Since breaching the $0.42539 support in late June, XRP has been on a downward trend with a current valuation around $0.25784. The recorded market cap at press time was around $11 billion and the 24h volume was over $1.05 billion, having experienced a 1.38% decrease in the last day.

1-hour chart

Resistance 1: $0.25828

Resistance 2: $0.6322

Support 1: $0.25435

The short term chart of XRP witnessed a slight downtrend which stretched the valuation from $0.26499 to $0.25435.

Awesome Oscillator exhibited the appearance of green with decreasing bullish momentum.

The MACD line remained bearish on the short term as the blue line crossed over the red line into a downwards trend.

The converging of the Bollinger Bands show that price volatility is lowering.

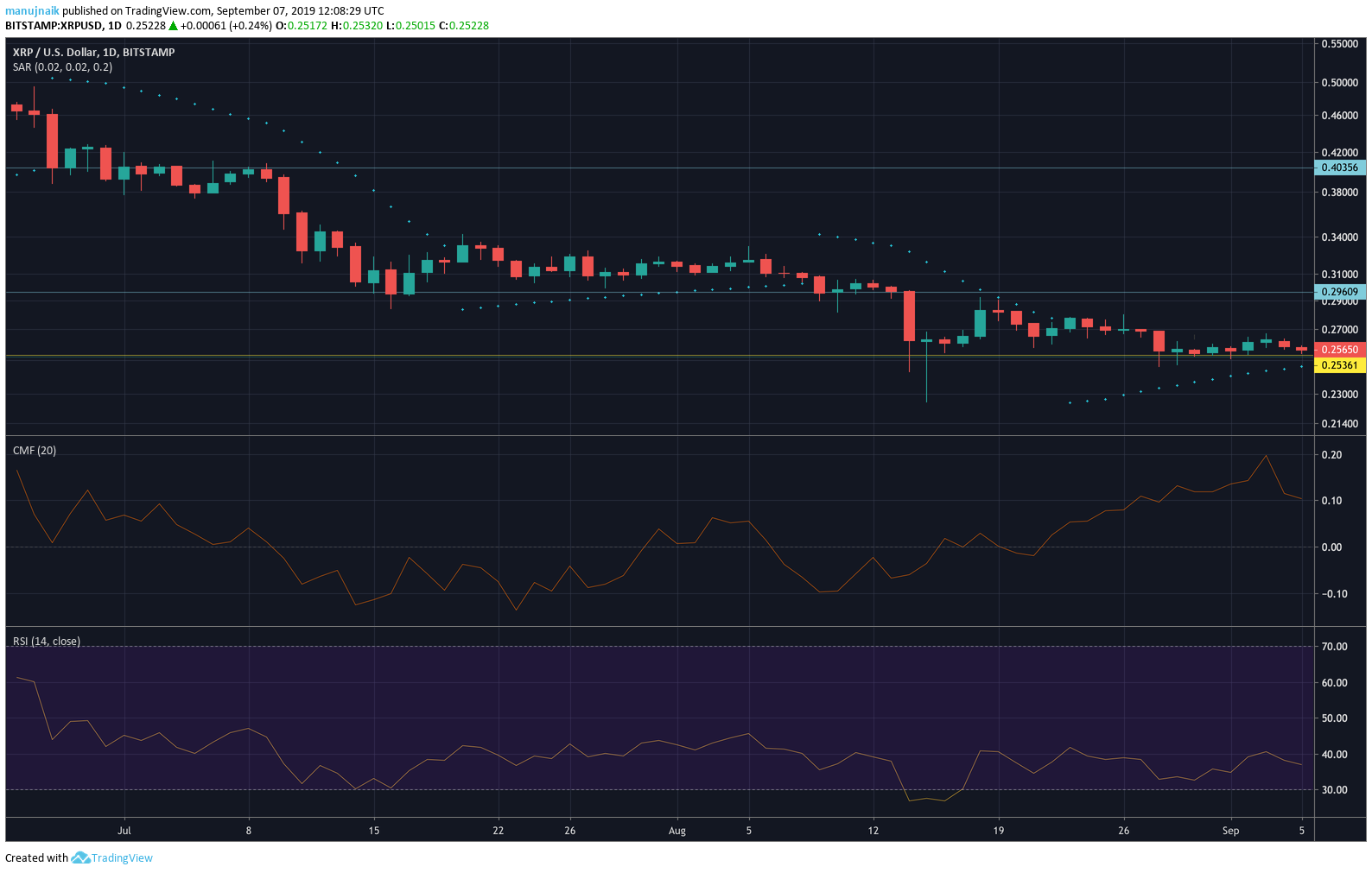

1-day chart

Resistance 1: $0.29609

Resistance 2: $0.40356

Support 1: $0.25361

The long term chart indicated that the price of XRP had been oscillating between Resistance 1 and Support 1 for almost three weeks. After it breached Resistance 1 in mid-August, the price attained sideways movement without any resistance breach.

Parabolic SAR suggests a bullish short-term as it moves under the candles.

Chaikin Money Flow (CMF) indicated higher capital in-flow than out-flow, suggesting possible bullishness.

RSI or Relative Strength Index indicates neither oversold nor overbought, oscillating between the 40 and 30 point markers.

Conclusion

XRP looks to be bearish in the short-term and the long-term charts indicate lower volatility and possible bullish movement.