$30 billion lost in blockchain hacks; security concerns rise

- 2021 was the most targeted year, with $9.8 billion worth of assets getting siphoned off.

- Contract vulnerability accounted for nearly 12% of all hacking incidents.

The blockchain industry has weathered several storms over its exciting growth trajectory in the past decade. Navigating through the ebbs and flows of the market, it has carved out a niche for itself, especially in the FinTech domain.

However, its rise has got some unwanted attention. According to blockchain security firm SlowMist, the total amount of losses from blockchain-related hacks shot up to a whopping $30 billion since 2012, exposing the vulnerabilities of the underlying technology.

2021 was the worst year

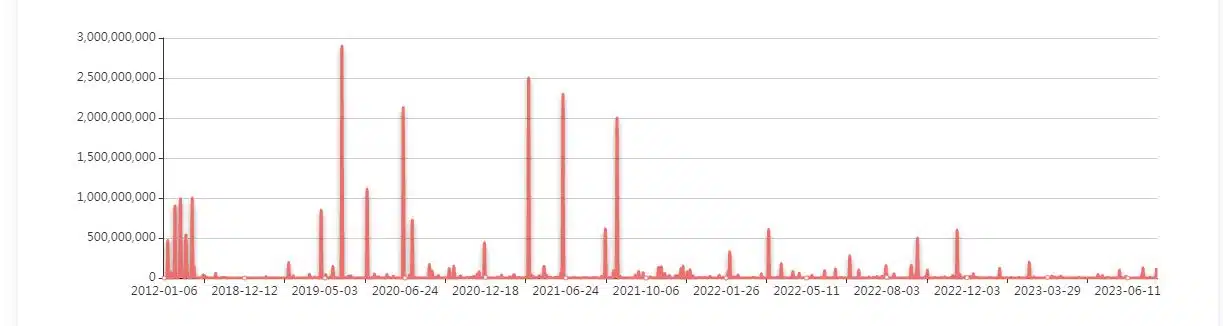

SlowMist added that these losses were a result of 1,101 hacking occurrences over the past 10 years. As shown below, 2019 and 2021 stand out as the most targeted by unscrupulous players. 2021, especially, saw nearly $9.8 billion worth of assets getting siphoned off in 236 incidents.

Interestingly, 2021 was also the year of the crypto market’s historic bull run. During this period, the global market cap touched all-time highs.

While the total money stolen came down drastically in 2022, the number of hacking incidents surged to 308, indicating that the threat still loomed large.

Most-targeted sectors

SlowMist also analyzed the losses by category to ascertain which market sectors were the most impacted by exploits. Cryptocurrency exchanges were the most attacked entities, accounting for nearly 33% of total losses. A total of 118 incidents of hacks were reported.

The most recent was the $415 million-hack from the collapsed exchange FTX shortly after it filed for bankruptcy protection in November last year. Hackers generally target an exchange directly by exploiting weaknesses in its security protocols or trading software.

Next on the list of most targeted entities was the Ethereum [ETH] ecosystem. Because of its status as the largest platform for decentralized finance (DeFi) applications, it stays high on the radar of bad actors. The network has lost more than $3 billion worth of assets in 217 hacks.

Preferred attack method

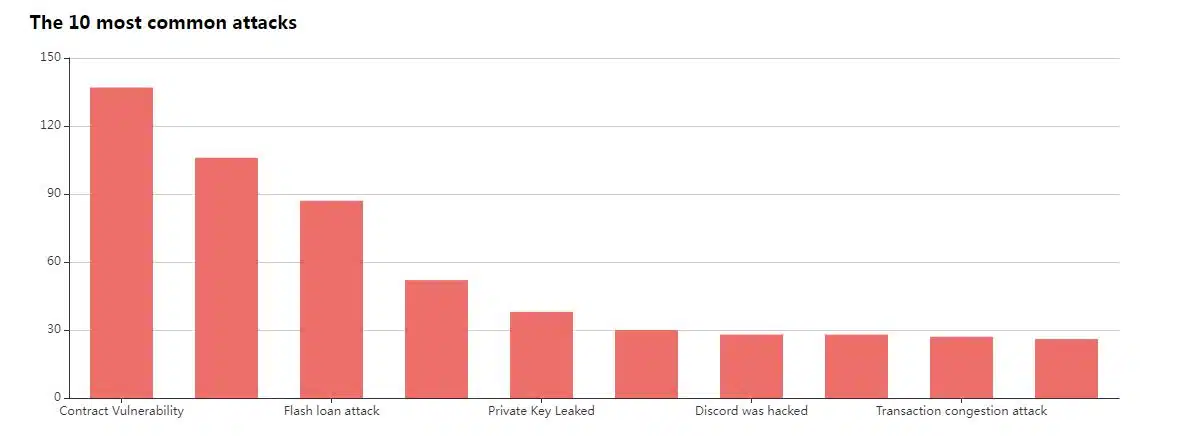

The most favored mode of attacks by hackers were contract vulnerability, rug pulls, and flash loan attacks. Contract vulnerability accounted for nearly 12% of all hacking occurrences.

The biggest example of this was the infamous Ronin Bridge exploit, where more than $600 million worth of ETH and USD Coin [USDC] was looted by hackers. It remains the largest hack in the history of blockchains.

Apart from this, incidents of rug pulls, wherein creator of a project hypes a project only to disappear with investors’ money later, have also increased. Over 100 hacking events were traced to rug pulls.