Why Bitcoin may close January below the $35000 price level

Open interest in CME Bitcoin options has increased 39.7% since the start of 2021 and its trade volume has also increased. Though Bitcoin is range-bound and has been after hitting $41000, there is an increased activity from institutional investors on spot exchanges. However, in the past week, on CME Bitcoin Options, the trade activity suggests that traders may have been awfully quiet or the direction of investment flow may have changed. Less than 50 contracts changed hands on January 19, 2021, and this suggests that the trading activity and the price was not a game-changer. With Bitcoin is trading in the $34800 range, experts at ecoinometrics predict that about 65% of the calls to expire in the money next week.

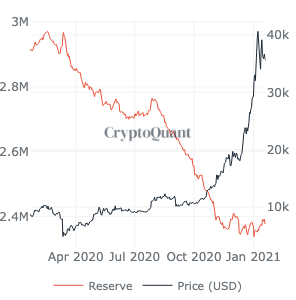

Grayscale’s ETHE launch may direct attention and investment flow away from Bitcoin, and had already begun when Ethereum started rallying and hit new ATH on January 19, 2021. After rebounding to the $39000 level a week ago, there has been scant progress in the rally. Retail traders may lose interest if the asset remains range-bound for another week. Based on data from CryptoQuant, Bitcoin inflow to exchanges has gone up since the last week of December, and reserves on spot exchanges are increasing. The narrative of the price rally was built on scarcity and dropping exchange reserves, however, the metrics suggest that a trend reversal may be incoming.

BTC reserves on exchanges || Source: CryptoQuant

Reserves dropped until 2021, however, they steadily increased back to the level of 0f October 2020. Bitcoin’s active supply has hit a three year high, according to data from Glassnode. This data is in line with the observation on Bitcoin exchange reserves. Additionally, Ethereum’s recent decoupling with Bitcoin raises flags for Bitcoin traders. It was anticipated for over a week now, and Ethereum has finally created a separation from Bitcoin on surging non-exchange whale accumulation. Ethereum tokens are moving off exchanges quickly and moving to private wallets and reserves. The active supply is increasing steadily, and so is the investment flow. Based on Santiment’s chart, there is a spike in the top 10 offline whale holdings, since Ethereum hit its new ATH. Based on these signs, Bitcoin may close January with a correction and probably fail to cross the $35000 level.