Bitcoin: Here’s what more institutional participation has meant

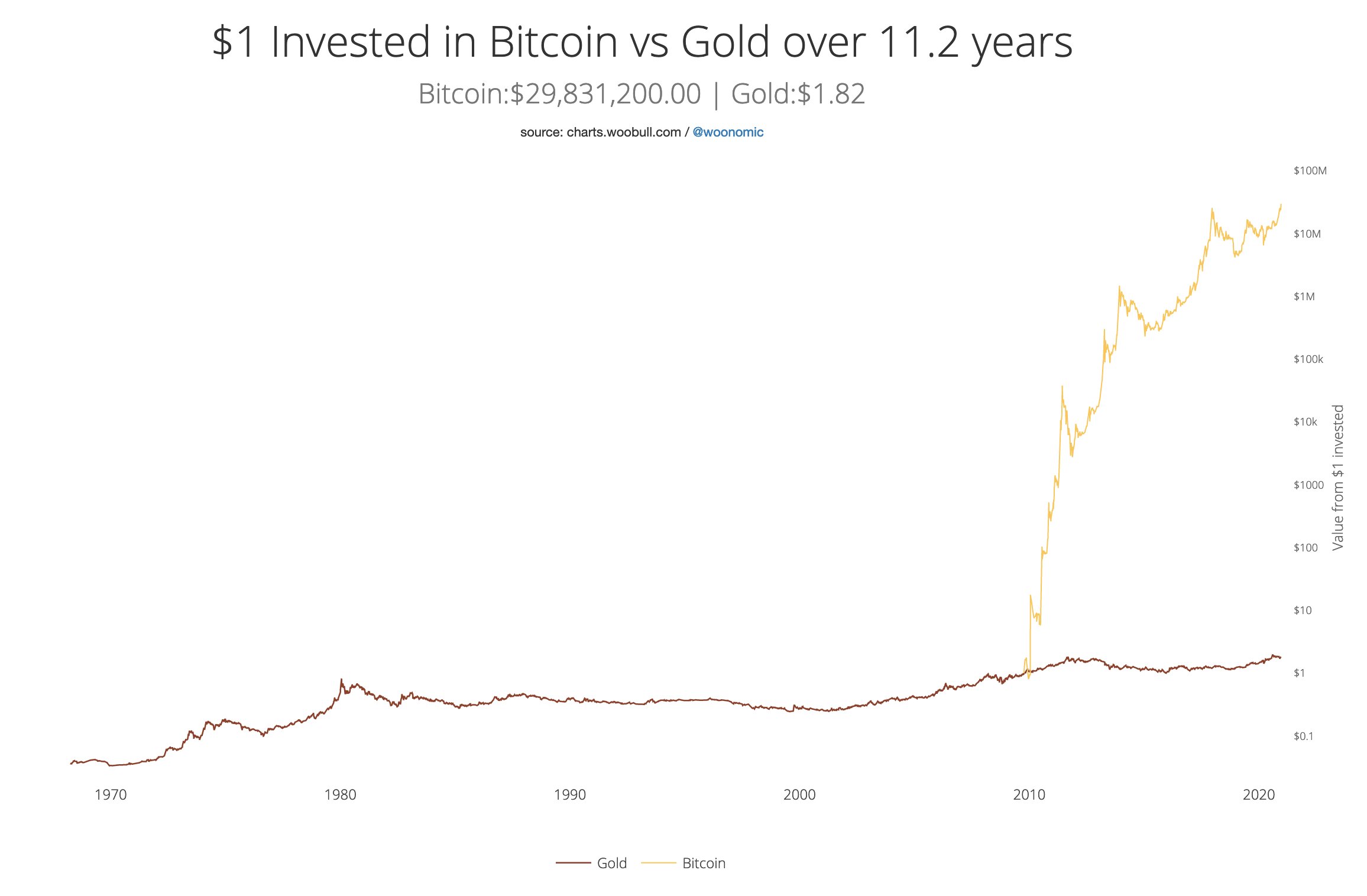

An interesting observation recently made by Willy Woo on the 18th of December 2020 was that over a period of 11.2 years, $1 invested in Gold appreciated to $1.82 whereas Bitcoin appreciated to $2,98,31,200.

Now, there is enough literature associated with how Gold and Bitcoin are correlated and how the correlation drops periodically. However, this contrast affects the returns on retail traders’ portfolios. Ergo, the question – Based on predictions by on-chain analysts, institutions, and technical analysts, what will the said number be 11 years from now?

Based on the current returns for Bitcoin, 11 years from now, investing $1 would mean that you could buy a Lambo, while $1 invested in Gold would buy you a Snickers bar. The parabolic rise in Bitcoin’s price over 11 years has yielded high returns, nearing 170% YTD. However, will a fall follow this parabolic rise? That can be examined through Bitcoin Futures’ aggregate daily volume chart.

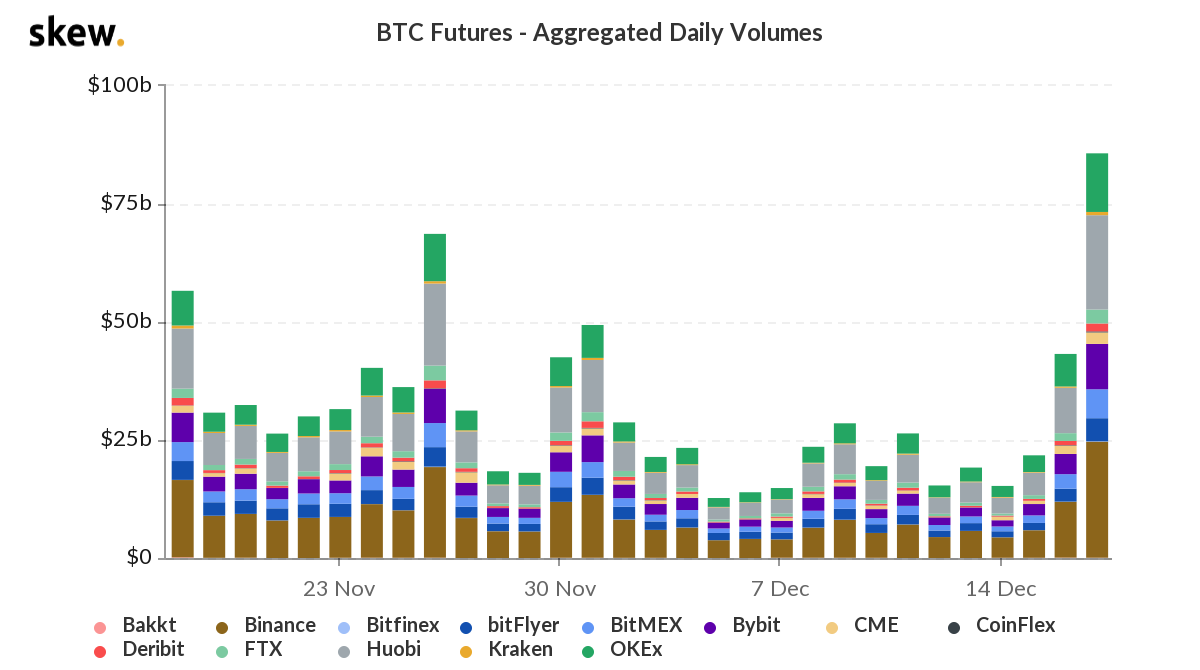

BTC Futures- Aggregate Daily Volumes || Source: Skew

Based on data from the Skew chart, BTC Futures volume spiked as it crossed $75 billion. However, the volume was below $25 billion for the most part over the past two weeks. The occasional spike in volume may not be enough to sustain demand on spot and derivatives exchanges. How do institutions plan on making profits if profit booking remains cyclical in nature? Well, institutional participation may be having an impact on Bitcoin’s volatility and network momentum.

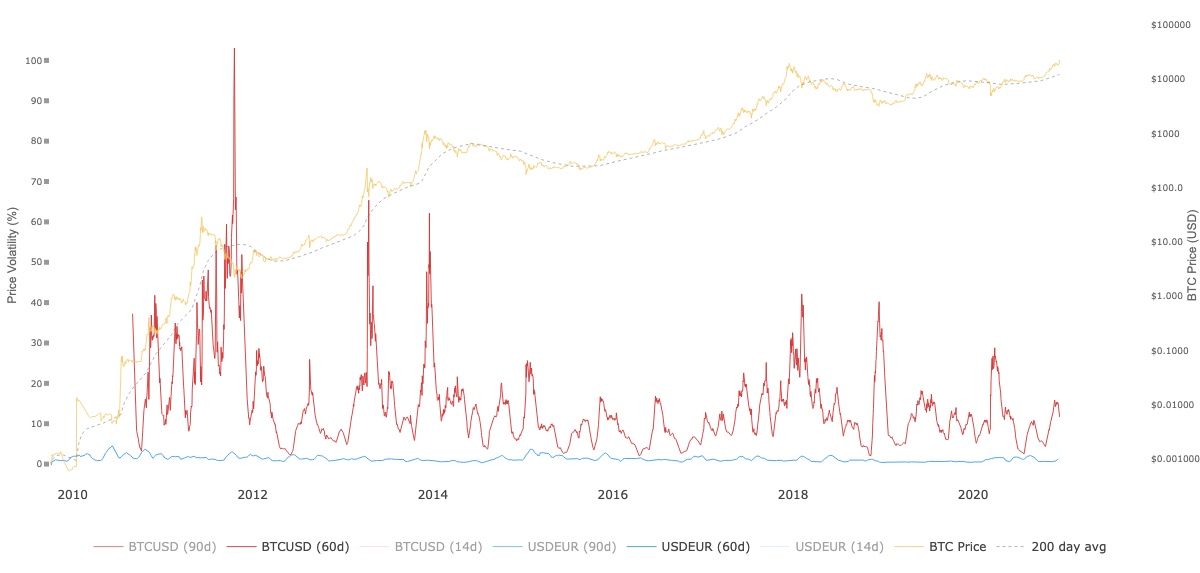

Bitcoin Volatility Index || Source: Woobull Charts

Based on insights from Willy Woo’s chart and the comparison of Bitcoin with Gold, institutional participation may be leading to further drops in volatility and network momentum, until profits become dependent on volume rather than cyclical volatility. In that case, retail portfolios may get affected, especially since more Bitcoin from 5Y-7Y reserves is now hitting spot exchanges.

As per the chart, since institutional participation increased, starting March of 2020, pre-halving, the volatility index has shown decreased activity to the extent that the volatility did not register on the charts as a bull run, despite a long and sustained price rally, one where the price crossed $20,000, even $23,000.

$1 in Gold vs $1 in Bitcoin in 11.2 years || Source: Twitter

So, where does Gold stand in this? Post its decoupling with Gold in November 2020, Bitcoin hit a new ATH and pursued price discovery post-$20000, and even post-$23000. However, Gold’s price hit further lows. Going forward, a correlation or comparison may not be justified unless Bitcoin’s market capitalization increases even further.

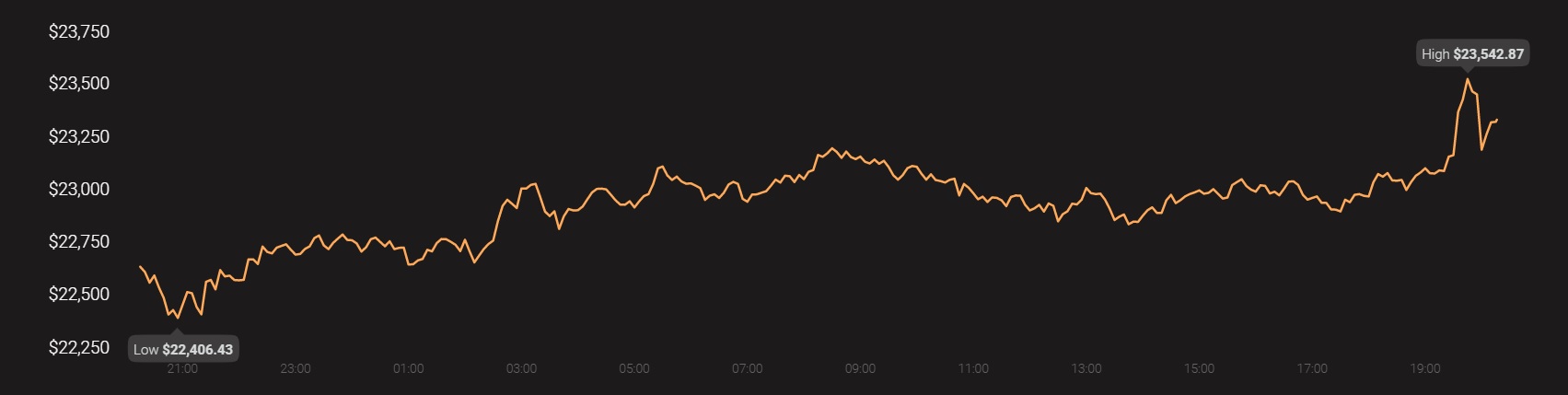

Source: Coinstats