2024, mixed bag for Arbitrum and Optimism – Why?

- Arbitrum and Optimism saw more transactions in the new year.

- ARB and OP were in a bear trend at press time.

Arbitrum [ARB] and Optimism [OP], two prominent Layer 2 scaling solutions for Ethereum [ETH], have experienced an increase in transaction activity this year, according to available data.

Despite this positive trend in transaction volume, both networks have seen a decline in their Total Value Locked (TVL) in recent days. Furthermore, the value of their native tokens has also declined.

Arbitrum and Optimism see increased transactions

According to a recent analysis by IntoTheBlock, the transaction volume on leading Ethereum Layer 2 solutions such as Arbitrum and Optimism has quadrupled over the past year.

This surge in activity was particularly pronounced in the second quarter, following the integration of Ethereum Improvement Proposal (EIP) 4844.

EIP-4844 is designed to enhance the scalability of Ethereum by introducing a new type of transaction that handles data more efficiently, contributing to lower fees and higher throughput.

Further analysis from Growthepie indicated that between the two, Arbitrum has experienced more substantial growth since the start of the new year.

Before this period of rapid growth, ARB transactions were under 1 million.

However, post-March, the transaction count on ARB escalated significantly, reaching over 1 million and peaking at approximately 2.6 million transactions on the 26th of June.

In comparison, OP showed a spike in early April, with transactions exceeding 800,000, but has since seen a notable decrease.

As of this writing, ARB has maintained a high level of activity with over 1.5 million transactions, whereas Optimism’s transaction count has decreased to over 409,000.

TVL on Arbitrum and Optimism declines

The Total Value Locked (TVL) on Layer 2 solutions like Arbitrum and Optimism, as reported by DeFiLlama, showed a pattern of initial increases followed by subsequent declines.

This trend is particularly evident with Arbitrum, which saw its TVL rise to over $3.1 billion in March. This increase reflected a period of significant adoption and investment into the platform.

However, since then, there has been a noticeable decline in TVL, with the latest figures showing that it was around $2.7 billion.

Similarly, Optimism also experienced an uptrend in TVL, crossing the $1 billion mark in March. Yet, like ARB, it has seen a reduction in TVL, with its current value around $665 million.

These declines in TVL for both Arbitrum and Optimism could be attributed to several factors, including shifts in investor sentiment, broader market conditions affecting the entire crypto ecosystem, or specific events within the Layer 2 networks.

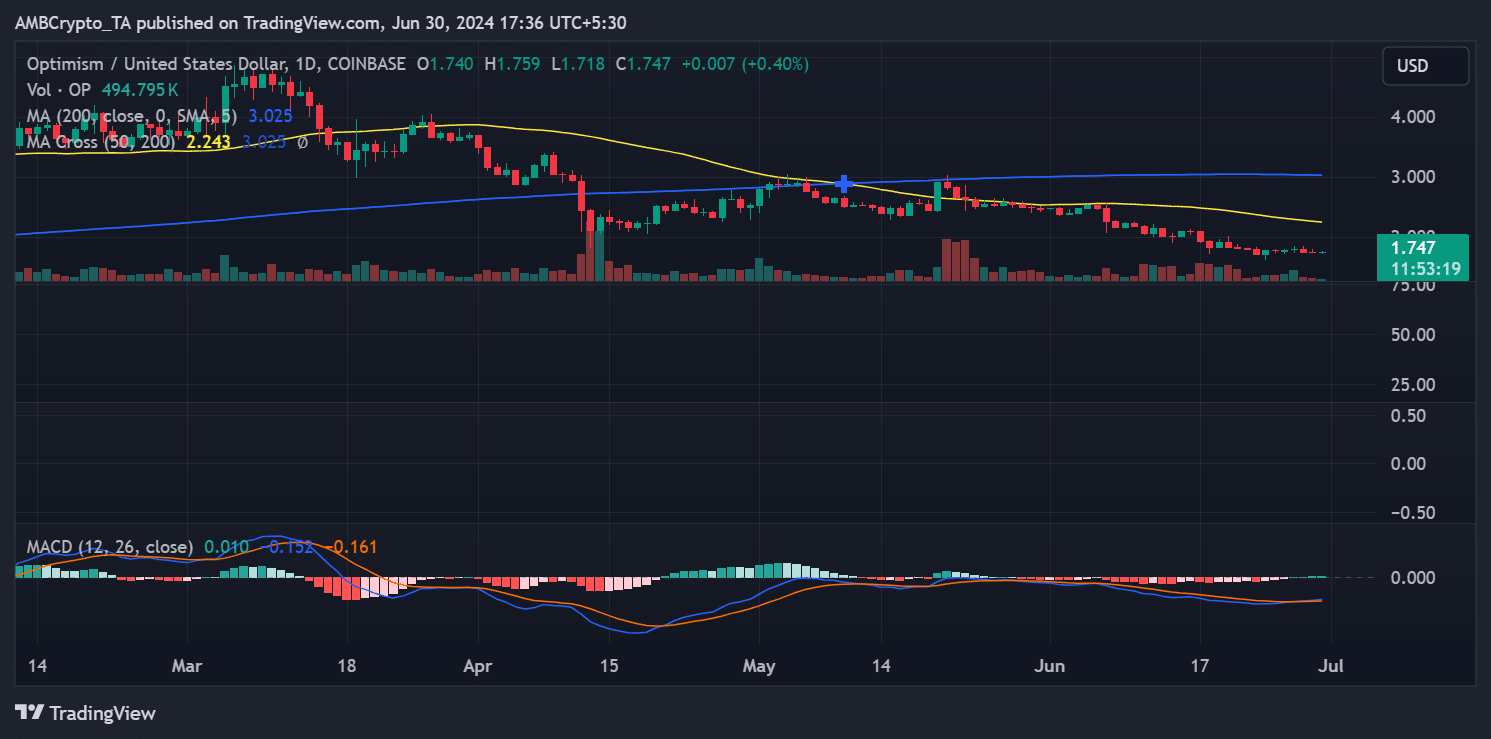

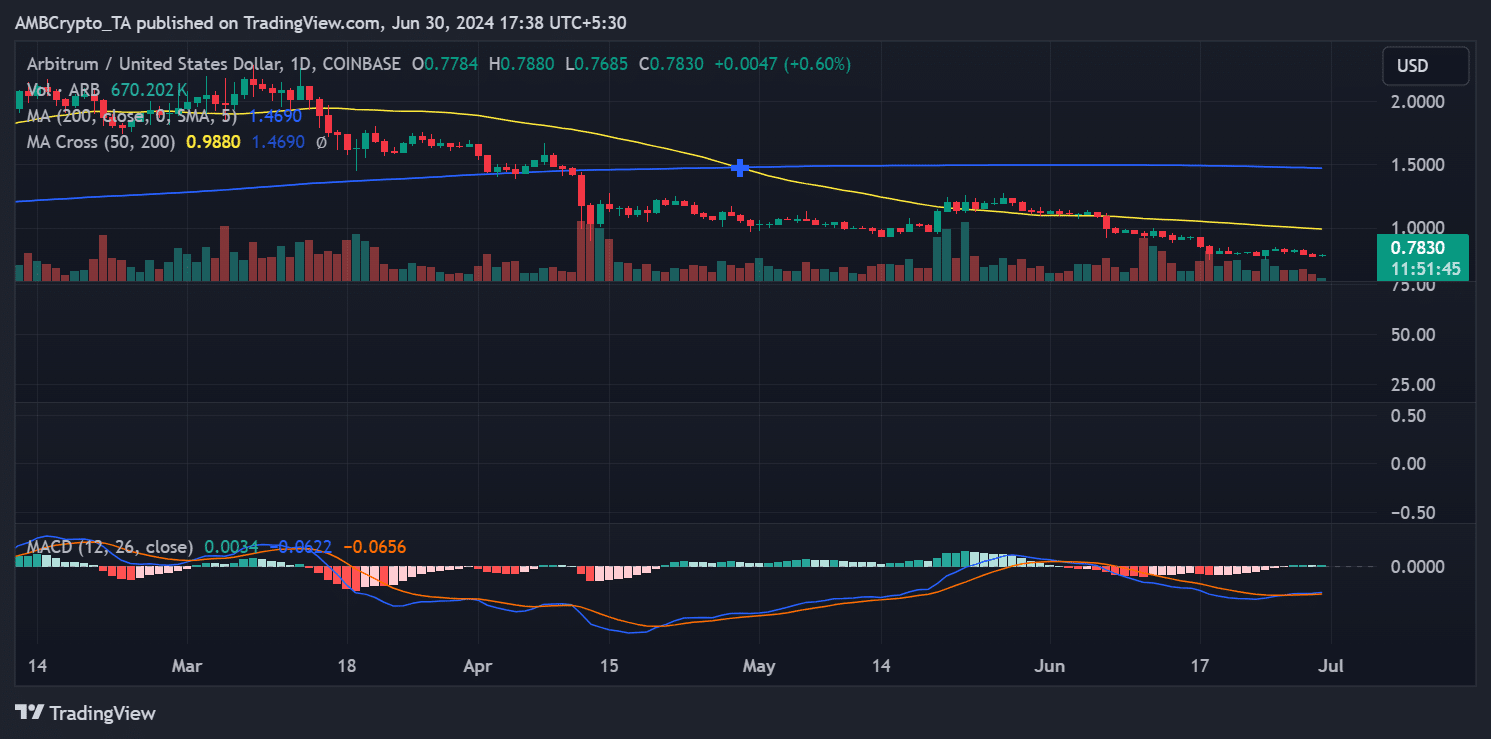

ARB and OP get strong resistance

The price trends for both ARB and OP have been on a downward trajectory, as detailed in AMBCrypto’s analysis.

Over the last few weeks, OP has increased its distance from its short moving average, which is currently at around $2.2.

This distance indicates that the $2.2 level is acting as a strong resistance point, signifying that overcoming this price hurdle is becoming increasingly challenging.

As of this writing, OP was trading at around $1.7, showing a modest increase of less than 1%.

Is your portfolio green? Check out the ARB Profit Calculator

Similarly, ARB has also moved further away from its short moving average, solidifying the resistance level at around $1. As of this writing, ARB was trading at about $0.7, with a slight increase of less than 1%.

The growing distance from the resistance levels for both tokens suggests a strengthening bearish sentiment, indicating that investors may be less optimistic about immediate upward movements in price.