3 days after 7 September’s crash, here’s the mood of Bitcoin’s investors

After the events of 7 September, most of the market’s cryptos managed to quickly recover and hit their previous price levels. Most, except Bitcoin.

Now, there has been some resistance on the price charts, which is why the king coin has not touched $52k again yet. However, the bigger concern is this – What about the investors? Because during the dip, they definitely saw some significant losses.

Did this push them to sell and if so, how is the slow recovery affecting investors’ behavior?

Bitcoin investors remain bullish

While the day of the crash did see selling, at present, the market is observing buying as the prominent trend. At press time, Bitcoin seemed to be struggling to go higher than $47k. However, that has not demotivated investors since they have become significantly more bullish than they were before.

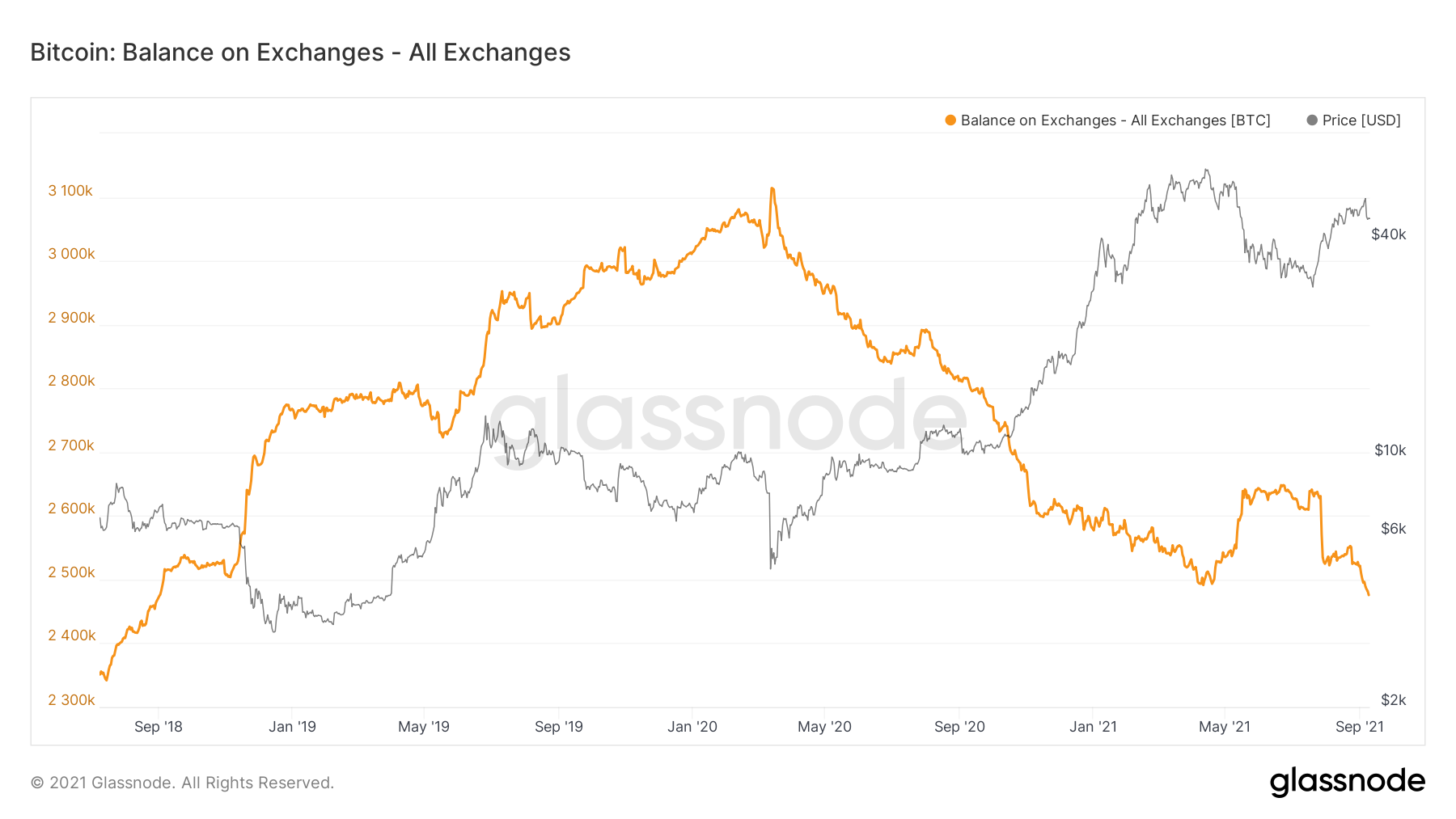

Its effects can be seen on the market too as the balance on exchanges has come down to its lowest in 3 years.

Bitcoin’s balance on exchanges | Source: Glassnode – AMBCrypto

At the same time, exchange withdrawals hit their highest in a month. Over 2,500 BTCs left exchanges over the last week.

A huge contributor to this was the social trend of “buy the dip.” This trend primarily motivated investors to jump into the market as social tools observed this term soared to a 4-month high. At the time of writing, in fact, the indicator had climbed back to its May levels.

‘Buy the dip’ search volumes were soaring | Source: Santiment

Was buying the right decision?

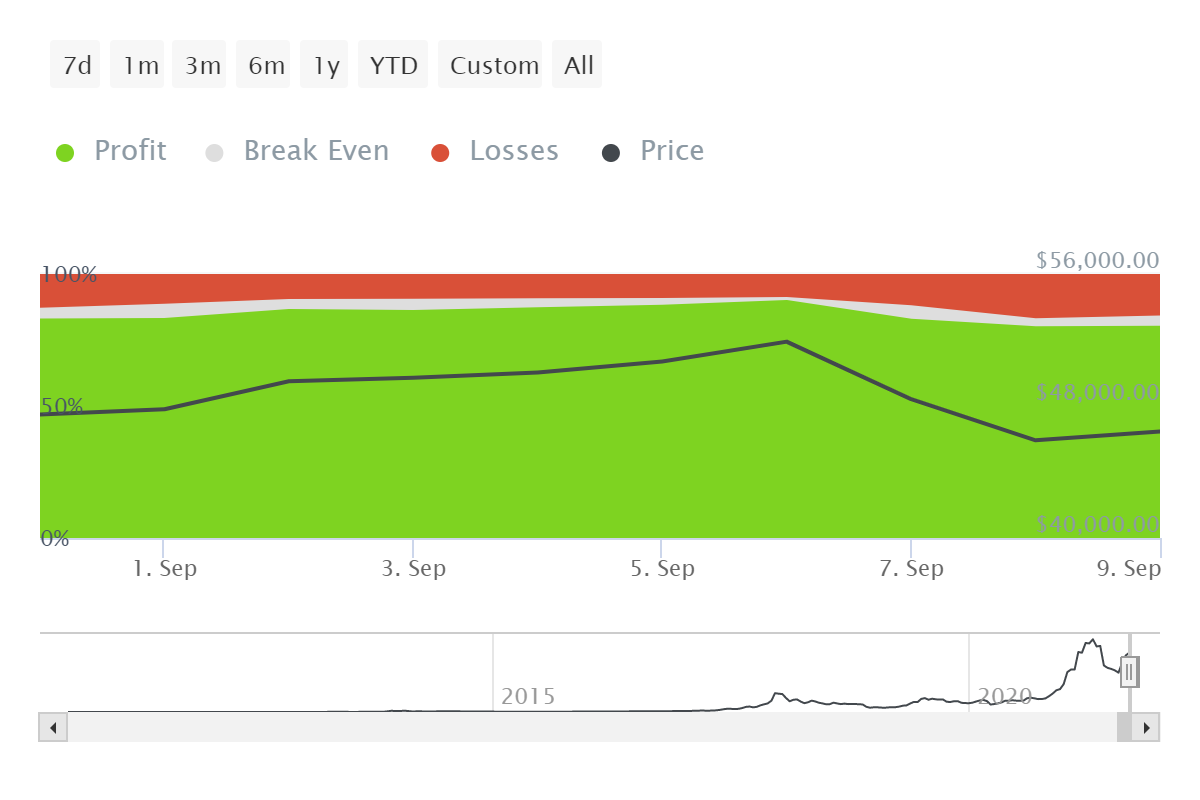

As a matter of fact, it was the right decision. This actually turned out to be a beneficial move for them. The market moved back into profits after dipping into losses yesterday. While there were ones who sold at losses, there were also those who bought during the dip and are now enjoying profits.

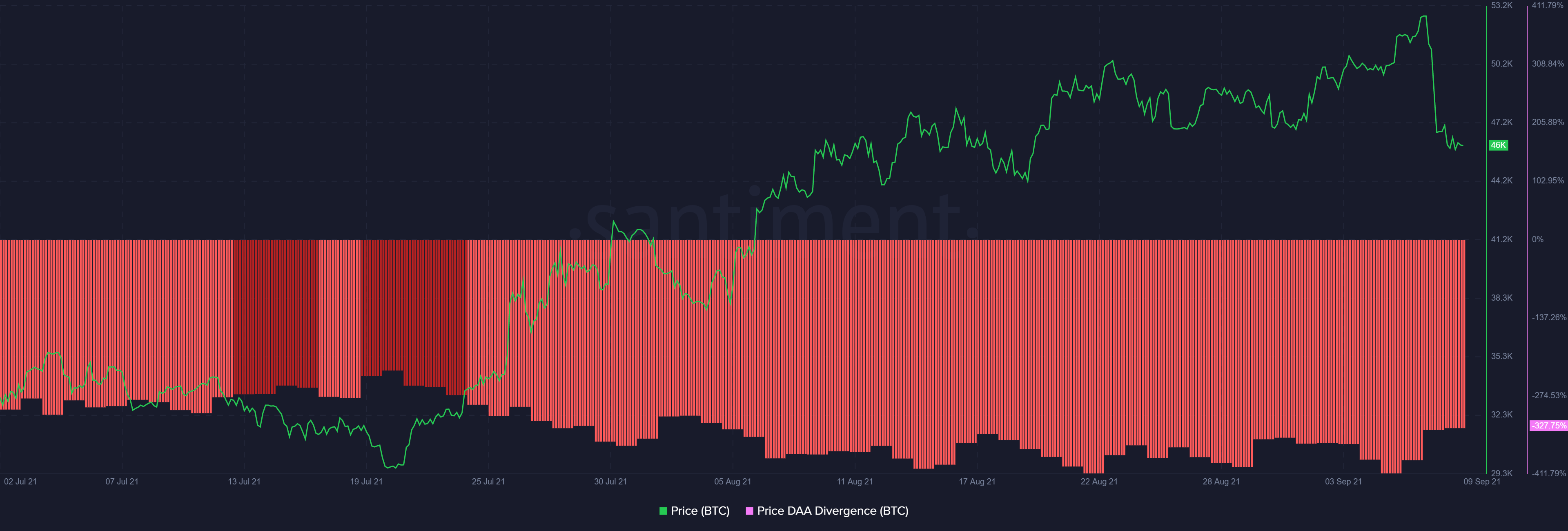

Plus, the Price DAA Divergence marked this as a strong buy signal as it hit its monthly lowest. As the price declined and active addresses increased, this was the right time to pick BTC off the market.

Bitcoin price DAA Divergence | Source: Santiment

Furthermore, most of the addresses are still in profit. The 4 million addresses that accounted for the 10% drop (the ones who faced most losses) are also slowly moving back into profits.

Thus, put simply, Bitcoin investors remain undeterred.

Bitcoin profitable addresses down by 10% | Source: Intotheblock – AMBCrypto