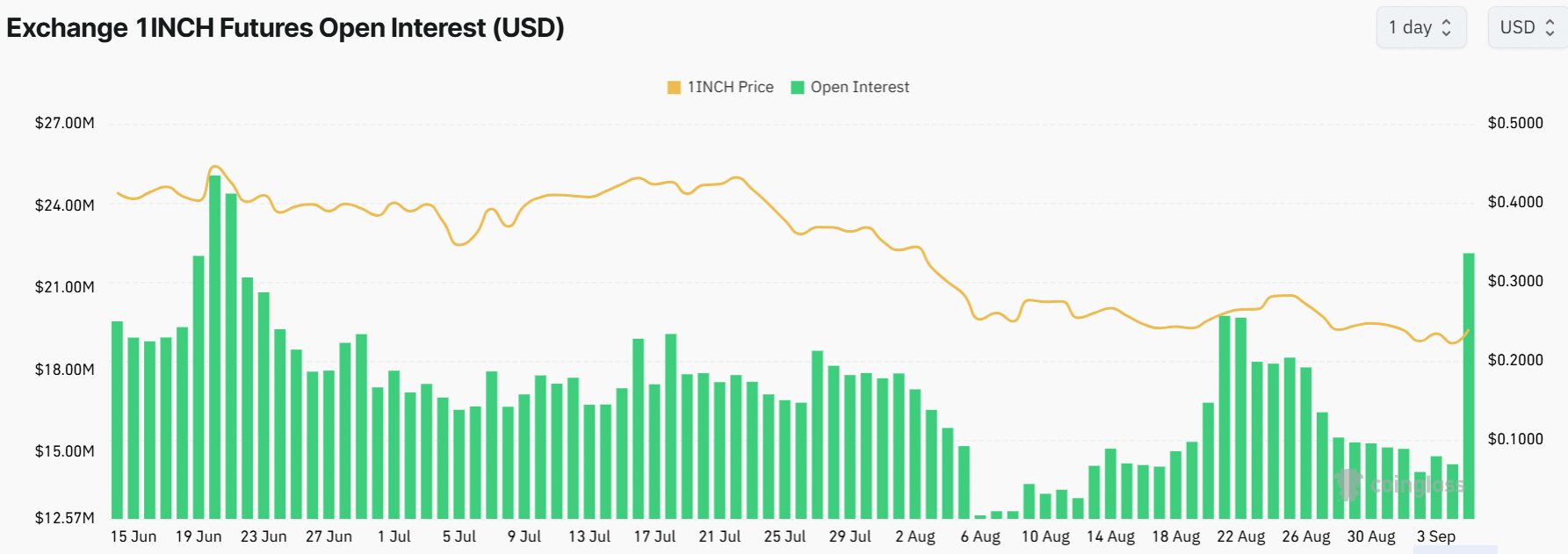

The recent volatility in 1INCH price has triggered interest in the futures market after liquidations reached a weekly high of $216,000 per Coinglass.

Read 1inch’s [1INCH]Price Prediction 2024–2025

1INCH’s Open Interest has also soared by 47% in the last 24 hours from $14M to $22M, and it was at the highest level since late June.

Funding Rates have also flipped positive, which also showed bullish sentiment among traders.