$3.4B Bitcoin longs at risk – Will this make BTC drop to $95K?

- Over $3.4B Bitcoin long positions risk liquidation as net taker showed aggressive sells.

- MSTR’s BTC holdings premium back to levels last seen during the 2021 bull run.

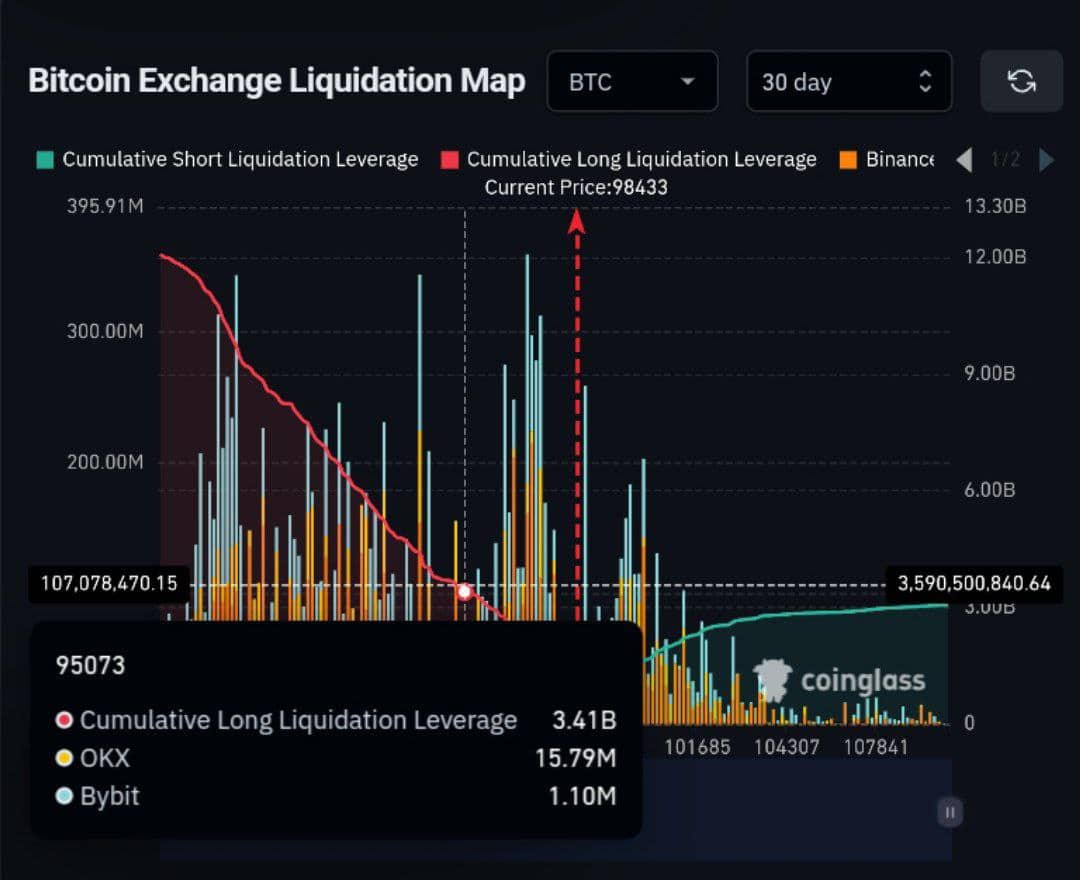

Bitcoin [BTC] showed that the $95K level posed significant risks for leveraged positions. As the market hovered close to this critical threshold, over $3.4 Billion in long leveraged bets were at risk of liquidation.

Market dynamics suggested that major players, often referred to as “whales,” could capitalize on this situation to push prices down to $95K, triggering these liquidations.

This tactic, known for flushing out over-leveraged positions, could pave the way for Bitcoin to rebound and aim for the $100K mark.

Traders to stay vigilant, as the anticipated drop is not guaranteed but remains highly probable given the current market setup.

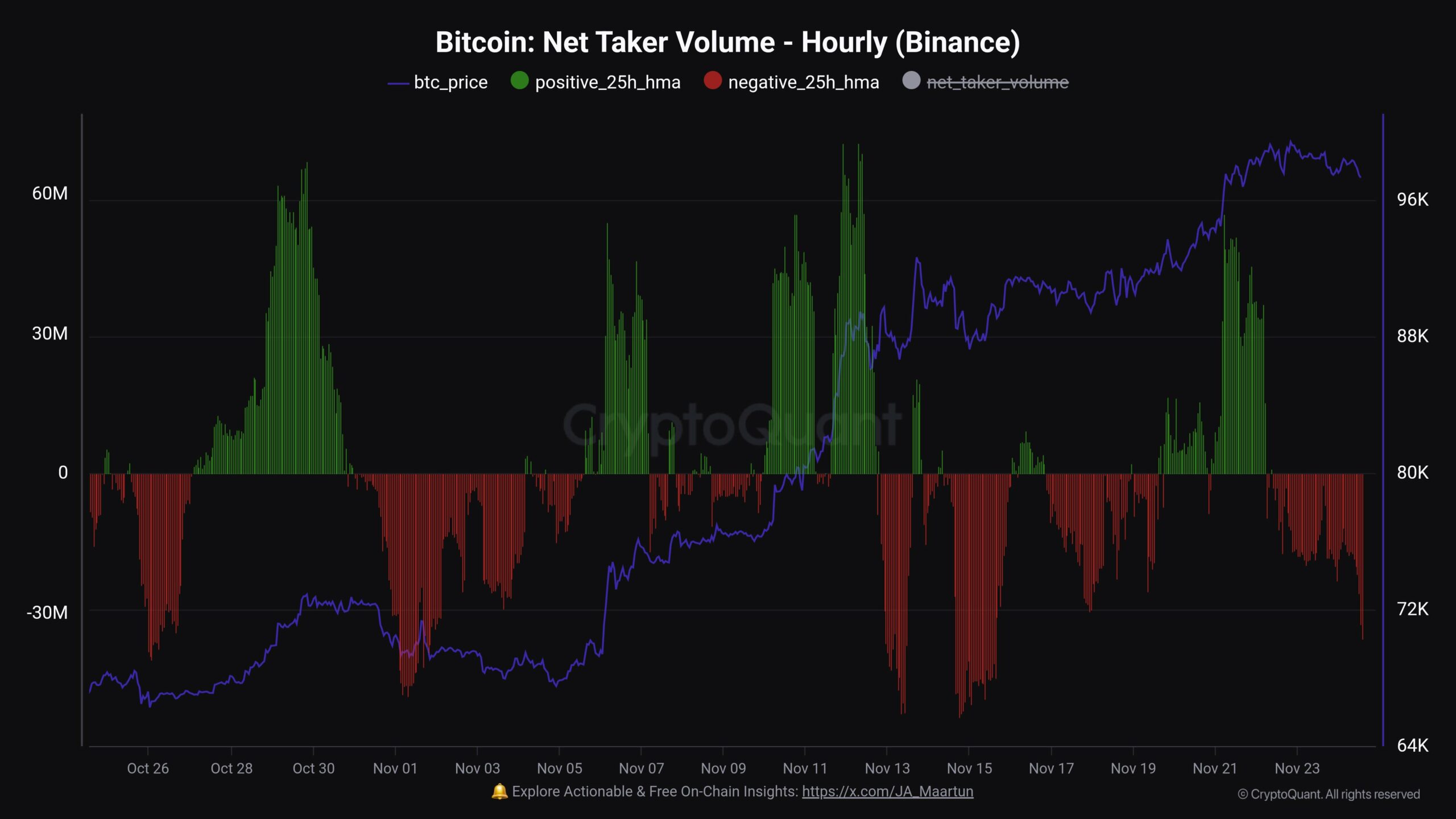

Aggressive sells and profit-taking

Further supporting this possible drop was the Binance’s aggressive short-selling on the Bitcoin market, suggesting a potential decline to $95K to scoop up liquidity before a bullish rebound to $100K.

With recent data revealing significant taker selling, market sentiment leans towards a strategic pullback.

This move, heavily influenced by large traders, may be a tactical play to shake out over-leveraged long positions.

As market dynamics hint at a manipulation tactic, traders should stay cautious of potential volatility spikes.

The observed trading patterns indicated that large players could be positioning for a substantial price movement, emphasizing the need for vigilance in the current unpredictable market environment.

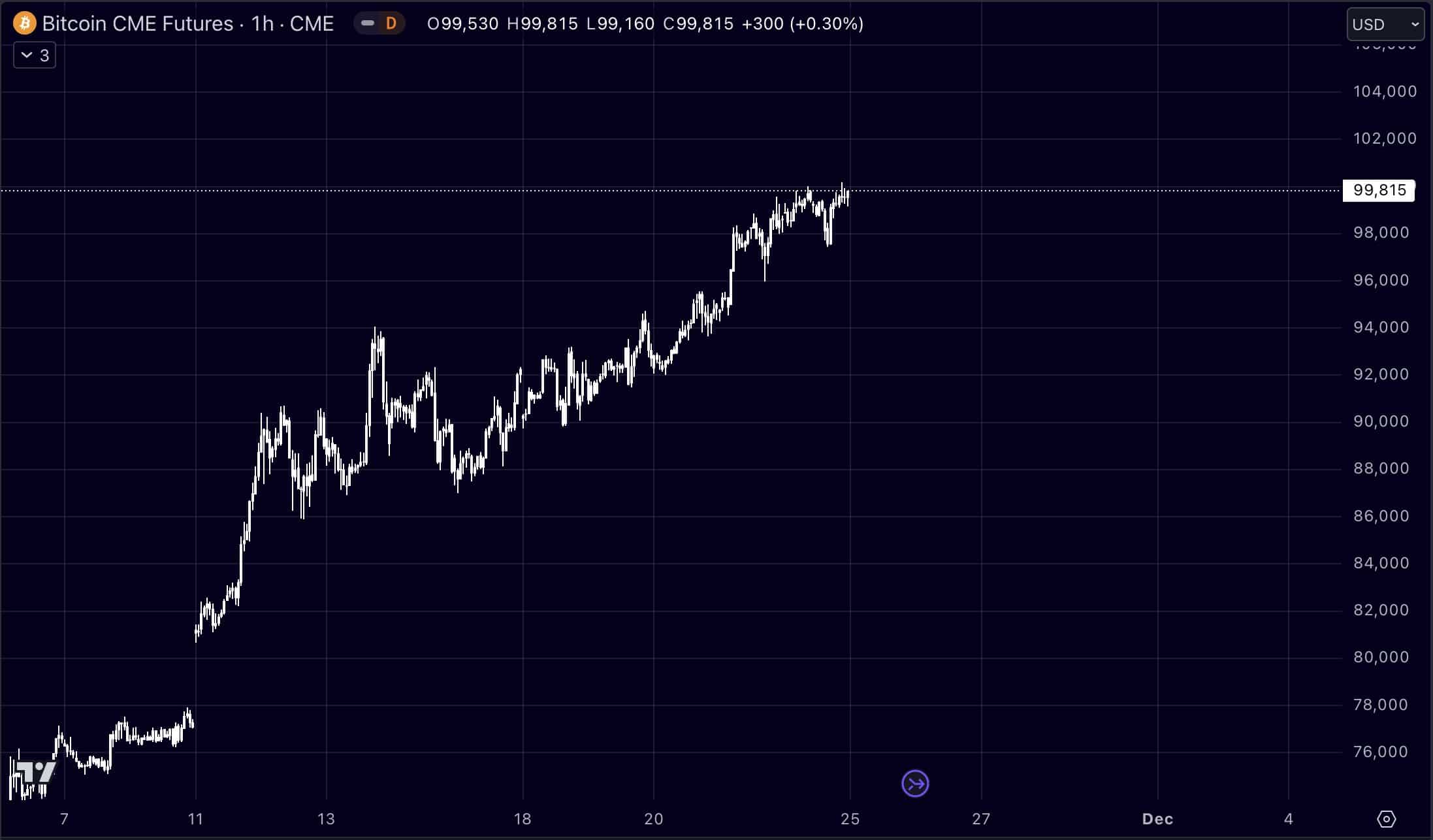

Why BTC’s drop maybe short-lived

Firstly, Bitcoin’s journey towards the $100K mark showed a mix of volatility and anticipation. Trading on the CME revealed Bitcoin flirting with $99.8K, hinting at the imminent breach of the $100K barrier.

This proximity to the milestone in a major futures market suggested that BTC could soon see similar levels across various exchanges. Despite this, a retreat to $97K signaled potential fluctuations ahead.

With the CME’s pricing consistently on the higher side, the close at $99.8K underscores a bullish sentiment, yet traders should brace for possible sharp corrections or further climbs beyond $100K.

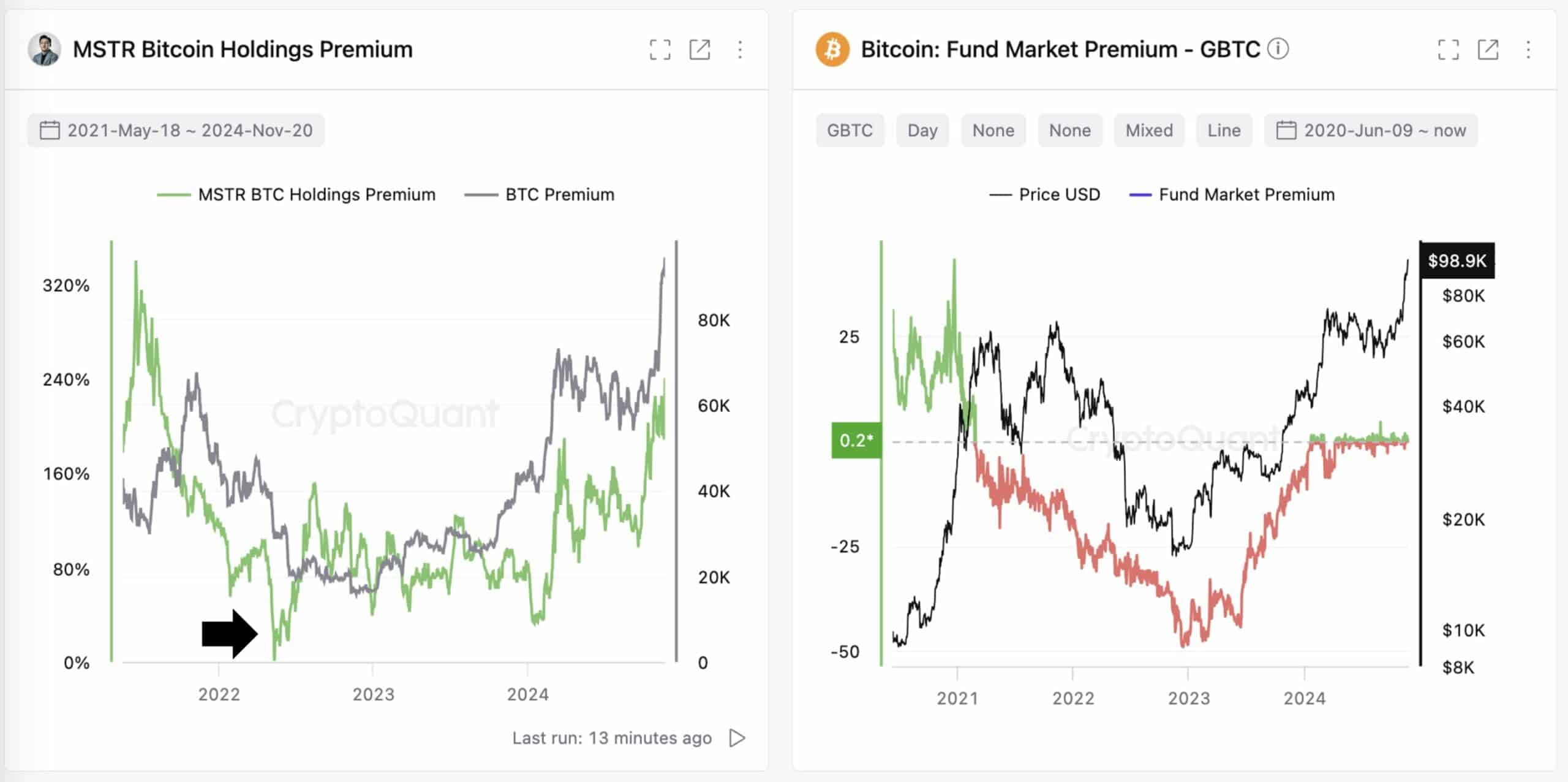

Again, MicroStrategy’s Bitcoin holdings premium has returned to the highs of the 2021 bull run, reflecting the earlier market optimism.

Unlike GBTC, which saw a -48% discount in the downturn, MicroStrategy’s premium consistently stayed positive.

This indicated Michael Saylor’s effective risk management in volatile times, further supporting that BTC’s strength was still in.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As the market again shows signs of vitality, Saylor’s approach to maintaining stability despite the 2022 bear market pressures indicated his significant influence and foresight in the cryptocurrency domain.

This resilience suggested a strategic positioning that could favor long-term investors looking to leverage Bitcoin’s market cycles. The market remains on edge, illustrating the typical dynamism of crypto trading.