Will 2021 see mass exodus of crypto-companies like Ripple? How much does the U.S stand to lose?

Ripple v. SEC will have some far-reaching implications for the crypto-industry. In fact, as former SEC Commissioner Joseph Grundfest recently suggested in a letter to Jay Clayton, the Ripple lawsuit will cause “multi-billion dollar losses to innocent third parties.”

The lawsuit in question alleges that XRP is a security that must be registered with the agency, and it is not, in fact, a currency outside the regulator’s purview. Calling the SEC’s move an attack against crypto, Ripple CEO Brad Garlinghouse had stated,

“Chairman Jay Clayton – in his final act – is picking winners and trying to limit US innovation in the crypto industry to BTC and ETH.”

While this lawsuit has raised concerns about the potential characterization of cryptocurrencies as securities, the graver concern is perhaps the impact of these regulatory actions on crypto-innovation in the United States.

It’s not just the SEC that can be held accountable for potentially stifling crypto-innovation here though, as the U.S Treasury’s new proposed rule isn’t exactly favorable for the space either. The resulting implications can’t be good for the industry and it may well lead to the mass exodus of crypto-companies from the U.S.

But, how likely is this scenario? How likely then is it that companies would just pack up and leave?

Crypto-companies outside the U.S

There’s good reason to believe that the United States is at the head of crypto-innovation in the world. After all, not only is it host to a few of the world’s biggest crypto-exchanges, but entities such as Ripple are also incorporated and headquartered here.

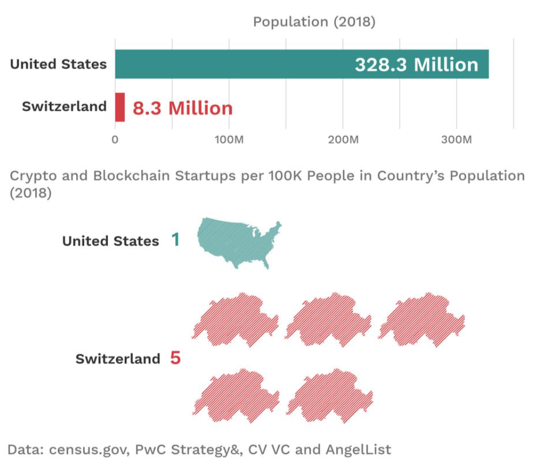

However, that may not really be the case. Consider this – As of last January, data confirmed that despite the U.S having close to 40 times its population, Switzerland had 5 times the number of crypto-startups per 100K people.

That’s not all as in fact, the second-largest cryptocurrency by market cap, Ethereum, has its foundation headquarters in Zug, Switzerland, along with Cardano and Polkadot – two chains that have often been referred to as Ethereum’s biggest competitors.

Switzerland is not the only country that is home to high-profile crypto-companies either Most recently, Efforce, founded by the iconic Steve Wozniak, established itself in Malta and its currency, WOZX, has been listed on a Singaporean exchange.

How much does the U.S stand to lose if this trend continues?

A lot, by the looks of things. Speaking to AMBCrypto about the impact of these companies potentially leaving the U.S, Ben Weiss, COO of CoinFlip said,

“You’re going to lose jobs, you’re going to lose the competitive edge and a bunch of big companies.”

According to him, the next Apple or Amazon is likely to be a blockchain company, with the exec going on to say that as things stand,

“Right now, that’s probably going to be in Asia and not the U.S. because of the regulations here.”

In fact, he believes that even in the event that there is a shift in the mindset of regulators in a few years, it will likely be too late for the U.S to regain any competitive advantage, seeing as the crypto-companies would have already established themselves abroad.

What could potentially stop this from happening?

Favorable regulations that are imposed sooner, rather than later, seems to be the desired course of action. Reportedly, Congressman Warren Davidson has been working in favor of this, with the re-introduction of the Token Taxonomy Act last year, an act that aims to exempt certain tokens and digital assets from federal securities laws.

However, the implication of this bill would prohibit states from regulating any aspect of digital token sales other than full-on fraud, according to crypto-lawyer Shapiro, who called this an “insult to states’ rights.”

What might reinforce positive regulations for the U.S this year is a feature of the crypto-markets that is unique to 2020 – The emergence of institutions.

In total 81,154 BTC, or 0.5% of all BTC in circulation is held in the treasuries of publicly traded companies.

? https://t.co/Rx6Z8a5NqN pic.twitter.com/DHB7N2dm8J

— Messari (@MessariCrypto) November 11, 2020

This year saw the largest ever Bitcoin allocation from an institution – MicroStrategy. It has now announced over $1 billion in total Bitcoin purchases for the year 2020. Many other institutions have followed suit too, allocating a portion of their Treasury reserves to Bitcoin.

Now, with the Chicago Mercantile Exchange (CME) becoming the largest Bitcoin Futures exchange, the newfound interest from institutions is not just a sign of mainstream adoption, but it also serves to further legitimize Bitcoin’s status as an asset class.

“The fact that large institutions are involved definitely changes the game on this,” notes Ben Weiss, adding that the presence of these institutions in crypto will help make regulations more favorable and encourage governments to get a better feel for the space.

Overall, although the industry has matured in many ways, it is still the beginning. As innovation continues to merge the worlds of centralized finance and DeFi, countries that are at the epicenter of that innovation are sure to benefit the most. Whether the U.S will continue to capitalize on that, however, is something that remains to be seen.