Arbitrum to unlock 93M tokens: Will it disrupt ARB prices?

- Just about 25% of their team members and investors’ allocation was unfrozen during the March unlock.

- ARB plunged 26% since the March unlock.

While the mega 1.1 billion-unlock was behind us, holders of Layer-2 (L2) token Arbitrum [ARB] should brace themselves for more volatility and potential price drops in the coming months.

Expect unlocks every month

As per Arbitrum’s unlock schedule, nearly 93 million ARBs, worth $136 million at prevailing market prices, would be pushed into circulation on a monthly basis over the next three years.

Notably, the unlocked supply would pertain to Arbitrum team members/contributors and investors. Just about 25% of their total allocation was unfrozen during the last unlock in March.

In the cryptocurrency realm, token unlocks involve a staggered release of a fixed number of tokens at predetermined time intervals and distributed to specific members.

They are typically seen as bearish catalysts since extra tokens in the market could induce selling pressure.

How did ARB deal with the last unlock?

True to the narrative, ARB plunged 26% since the massive unlock on the 16th of March, per CoinMarketCap. In fact, ARB started to fall in the days leading to the unlock event, signaling anxiety.

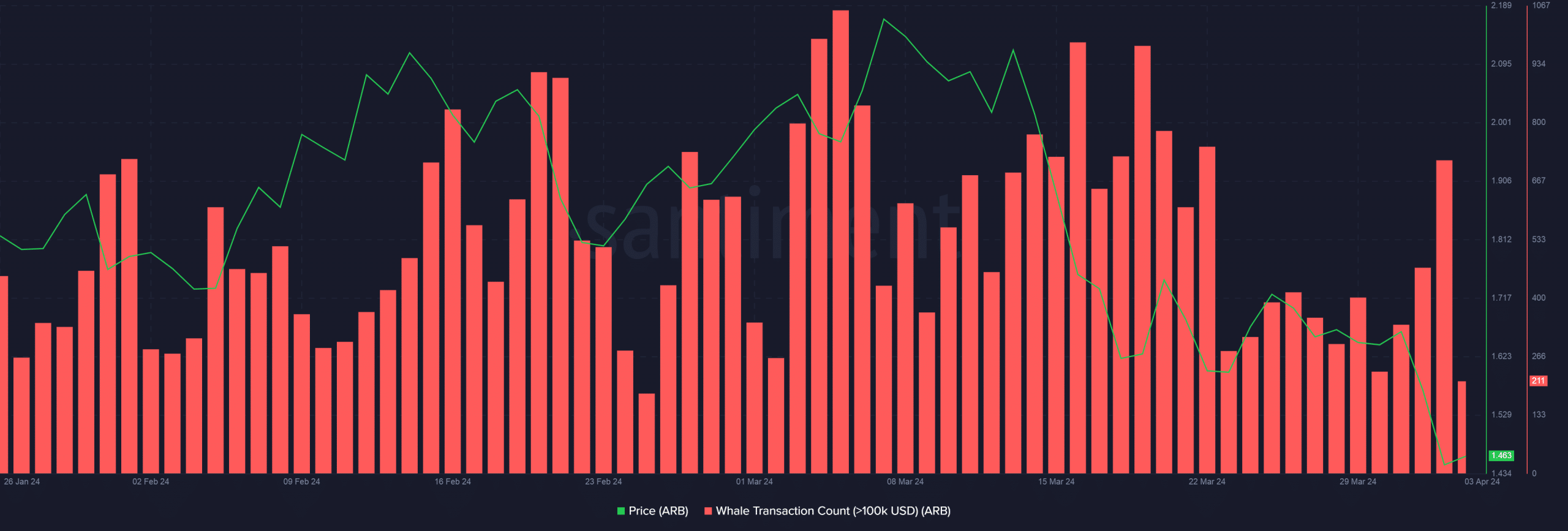

It was observed how large transactions worth more than $100k started to rise just before the unlock and continued for a nearly a week after the event. The subsequent price action suggested that selling pressure was stronger than buying pressure.

Even the first two days of April recorded a spike in whale transactions, resulting in further drops in price, AMBCrypto noticed using Santiment’s data.

Realistic or not, here’s ARB’s market cap in BTC’s terms

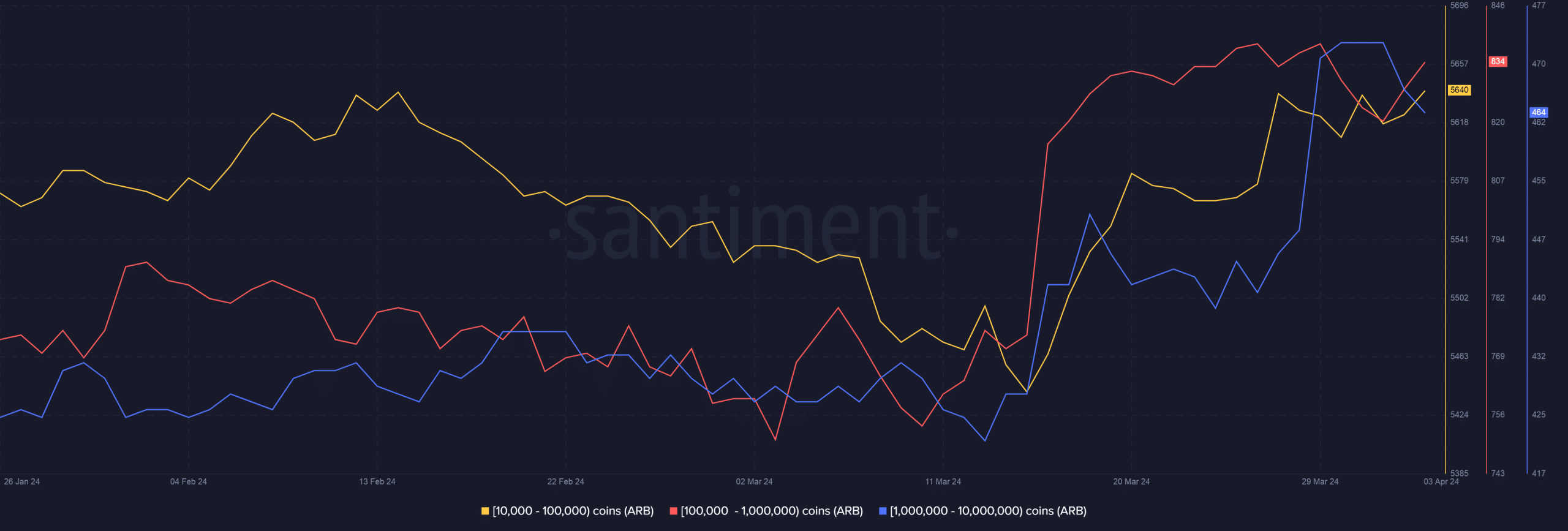

That being said, large whale holdings increased considerably since the event. There could be two explanations to this.

Firstly, the distributed tokens inflated the wallets, and secondly, some investors actually utilized the opportunity to buy tokens at lower prices.