52.89% Litecoin [LTC] investors in profit: Will the other shoe drop?

![52.89% Litecoin [LTC] investors in profit: Will the other shoe drop?](https://ambcrypto.com/wp-content/uploads/2023/03/rodion-kutsaiev-xkEtD4Stn0I-unsplash-1.jpg)

- 52.89% of LTC holders hold at a profit.

- The LTC market is currently plagued by low investor conviction.

Following a 33% price rally year-to-date, data from IntoTheBlock indicated that there has been a corresponding increase in the number of Litecoin [LTC] investors holding the cryptocurrency at a profit. At press time, over 50% of LTC holders were in profit.

#Litecoin has seen a surge in profit for its holders, with over 52.89% currently in the money! This indicator can say a lot about potential bottom and top formations, so let’s examine ?#LTC #Analysis #Crypto pic.twitter.com/4FoXOgxCFe

— IntoTheBlock (@intotheblock) February 28, 2023

Read Litecoin’s [LTC] Price Prediction 2023-24

According to the on-chain data provider, LTC hit a bear market low in 2022 when 85% of its holders logged losses on their investments. Historically, this low was also hit in the bear market of 2015, 2018, 2019, and 2020. While it ushered in momentary periods of relief, this low has often been revisited, IntoTheBlock noted further.

“While Litecoin may have hit its bear low, past bear markets have seen Litecoin revisit these levels frequently.”

Uptrend remains weak

At press time, LTC exchanged hands at $97.07, per data from CoinMarketCap. With increased trading activity in the last 24 hours, the alt’s value was up by 3%, while its trading volume spiked by almost 30%.

Having spent the last week trading in a tight range, LTC’s price has oscillated between the $95 and $97 price marks in the last seven days. Trading in a tight range can occur during periods of low trading volume when there is limited activity in the market.

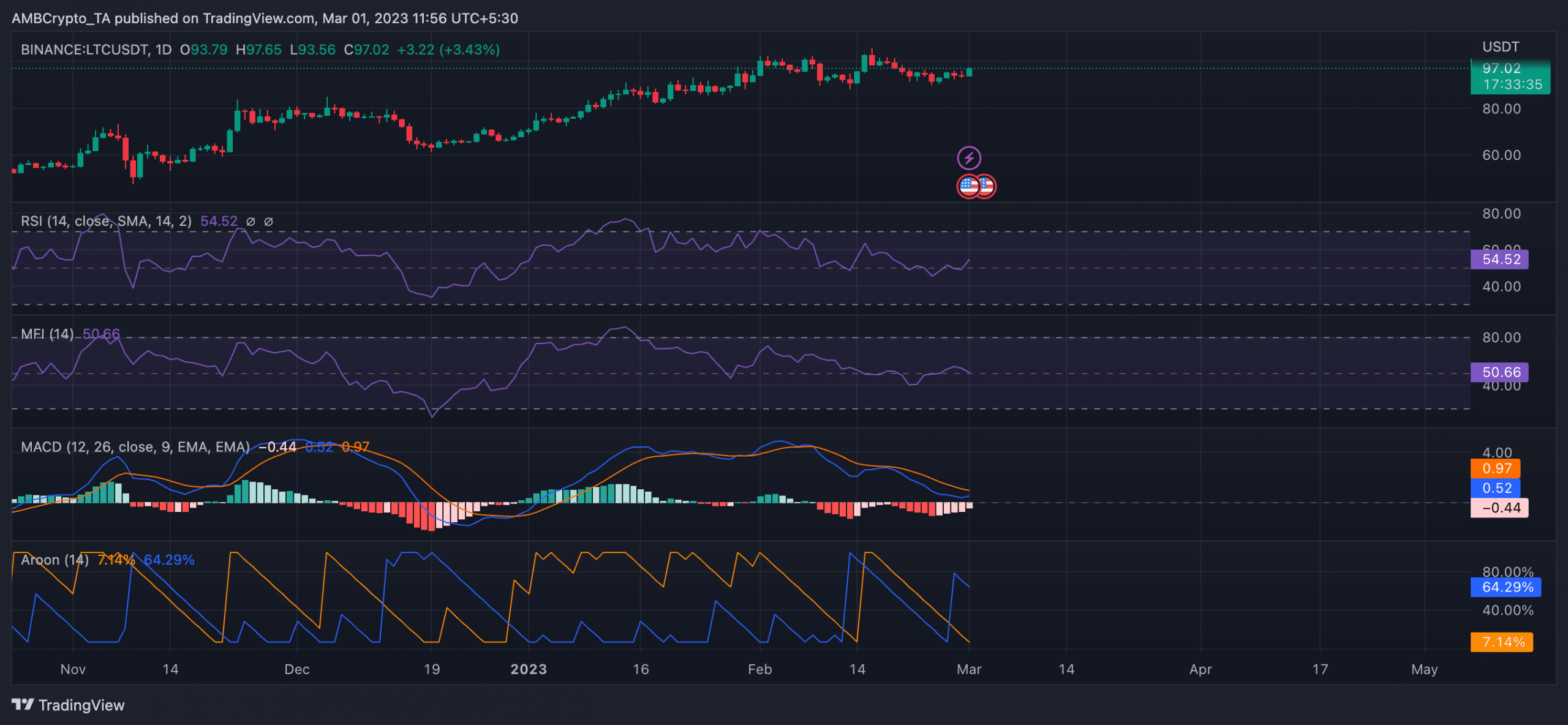

Key momentum indicators remained stagnant in the last week, revealing a lack of enthusiasm amongst market players.

At press time, the coin’s Relative Strength Index (RSI) and Money Flow Index (MFI) rested above their neutral lines. This, typically, indicates high buying momentum. However, a look at the Aroon Up Line (orange) showed that the uptrend in the LTC market was almost non-existent. As of this writing, this was pegged at 7.14%.

When an asset’s Aroon Up line is close to zero, the uptrend is deemed weak, and the most recent high was reached a long time ago. This can be an indication of a potential price reversal that might cause LTC to shed all its gains in the past 24 hours.

Conversely, the coin’s Aroon Down Line (blue) was spotted in an uptrend at 64.29%. When the Aroon Down line is close to 100, it indicates that the downtrend in the market is strong and that the most recent low was reached relatively recently.

Is your portfolio green? Check out the LTC Profit Calculator

Chances of a sustained bull run

Lastly, a new bear cycle was underway at press time and has been since 18 February. This was confirmed by the position of LTC’s moving average convergence/divergence (MACD). Since 18 February, LTC’s price has dropped by 4%.

To initiate an uptrend in price, a shift in investor sentiment is necessary. If investors continue to hold a significantly bearish outlook, there could be a significant drop in the number of LTC holders who are currently in profit.